Cryptocurrency money laundering to decline by 30% in 2023: Chainalysis | CoinDesk JAPAN

- 2023 will see an increase in the use of blockchain bridges and a decrease in the use of crypto asset mixers for money laundering.

- This change shows how sophisticated illegal actors can adapt their money laundering strategies.

Illegal activities using crypto assets (virtual currencies) decreased significantly in 2023, partly due to a decline in the trading volume of crypto assets and the increase in the number of advanced threat actors such as the Lazarus Group. have developed ways to avoid detection. Blockchain analysis firm Chainalysis pointed out this in its annual report on crypto money laundering.

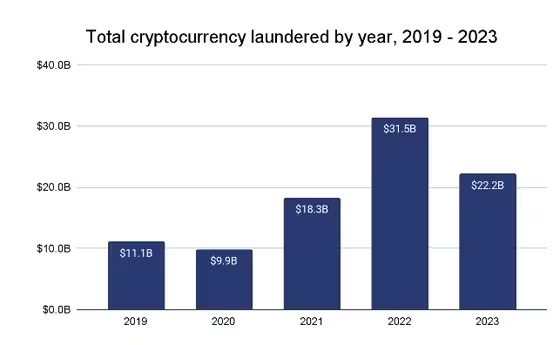

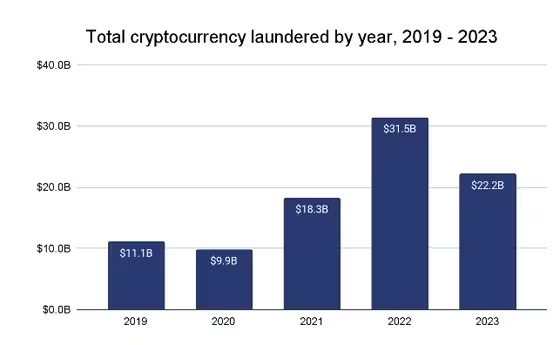

22.2 billion dollars in 2023

According to Chainalysis, $22.2 billion (approximately 3.33 trillion yen, at an exchange rate of 150 yen to the dollar) was laundered through crypto assets in 2023, down from $31.5 billion the previous year. This decline was greater than the decline in trading volumes, indicating that factors other than the overall market downturn may have contributed to the decline in illegal activity. This figure shows that only about 1% of all money laundering is carried out using crypto assets. Deloitte said in a June 2023 report that the amount of all illegal money laundered is about $2 trillion annually.

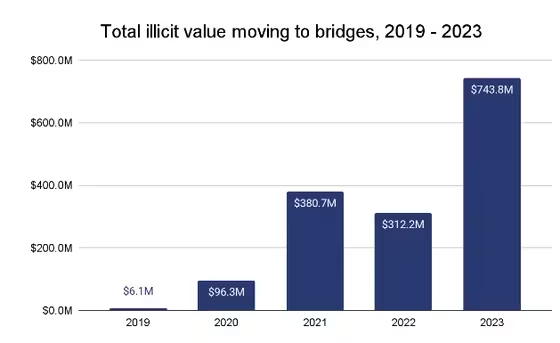

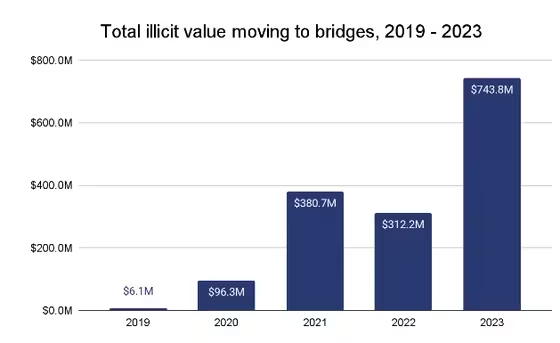

2023 saw an increase in the use of blockchain bridges and gambling services for crypto money laundering purposes. Meanwhile, in 2022, reliance on illegal service types and centralized exchanges increased.

Illegal fund inflow into DeFi is also increasing

The report also notes that the proportion of illicit funds transferred to decentralized finance (DeFi) protocols has increased, with this increase primarily due to the rise in DeFi assets under custody (Total Value Locked: TVL) during this period. Then it was pointed out.

“DeFi’s inherent transparency makes it generally a poor option for obfuscating the movement of funds,†Chainalysis explained.

For example, blockchain transparency allows Hamas, which is classified as a terrorist group by jurisdictions such as the United States, United Kingdom, and European Union, to track a significant portion of the crypto assets it procures and close its crypto accounts. has been done.

Adapt your money laundering strategy

According to Chainalysis, the Lazarus Group, a threat actor based in North Korea, is adapting its money laundering strategies to avoid finding itself in the same situation.

Lazarus Group has utilized various protocols, including mixers like YoMix and cross-chain bridges, to obfuscate the origin of stolen funds and avoid detection.

“The growth of YoMix and its use by Lazarus Group is a prime example of the ability of sophisticated actors to adapt and find replacement obfuscating services when a previously popular service is shut down. †Chainalysis pointed out.

Are mixer remittances decreasing due to authorities’ efforts?

While bridges have grown in popularity thanks to Lazarus Group’s preference, the amount of funds sent to mixers from illegal addresses has nearly halved to $504.3 million. Ta.

“Much of this is likely due to law enforcement and regulatory efforts, such as the sanctions and closure of mixer Sinbad in November 2023,†Chainalysis noted.

As CoinDesk reported at the time, the U.S. Treasury Department has sanctioned Sinbad, a cryptocurrency mixer with suspected ties to a North Korean hacking group, resulting in the FBI, Dutch and Finnish authorities targeting Sinbad’s website. led to the seizure of

“The changes in money laundering strategies we see from crypto criminals like Lazarus Group are a reminder that the most sophisticated illicit actors are constantly adapting their money laundering strategies and exploiting new types of crypto services. “It plays an important role in the development of the economy,†Chainalysis pointed out.

|Translation and editing: Rinan Hayashi

|Image: Jason Leung/Unsplash

|Original text: Crypto Money Laundering Dropped 30% Last Year, Chainalysis Says

The post Cryptocurrency money laundering to decline by 30% in 2023: Chainalysis | CoinDesk JAPAN appeared first on Our Bitcoin News.