Weighing the Block Size Debate

Over the last month, there has been a lot of debate kicked up by proposals of Bitcoin luminaries Gavin Andresen and Mike Hearn to raise the block size limit  in an effort to expand Bitcoin’s ability to scale.

in an effort to expand Bitcoin’s ability to scale.

There are a lot of arguments against the move. One is that larger blocks will require more bandwidth and better equipment to run nodes which may discourage smaller players from running nodes or mining operations.

The larger blocks will also take more time to transmit, which will create more orphaned blocks and provide an incentive for miners to artificially lower the block sizes that they produce to ensure that their blocks get recognized first.

Finally, there is the economic argument that if blocks become too big, then the competition for fees will get so low that they become economically negligible. Miners, so the argument goes, will have no incentive to mine and secure the network if fees, already low, become much lower.

I am sure that there are more, and more technical, arguments to be made, but after spending more than a month reading about this, I have to side with the ‘big block size’ crowd.

One of the first things I felt I needed to consider when coming to this choice was to answer the question, is Bitcoin a commodity or a currency. The answer, it seems to me, is both – but its utility as a commodity is currently realized and its utility as a currency will only be realized when it hits a tipping point of mainstream adoption.

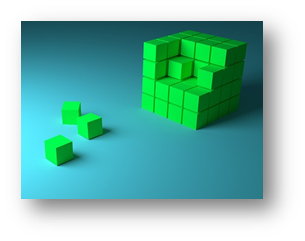

The problem is that I don’t think that you can separate these two things. Gold isn’t a great currency, but it has other uses, and Bitcoin is going to need to have other uses than just digital gold if it’s going to take off. It may be that people never use Bitcoin on the blockchain to buy cups of coffee, and big businesses may be built up around allowing people to do that reliable off the blockchain; but, people have to have the option to do that. And that means that the number of transactions per second available needs to rise to meet whatever the demand is.

For my money, creating capacity before the demand is here is the smart thing to do, and building in an algorithmic way for Bitcoin to automatically adjust in the future is further a no-brainer.

The idea that raising the block size will create too-much centralization also seems wrong to me. Right now we are going through a phase of Bitcoin development where huge mining farms compete for a very few Bitcoins. As we go through halvings and as more people and institutions come online, I think it likely we are going to see a re-decentralization of mining. Governments and banks will set up miners, hobbyists will set up miners, and kids will set up miners for school projects.

Likewise, the notion of fee structures, orphan blocks, and non-cooperative miners all strike me as short-term, transitional problems that would find their own solution in the new reality of bigger blocks.

The end goal here is to have a fully functional digital commodity/currency that is so much better than what governments and banks can do that people begin to use it by default. That is where we should all be keeping our focus.

The opinions expressed here are solely my own. I invite comment, correction, and criticism.