Bitcoin’s influence on traditional financial markets

Bitcoin is a groundbreaking innovation in the modern world. It is the most widely acknowledged and well-known cryptocurrency to date, thanks to the enormous market capitalization. It was created in early 2009 by an unknown person or a group of people behind the nom de plume of Satoshi Nakamoto. It was at first mainly used for online gambling and barely attracted any attention. However, it soon became a global phenomenon, as its advantages appeared beneficial to many.

It is a decentralized digital currency, meaning that its operations are not dependant on any national legislation. As a result, bitcoin is free from governmental authorities and often from regulations. Money is being transferred through so-called digital wallets, which guarantees the anonymity of both senders and receivers. Only digital wallet IDs are displayed, which are not identifiable, maintaining the discreet character of the platform. Moreover, amid its anonymity, all the transaction records are still saved, making it rather transparent. Individuals, i.e. parts of the financial transaction can still not be traced, however, records make bitcoin more trustworthy. Other than the aforementioned benefits, bitcoin operations offer many other pros, including being fast, simple, entirely digital, more convenient, etc.

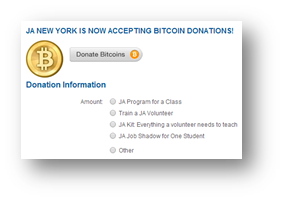

Another factor contributing to the success of bitcoin is its accessibility. The number of internet users is soaring, thus digital payment systems and virtual currencies become more popular. Bitcoins can be purchased or sold on the web in a matter of seconds to other sovereign currencies. As a result, Bitcoin FX brokers are present in many markets boosting the activity of the crypto industry. The convenience of exchanging, purchasing, or selling them is why many young, particularly technological enterprises choose to use bitcoin over traditional currencies.

Bitcoin is not the only cryptocurrency that is widespread today. More and more digital payment methods appear on the global web every year. When Bitcoin, which still is considered the most successful cryptocurrency on earth soared, expectations were that it would make a major shift in how the financial industry operates. Then in 2017, there was a massive downfall in bitcoin’s price, arising further questions about its stability and reliability. Events that year shook the markets, mainly due to the outstanding media coverage of bitcoin market price change. However, the question is whether it actually influenced traditional stock markets in global financial capitals, such as London, Tokyo, and New York.

Many economists and professionals within the financial industry believe that the growing influence and the current state of cryptocurrencies are not sustainable. Many countries and their respective legislations still fail to recognize virtual currencies as a part of their financial spheres, lagging behind to deliver on the demand. They are either completely unregulated and left to float on their own or limited to a very strict extent. As a result, cryptocurrencies like bitcoin and others are increasingly used by industries that lack recognition of their own. It helps them make financial transactions without having to use traditional banking services and money transfer platforms. This is what caused a number of booms on bitcoin’s path to where it stands today. It still faces many challenges despite its benefits and lacks the implementation in traditional sectors of the economy, reducing its importance and influence over the global financial market.

The right thing to do is not strictly regulating or leaving them on their own. Virtual currencies should be treated equally to other traditional financial instruments. With the increased access to the worldwide web and affiliated services, the use of bitcoins is gaining a more transnational character than ever before. It is used for international financial operations and banning them is almost impossible, as restrictions would require major pressure on internet freedom. The contrary should be done to incorporate them better and more organically into national economies and make the best use of them in terms of harmonized international money transfers or other financial operations. Without such, they will remain the way they are without any more significance and will keep facing the same challenges for a while.

Main question: is bitcoin influencing traditional financial markets?

As mentioned above, bitcoin and more generally cryptocurrency stock price hysteria hits the global mainstream media from time to time. More notably the 2017 downfall caused a major outrage around the world and it also had a minor impact on connected financial industries. However, even after more than a whole decade from its initial introduction, bitcoin still remains rather marginal. This might come as a surprise to many, as the article began with a mention of its major market capitalization. However, the truth is that its cap of roughly $300 billion USD is still nothing in comparison to the total broad money of more than $18 trillion in the United States alone. With such figures, bitcoin can not compete with them on traditional markets in any way, setting its role and overall influence at a bare minimum. Gaining momentum is even more difficult in more restricted markets, such as some in Europe and major economies worldwide as bitcoin struggles to integrate itself into their ecosystems. Even though an increasing number of companies allow the use of virtual currencies around the globe, this still is not enough to bring further importance to bitcoin.

Without a doubt, the future will certainly bring more innovation and technological advancement to us. As a result, the chances for digitalized financial services and cryptocurrencies to succeed and influence traditional markets is high. However, with the current situation, sovereign currencies will remain dominant in traditional markets for a foreseeable future.