JPMorgan Chase Allegedly Conflicting Trading Activities vs CEO Statements

On September 12, Jamie Dimon, CEO of JPMorgan Chase & Co, has made news for himself by criticizing Bitcoin saying that the decentralized digital currency is a fraud.

Recent expose shows that the leading banking institution is actually one of the active buyers of Bitcoin on Nasdaq.

Could Jamie Dimon is playing tricks with the public for a bigger profit all this time?

JPMorgan playing one of its oldest tricks?

It’s not the first time that the nation’s bank got involved in such complicated controversy.

In November 2013, the bank was reportedly asked to pay a whopping $13 bln fine to the federal and state authorities for the misleading investors that had led to a huge financial crisis.

The settlement was questioned by many journalists and financial experts as they seem to sense something is not right with it.

The public, however, lauded Dimon for the bank’s heroism in the times of crisis that helped the US economy. Today, the bank is involved in another rising controversy. This time, it’s Bitcoin.

In an investor’s conference in New York, Dimon has gravely criticized Bitcoin and its capabilities last Tuesday.

For him, Bitcoin is not a real thing and it will soon blow up. He even compared it to the tulip bulbs that collapsed in the 17th century. He said:

“It’s worse than tulip bulbs … it will be the emperor with no clothes.”

Dimon even said that he would no doubt “fire any second” any JPMorgan trader who trades in Bitcoin because it is against their rules and it is such a stupid thing to do. W

With all these negative remarks against the cryptocurrency, it looks like Dimon is supposedly denouncing the innovation in the financial technology.

JPMorgan trading activities conflicting with CEO statements

The news spread like a wildfire and affected Bitcoin’s value on the following days. From $4190, the value shrunk to $2,975.01. After 3 days of the consistent drop, the prices recovered and was up to more than 25%, ending up to $3,740.

Charlie Shrem reveals that the bank has had Blockchain Working Group for a couple of years now, clearly highlighting contradictory workings of the bank from its CEO’s words:

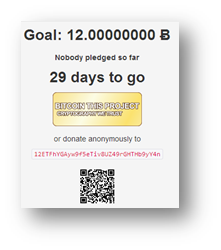

A recent screenshot of JPMorgan Securities Ltd allegedly shows the bank buying Bitcoin on behalf of its clients during the period when its CEO has been making snide remarks against Bitcoin. One person also found out that the wallet used for the transactions showed the same trade reports.

It seems like the bank and the other big game players in the market took their chance to buy huge volumes of Bitcoin while it is cheaper to gain more profit in the future. Now, it’s doubtful if Dimon would fire that so-called JPMorgan trader.