Bank of Japan and government hold first digital yen liaison meeting in preparation for spring legislation

Organizing the outline of CBDC system design

On the 26th, the Japanese government and the Bank of Japan held their first liaison meeting to organize the general outline of the system design for central bank digital currency (CBDC). They discussed future points of contention and confirmed a policy to organize legal issues by related organization. NHK and others reported this.

Assuming the introduction of the digital yen, the plan is to compile the results of a study by spring of this year regarding legal developments in the Bank of Japan Act, Criminal Code, and Civil Code. It has not been decided at this point whether or not the digital yen will actually be issued.

The Ministry of Finance held its 8th expert meeting on CBDC in December last year. Digital Yen is envisioned as a digital currency that can be used for payments using smartphone apps and cards.

It is said to be a payment method that anyone can use for a wide range of everyday purchases anytime and anywhere, and is essentially instant payment without credit risk.

What is CBDC?

Refers to digitized currencies issued by the central banks of each country or region. Abbreviation for “Central Bank Digital Currency.†The major difference from virtual currency is that CBDC is legal tender. While it is expected to reduce costs and improve efficiency in currency management and payments, there are many issues to consider, such as protection of personal information and privacy, security measures, and impact on the financial system.

Virtual currency glossary

Virtual currency glossary

connection: Yusuke Narita discusses “The future after the realization of the digital yen†| WebX conversation report

Contents of the expert meeting

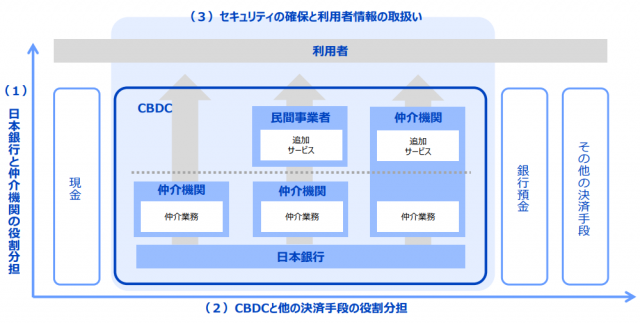

At the December expert meeting, the division of roles between the Bank of Japan and intermediary banks was also discussed. As with cash, a “two-tier structure†is considered appropriate, with an intermediary institution standing between the Bank of Japan and users and mediating CBDC.

The idea is for the Bank of Japan to centrally issue CBDCs and manage ledgers to accurately record and confirm CBDCs. The company also said it would continue to consider technological aspects, including whether to utilize token-based or distributed ledger technology.

Regarding additional services related to the digital yen, such as household account book services and conditional payment services, the plan is to consider ways to allow private businesses to participate while ensuring fair competitive conditions.

Source: Ministry of Finance

Other topics on the agenda included the division of roles between CBDC and other payment methods, ensuring security and handling of user information, cross-border payments, cost burdens, and legal responses.

connection: Utilization of tokens and distributed ledger technology also needs to be considered — Ministry of Finance holds expert meeting on “digital yenâ€

Also considering China, EU, US, etc.

CBDC is currently being considered in various countries and regions.

In particular, in China, large-scale demonstration experiments involving consumer participation are already underway regarding the digital renminbi. The first crude oil transaction took place in October last year.

connection: First successful crude oil transaction using digital renminbi; de-dollarization progresses

The European Union (EU) is also considering creating a digital euro. Last October, the European Central Bank (ECB) Governing Council moved the digital euro from the exploration stage to the preparation stage.

Although a decision has not yet been taken to publish, the preliminary phase will include more detailed analysis, comprehensive testing and experimentation, and thorough consultation with all stakeholders.

connection:European Central Bank advances to preparatory stage for digital euro

The US Federal Reserve is also considering issuing a digital dollar. The Biden administration presented a development framework for digital assets in 2022, and included the consideration of CBDC as part of it.

On the other hand, former President Donald Trump, who is currently running as a candidate for the US presidential election and is gaining support among the Republican Party, opposes CBDC, arguing that it will lead to public surveillance.

connection: Added Bitcoin Ordinary Benefits to Former President Trump’s 3rd NFT “Mugshot Editionâ€

Special feature for virtual currency beginners

The post Bank of Japan and government hold first digital yen liaison meeting in preparation for spring legislation appeared first on Our Bitcoin News.