Why Bitcoin ETFs are coveted by professionals | CoinDesk JAPAN

Bitcoin (BTC) is slowly and suddenly becoming mainstream. Some of the world’s largest asset managers, such as BlackRock and Fidelity, are preparing to launch Bitcoin ETFs (exchange traded funds) in the United States.

As Grayscale Bitcoin Trust’s discount to NAV (net asset value) has narrowed dramatically, the market is betting on the odds of the US Securities and Exchange Commission (SEC) approving a Bitcoin ETF. is estimated to be around 90%.

But why is there such a big need for a spot-based Bitcoin ETF when futures-based Bitcoin ETFs already exist?

Disadvantages of futures ETFs

First, Bitcoin futures ETFs have a number of drawbacks compared to spot-based ETFs, among them: 30 percentage points (!) of annual performance if the Bitcoin futures curve exhibits sharp contango. It also includes a high roll cost that wipes out.

To put it simply, if Bitcoin futures prices are significantly higher than the current spot price, Bitcoin futures investors will be giving up a large portion of their performance.

Therefore, if you invest in futures-based products, you will not be able to reap the full performance benefits of owning Bitcoin.

Reference article: “Contango†risk hidden in Bitcoin futures ETFs[Opinion]

Expansion of portfolio

By expanding investment access to Bitcoin and other crypto assets, physical ETFs can open up a whole new world of potential portfolio allocations that were not possible before.

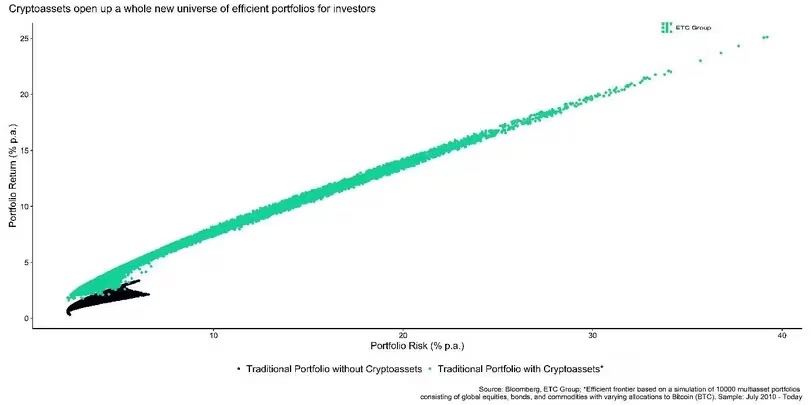

In portfolio manager jargon, investing in Bitcoin significantly expands the so-called “efficient frontier†of a multi-asset portfolio.

The efficient frontier represents all potential portfolios shown in the risk-return chart, with varying weights of different asset classes.

For example, one dot represents a portfolio that invests X% in stocks, Y% in bonds, and the rest in Bitcoin.

Portfolio managers want to be on the edge of that frontier to get the highest possible returns with the lowest possible risk.

(ETC Group)

A cluster of black dots represents a potential portfolio based solely on traditional asset classes. The cluster of green dots shows the new portfolio that is possible by adding Bitcoin. As you can see, adding crypto assets like Bitcoin greatly expands the possibilities.

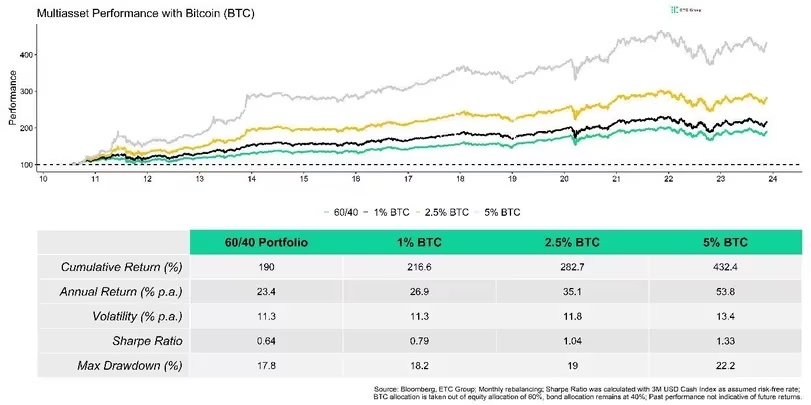

Therefore, by including Bitcoin in a classic 60/40 stock/bond multi-asset portfolio, risk-adjusted returns (the “Sharpe Ratioâ€) can be significantly increased with only a small increase in portfolio drawdown. It’s not surprising that it does.

Big impact on crypto assets

It is not yet known when spot-based Bitcoin ETFs will be finally approved, but most expect it to be approved in bulk in January 2024.

The prospective issuers of Bitcoin ETFs have an estimated asset management balance of approximately 16 trillion dollars (approximately 2,400 trillion yen, equivalent to 150 yen per dollar), which is a considerable amount, and there is a possibility that it will have a significant impact on crypto assets. be.

Even if just a small percentage of that goes into Bitcoin, the impact is likely to be huge. Currently, Bitcoin exchange-traded products are worth just $38.8 billion by our calculations (including Grayscale Trust).

But this money won’t be invested overnight. It will likely be many months before investors start replacing parts of their traditional asset allocation with Bitcoin.

Gradually and then suddenly, as the saying goes.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Why Are Pros Craving a Spot Bitcoin ETF?

The post Why Bitcoin ETFs are coveted by professionals | CoinDesk JAPAN appeared first on Our Bitcoin News.