A Talk with Panagiotis Pollis on Greece, Bitcoin, and His New Site, BitForTip.com

I was recently contacted by Panagiotis Pollis, a Greek national who has created a new website, BitForTip.com, where people can get tipped Bitcoin for answer questions posted on the site. He wanted to know how he could advertise on Bitcoin Warrior. I took a look at Panagiotis and the site and declined. Rather, I told him, as a Greek national involved in Bitcoin at a time when Greece is going through a massive financial crisis, I would like to interview him. I thought the perspective he has to bring to the need for Bitcoin is far more valuable than an ad.

One of the ideas that we at Bitcoin Warrior hold to is that Bitcoin is an adversity currency. What we mean by that is that if the banks and governments acted honorably and equitably, that a currency like Bitcoin would never stand a chance because it would not be needed. And, no matter how good Bitcoin may be for remittances, Internet purchases, or any of the 2.0 uses that have been suggested, none of them really have the oomph that will drive Bitcoin into everyday use. It’s going to take something more. It’s going to take the current government-financial-oligarchic system causing another 2008 style financial collapse. If and when that happens, it’s likely that people will be panicked out of their complacency and the ‘risky’ asset of Bitcoin will come to seem the safest bet of all. And, to our eyes, the powers-that-be seem to be doing everything they can to make that collapse and subsequent switch to a global currency based on math a reality.

Panagiotis was born in New Zealand and was transported to Greece soon after. He is self-taught in computers and web design. He is interested in sports and is a practitioner of the Tango Argentino, Salsa, and Bachata. He feels that it’s important to stay active to stay sharp.

Like many of us, Panagiotis first heard about bitcoin from the general media when it had one of its wild price swings, and like many of us, didn’t act on it initially. After hearing about it a few more times, and especially after seeing a YouTube video about the Deep Web that featured Bitcoin, began to investigate it more. He learned that it was not only used on the Deep Web, but was being accepted more and more placed and that the technology behind it has real possibilities. That is when Panagiotis decided to get involved with Bitcoin.

Here is the conversation that I had with Panagiotis. Please and enjoy the read, and please help out his new site by visiting BitForTip.com.

Greece has been in the headlines so often lately that it’s nice to talk to someone on the ground with a personal perspective. First, can you give me a brief outline of the financial problem that Greece is facing? What do you think are the main causes?

The great recession that started from the U.S has triggered the European debt crisis. Investors were heavily concerned about the countries future debt sustainability and that has severely struck the weakest economies of the European Union.

Especially Greece was proven to be naked and unprepared due to a combination of structural weaknesses of the Greek economy (it hadn’t invested in heavy industry or in education to remain competitive with the other economies) along with decades old structural deficits and debt to GDP levels on public accounts in addition to high-levels of corruption and mistreatment of money. That led to a loss of confidence among investors in the ability of Greece to repay her debts. Greece is now in a very dire situation. The country can’t borrow from the markets and it’s getting just enough money from the IMF and the E.U to cover its financial needs for the public sector and to pay for the preexisting loans to its creditors and avoid a default.

There’s always enough blame to go around in cases like this. How much blame would you give to a government too willing to borrow indiscriminately and international banks like JPMorgan too willing to facilitate that borrowing in the name of making a quick buck?

The blame goes mainly to the Greek governments that couldn’t handle money and make the necessary reforms that were needed decades ago to remain competitive. JP Morgan is a multinational banking and financial service holding company and its goal is to make a profit.

Do you think that Greece should leave the Euro and go back to the Drachma?

Do you think that Greece should leave the Euro and go back to the Drachma?

No, I believe that the future of Greece is to remain in the Euro. It would be a step backwards to go back to the Drachma. In 2001, 1 euro was equivalent to 340.75 Drachma’s. At the current situation 1 euro will be at least 3400 Drachma’s, but I could see that the Greeks could use a second currency simultaneously with the Euro, if not Bitcoin, perhaps a new alternative cryptocurrency specific for the Greeks under 40 that could benefit them.

Plus a lot of stolen money that currently reside outside of Greece, the <> will see the value go up 5-10x overnight and then could even bigger buy outs in the country.

It’s been said that Greece ditching the Euro and adopting Bitcoin would be solving a problem with a bullet in the head – a criticism that carries some weight. Had Greece been able to print Drachma, the economy would have suffered, but there wouldn’t have been this massive crisis. Nevertheless, you’re a Bitcoin entrepreneur and must have a feeling that Bitcoin can help the situation. What do you think Bitcoin could do for Greece in general and individuals in specific?

Bitcoin could prove very useful for Greece with its Blockchain technology. If it were to be used wisely, it could replace a lot of the bureaucracy that has hampered Greece for a long time, and it would attract of lot of pioneers willing to create applications to automate the economy, certain parts of the public sector, and even large parts of the legal system. The Blockchain could provide proof of ownership, help with inheritances or the transmission of a variety of types of titles. Additionally, people could start using it to receive remittances from friends and family from abroad. This would save people a lot of hassle and a lot of fees, fees that are currently going to the big banks.

What is the opinion of Bitcoin regular people have?

Greek people are unaware of Bitcoin. Only one in every thousand knows what it is and half of the ones that do know about it believe that it’s a fraud and don’t trust it.

What would it take for people to begin to trust Bitcoin?

As with all things, it takes understanding something before people would begin to trust it. They will have to put in the work to research and read up on Bitcoin and then see the opportunities and benefits it will have for them.

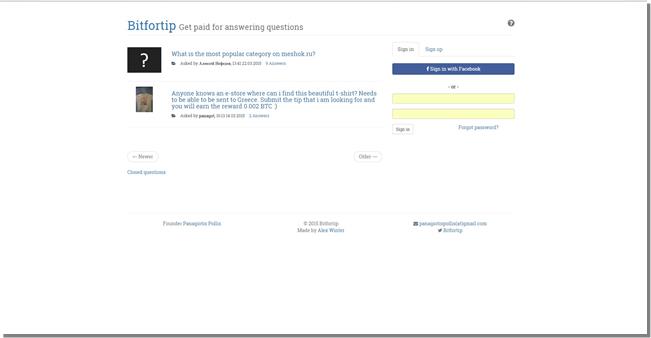

Now you have created a new site, Bitfortip.com, which is a place where people can go with questions and tip Bitcoin for the best answers. The site looks brand new. Can you tell me something about why you created it, who it’s for, and how you see it getting used?

As I said above, developing a use case for Bitcoin seemed like a reasonable idea since day by day it’s becoming more mainstream and it’s being used by more and more people.

As I said above, developing a use case for Bitcoin seemed like a reasonable idea since day by day it’s becoming more mainstream and it’s being used by more and more people.

Bitfortip.com is for anyone who wants to learn more about Bitcoin or for those who are simply interested in earning some tips.

There are already some sites like this. What makes BitForTip stand out?

Bitfortip.com is unique because it enables you to seek for information provided by other members that you can’t find through online searching with exchange for some Bitcoin.

How it works: To be able to post a question you will need to fund your account with bitcoins. You then connect the question with a bitcoin reward of your choice (say for example 0.05 btc) that is held in escrow. What happens next? When someone gives the right answer or information you were looking, you then manually release the reward and the 0.05BTC is credited to his or her BTC wallet address.

What are your plans for it in the future?

Spread the word about this website and hopefully it will get the attention of the Bitcoin community soon.

To end, I often like to ask people what their 30-second elevator pitch for Bitcoin is.

-Hi John. So you’ve heard about Bitcoin?

-Well kind off but not much.

– You should take a look at it. It’s still in its early stages, but in the future, it’s something you’re going to see used in a lot of ways and a lot of places. Already, big companies are being created and lots of applications are being developed based on it. It’s a really exciting technology because it’s just getting started and the possibilities are endless.

Panagiotis’ responses have been edited for clarity. You can also follow Panagiotis on twitter at: https://twitter.com/bitfortip.