On-chain transaction volume: why is it an important metric for blockchain? | CoinDesk JAPAN

On-chain transaction volume is the pulse of the blockchain network. For digital asset investors, keeping a close eye on these flows within the network and comparing them across protocols can help confirm a protocol’s prevalence and usefulness, and determine whether a project will develop further or is an outdated relic. This is a way to judge.

Trading volume and market sentiment

The trading volume perspective provides valuable insight into user activity, network availability, and the overall health of the crypto ecosystem.

A spike in trading volume often means increased network usage, adoption, and trading activity. This could indicate increased interest, the utility of a new protocol, or speculative enthusiasm.

Conversely, a decline in on-chain transaction volume may indicate declining development, stagnation of the protocol, or loss of market share to competitors.

There are several factors that drive blockchain trading volume, and understanding these nuances can help you navigate the ever-evolving cycles of the crypto market. Trading volumes tend to spike during periods when the crypto market becomes an overly bullish festival. Positive news such as regulatory clarity, adoption by institutional investors, and major protocol upgrades will fuel trading activity.

Additionally, market sentiment also plays an important role. Bullish sentiment often drives traders and investors towards DEXs (decentralized exchanges), leading to a surge in on-chain trading.

DEXs will focus on trading newer, innovative products such as NFTs and smaller token launches that have a greater impact on on-chain activity than the major tokens traded on CEXs (centralized exchanges). Tend. This contributes to increased trading volume in bullish cycles.

Conversely, during a bear cycle, trading volume begins to decline, and during periods of deleveraging, trading volume spikes. Uncertainty, negative news, regulatory crackdowns, and market rebound often lead to fewer trades.

Investors will adopt a wait-and-see approach, which will lead to a decline in trading volumes. Additionally, they may move assets into cold storage or stablecoins, reducing overall trading activity on exchanges.

Usefulness of trading volume data

To dig deeper into the usefulness of on-chain trading volume data, we use data provided by SonarVerse, which provides dollar-denominated on-chain trading volume by protocol. Let’s compare.

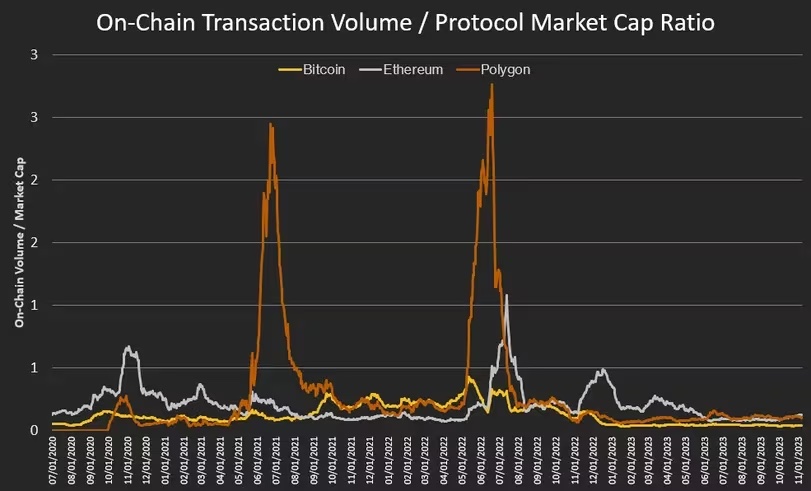

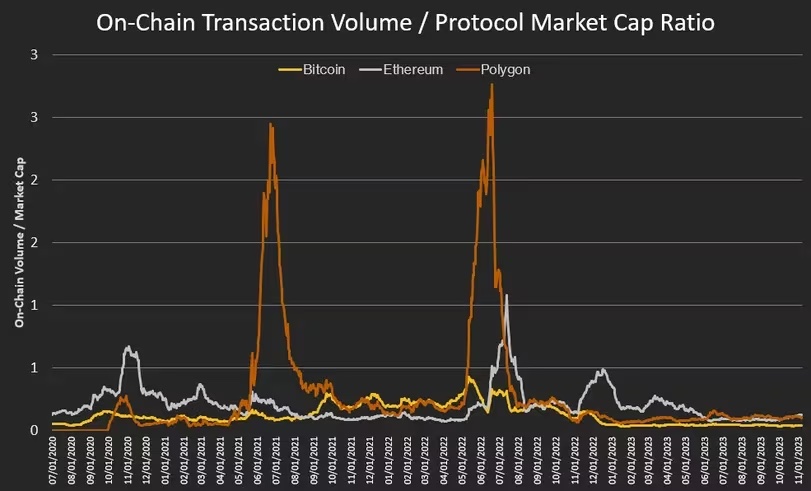

To normalize the trading volume of these protocols, we divide the trading volume by the protocol’s market capitalization.

(SonarVerse, CoinDesk Indices Research)

Bitcoin’s trading volume is relatively low and stable, while Ethereum and Polygon’s trading volume has peaks and relatively offsetting trading activity. This makes sense considering Polygon is an EVM scaling solution for Ethereum-based protocols.

Leverage your data

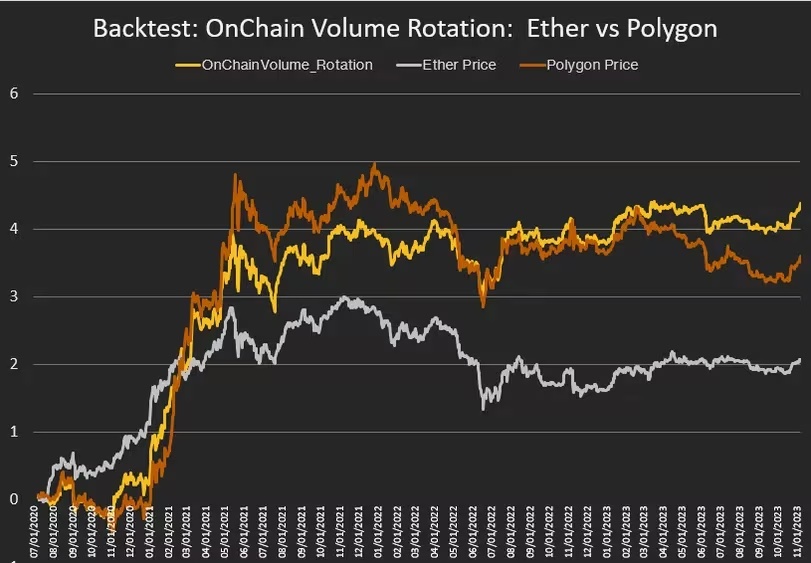

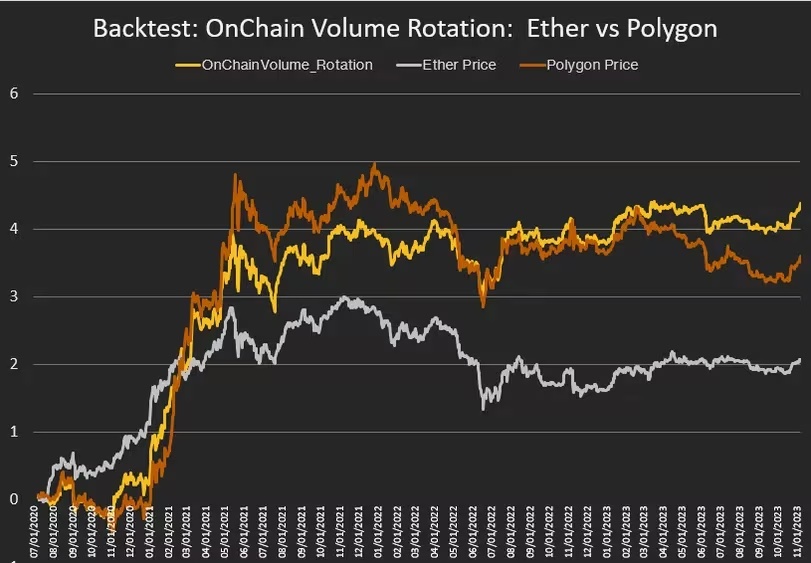

To further highlight the investment benefits of this data, we performed a very simple backtest. Here, we use recent normalized on-chain trading volume with a simple rule of rotating to Polygon if the normalized trading activity is greater than Ethereum, otherwise holding Ethereum’s native token. Rotate Ethereum and Polygon based on.

This rotation strategy improves absolute and risk-adjusted returns over crypto market cycles compared to separate allocations to Ethereum and Polygon tokens.

This outperformance may be due to the information contained in on-chain trading volume metrics, which drives strategies toward protocols with more recent activity and, by association, greater demand for blockchain protocols. .

(SonarVerse, CoinDesk Indices Research)

By understanding the dynamics of on-chain activity, you can better gauge market sentiment and assess the health of the underlying protocols to make more informed trading decisions.

During bullish periods, high trading volume indicates potential profit-taking opportunities and increased volatility. In a bearish cycle, low trading volume may indicate a potential market bottom or an accumulation opportunity.

Keeping a close eye on on-chain trading volume and other blockchain metrics like TVL (values ​​under custody) is like listening to the pulse of the crypto market, helping investors navigate the twists and turns of industry developments. enable.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Why On-Chain Transaction Is the Key Blockchain Indicator

The post On-chain transaction volume: why is it an important metric for blockchain? | CoinDesk JAPAN appeared first on Our Bitcoin News.