Coinbase report points out that selling pressure has dried up as miner selling continues ahead of Bitcoin halving

Macroeconomics and financial markets

In the US New York stock market on the 2nd of last weekend, the Dow Jones Industrial Average closed 134.5 points (0.35%) higher than the previous day, and the Nasdaq Index closed 267.3 points (1.7%) higher.

U.S. employment statistics were stronger than market expectations, demonstrating the resilience of the U.S. economy, but expectations for an early interest rate cut by the Federal Reserve (Federal Reserve System) have faded.

CoinPost app (heat map function)

connection:Strong financial results lead to a rise in AI-related virtual currency stocks, and strong U.S. employment statistics continue to boost U.S. stocks | 3rd Financial Tankan

connection:Recommended securities account ranking for the stock market that can be used at a profitable price

NISA, virtual currency related stocks special feature

Virtual currency market conditions

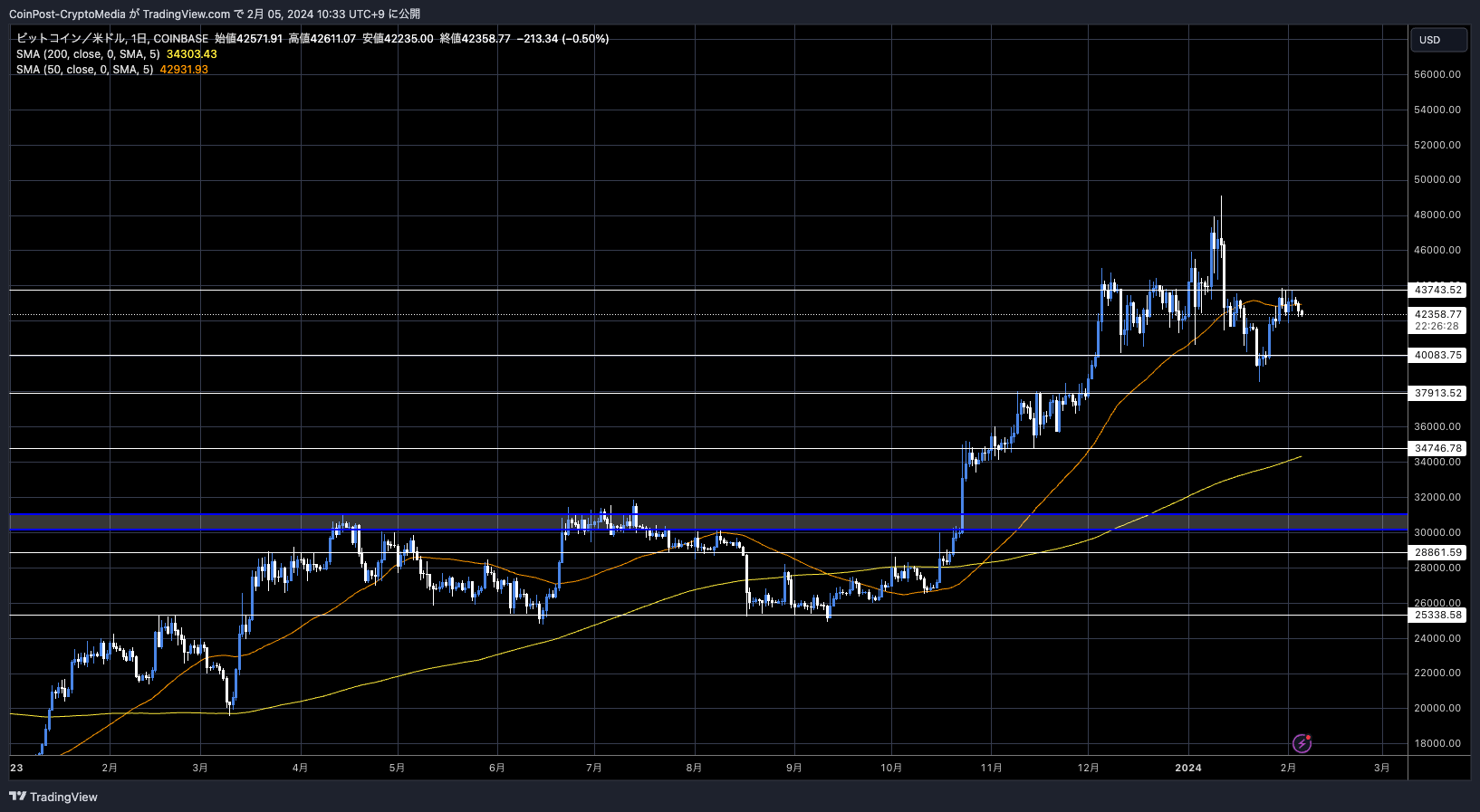

In the crypto asset (virtual currency) market, the Bitcoin price fell 1.43% from the previous day to 1 BTC = $42,389.

BTC/USD daily

The price has stalled at the $44,000 resistance line and will likely be tested to see if it can pull back in half and head toward the lower end of the range. Among the major alts, Solana (SOL) fell 3.1%, XRP fell 3.4%, and Avalanche (AVAX) fell 4.6%.

connection:Bitcoin monthly chart suggests a trend change signal, with a short-term possibility of testing the top price | Contributed by a bitbank analyst

In recent weeks, the market has continued to sell ahead, with profits being taken in crypto assets (virtual currencies), which have soared in anticipation of approval by the US SEC (Securities and Exchange Commission) for Bitcoin spot ETFs (exchange traded funds).

In addition to the large-scale selling of Bitcoin Trust (GBTC), a grayscale investment trust that converted into an ETF, there was also selling by major miners who wanted to secure cash reserves in preparation for the halving scheduled for April this year. It overlapped.

Caueconomy, posting on data analysis firm CryptoQuant, pointed out that the “miner reserve,†which measures the total amount of Bitcoin held by miners, has decreased by more than 14,000 BTC ($600 million) in the past two days.

Miner reserves

This suggests that funds are being transferred from wallets for the purpose of remittance to and sale of crypto asset exchanges, and there was a phase where there was a sharp 10% decline in November 2022, when the Alameda Shock accompanied the FTX bankruptcy occurred. . It has now fallen to its lowest level since July 2021.

Coinbase market analysis

According to a market report posted by Coinbase last Friday, selling pressure on Bitcoin liquidations from GBTC and the failed FTX is starting to dry up.

Additionally, net inflows into Bitcoin spot ETFs in the U.S. last week averaged over $200 million per day, bringing total net inflows since January 11th to $1.46 billion.

Coinbase also mentioned the timing of the Fed’s interest rate cut. He said the cycle of monetary tightening and then easing would most likely begin on May 1, and predicted that the Fed’s plan to shrink its balance sheet would end in June.

The timing almost coincides with the Bitcoin halving in April of this year, so liquidity will increase sufficiently from this spring onwards due to the advertising effect of Bitcoin ETFs (exchange traded funds) and its inclusion in asset management companies’ portfolios. It is said that

Furthermore, he also mentioned the airdrop that became the largest in the Solana (SOL) market.

The air draw of Jupiter (JUP), a decentralized exchange aggregator based on Solana, which took place at the end of January, follows the flow of Pyth in November 2023 and Jito in December, and this virtuous cycle will continue for the time being. It is expected to continue. One of the reasons for this is the increasing pace of stablecoin inflows to Solana Chain. Last week, sales rose 13.7% to $2.1 billion.

He said he believes the Airdrop is undervalued and serves as a stress test for Solana Chain. Specifically, although there were some cases where some nodes were overloaded, resulting in poor user experience and transaction timeouts, the large-scale airdrop caused widespread blockchain outages. I appreciated what I didn’t do.

Solana Chain has not experienced any downtime since February 2023, and an article in Yahoo Finance mentioned a spin-off of Solana Labs considering the transfer of business and technology to a new corporation, Anza Technologies. This is seen as a positive move as it leads to centralization and decentralization.

altcoin market

In response to the soaring price of Meta (formerly Facebook) stock, the crypto asset (virtual currency) market is also looking for AI (artificial intelligence) related stocks. In meta’s quarterly (October to December) financial results announcement, it was revealed that net income had tripled to approximately 2.5 trillion yen, and the stock price soared to $474.9, an increase of 20.3% from the previous day.

In addition to announcing its first dividend, the announcement of a $50 billion share buyback was also well-received. This was due to strong performance in the advertising business due to successful large-scale cost reductions. The Metaverse (virtual space) business, which the company entered with much fanfare, did not grow as expected and slumped for a while, but the company has indicated a policy of shifting its focus to the AI ​​field, emphasizing the results of AI development.

In the crypto asset (virtual currency) market, CoinMarketCap’s ICP in the AI ​​& Big Data sector rose 3.1% from the previous week, and Render (RNDN) rose 17.4% from the previous week.

“WebX2024†New IP area will be established where Kodansha, Toho and others will exhibit, ETH Tokyo and DAO Tokyo will also be held at the same time https://t.co/Gs5y7wI1Kx

Date and time: 2024/8/28 (Wednesday) – 8/29 (Thursday)

Location: The Prince Park Tower Tokyo

*The video is “WebX2023†pic.twitter.com/vHZmFbNjwM— CoinPost (virtual currency media) (@coin_post) January 18, 2024

Bitcoin ETF special feature

We have introduced the “Heat Map†function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.â– Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Coinbase report points out that selling pressure has dried up as miner selling continues ahead of Bitcoin halving appeared first on Our Bitcoin News.