Bitcoin, which has reached a new all-time high in yen, what risks does it face from recent selling pressure?

Macroeconomics and financial markets

On the 15th, in the US New York stock market, the Dow Jones Industrial Average closed 348 points (0.91%) higher than the previous day, and the Nasdaq index closed 47 points (0.3%) higher.

In the Tokyo stock market, the Nikkei Stock Average rose 316 yen (0.83%) from the previous day. The price rose by more than 700 yen at one point, and is about to break its all-time high of 38,957 yen for the first time in 34 years.

Among US stocks related to crypto assets (virtual currency), Coinbase rose 3.25% from the previous day to $165 following the announcement of financial results. Shares are up 12% in after-hours trading.

Revenues related to virtual currency trading reached $520 million (approximately 79 billion yen), an 83% increase from the previous quarter.

CoinPost app (heat map function)

connection:Coinbase results show net profit in the black due to increase in virtual currency trading, stock price rises over 12% after hours

connection:Why Sumitomo Mitsui Card Platinum Preferred is rapidly gaining popularity as a new NISA savings investment

Virtual currency market conditions

In the crypto asset (virtual currency) market, Bitcoin (BTC) rose 0.33% from the previous day to 1 BTC = $52,158.

This is a 15% increase compared to the previous week and a 20.8% increase compared to the previous month.

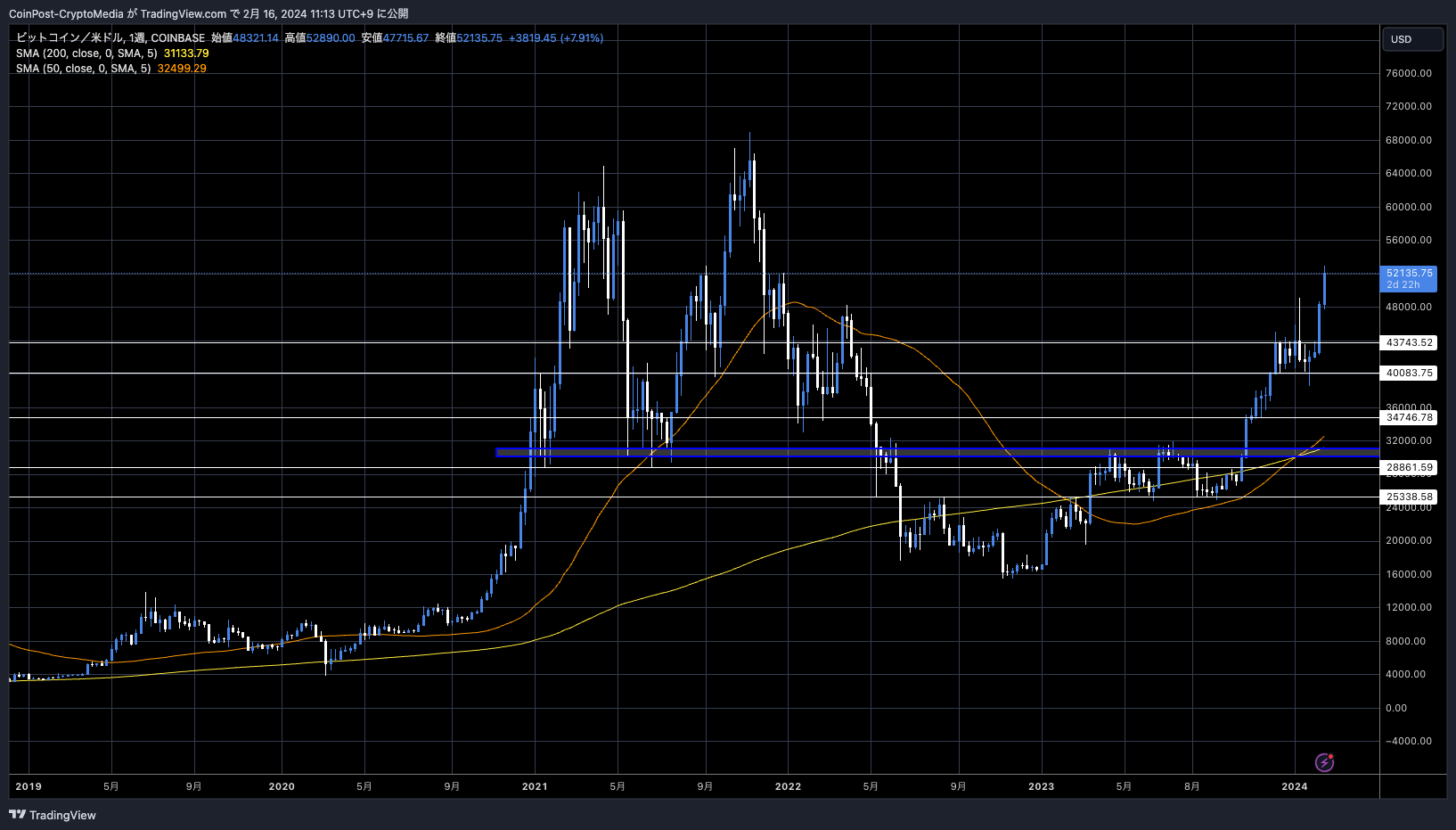

BTC/USD weekly

In addition to exceeding the $1 trillion market capitalization mark for the first time since December 2021, the market capitalization in Japanese yen terms reached a record high of 7.9 million yen due to the weaker yen. Some point out that the recent surge in the Nikkei Stock Average (Japanese stocks) has led to an influx of surplus money from individual investors.

The highest price in dollar terms was recorded in November 2021, when 1BTC = $69,000. Net flows of Bitcoin spot exchange-traded funds (ETFs) have already exceeded the $3 billion mark after approval by the U.S. SEC (Securities and Exchange Commission), easily outpacing gold-based alternative funds.

Meanwhile, according to a report by Spot On Chain, the crypto asset (virtual currency) market risks facing two selling pressures.

The #Bitcoin price has been on the rise for the past 7 days and finally broke the $52K mark again after 2 years!

However, there are two impending big threats to the short-term $BTC price. Can it overcome?

1. #Genesis was approved to sell 35M Grayscale Bitcoin Trust shares… pic.twitter.com/Qn7wbQXaDa

— Spot On Chain (@spotonchain) February 15, 2024

The first is Bitcoin selling by Genesis, which went bankrupt in 2022.

Genesis has received approval to sell 35 million shares of Grayscale’s Bitcoin Trust (GBTC), worth $1.3 billion, in order to settle its debts and pay off its creditors.

The second is the US government’s selling of Bitcoin.

On January 25, the US government filed a notice of sale of 2,875 BTC (equivalent to $150.6 million) seized in the Silk Road incident, and is said to hold 208,000 BTC ($10.9 billion).

Famous analyst Ali pointed out that the set-up “9†was lit on TD Sequential indicating a short-term reversal.

Warning! The TD Sequential presents a sell signal on #Bitcoin daily chart, anticipating a one to four daily candlesticks correction. Note that the buy and sell signals this indicator has shows since December 2023 have all been validated. pic.twitter.com/XQoP8TLvye

— Ali (@ali_charts) February 15, 2024

In the past, there were many cases in which the market functioned as a reversal signal, such as a push or a pullback. If the countdown “13†lights up, it may indicate a larger trend reversal point.

TD Sequential, created by Tom DeMark, is said to help predict price reversals and market turning points by analyzing patterns of highs and lows on charts and converting them into numerical sequences.

That said, the market is currently being driven by real demand from institutional investors for Bitcoin spot ETFs (exchange traded funds), and there is no sign of overheating in the derivatives market as Bitcoin halving approaches.

connection:What is Bitcoin halving?Outlook for 2024 based on past market price fluctuations

Significant buying of US time

According to 10xResearch, Bitcoin’s recent rally occurred during US trading hours, significantly outpacing Asian and European trading hours. BTC rose 17% month-over-month, with 11% of that increase occurring during US time. Asian and European time zones account for only 3% each.

Coinbase premium has also risen to the highest level in the past nine months, indicating that demand from US institutional investors is rapidly increasing.

Meanwhile, on Coinbase, institutional brokers seem to be fulfilling client purchase orders for #Bitcoin.https://t.co/CBvH58cfIG pic.twitter.com/Opl3rAoCuR

— Ki Young Ju (@ki_young_ju) February 15, 2024

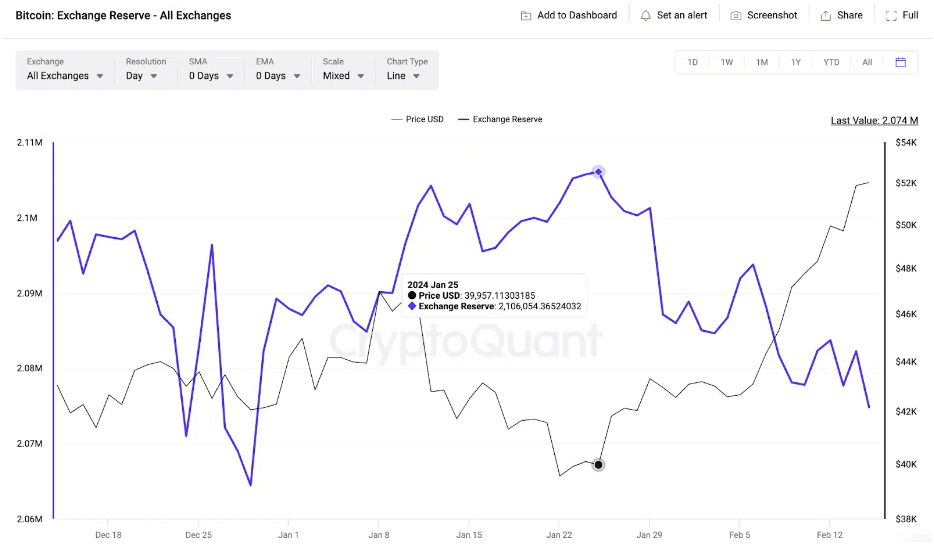

The significant decrease in Bitcoin reserves at crypto asset (virtual currency) exchanges means that investors are increasingly willing to hold the Bitcoin for the long term. As of January 25th, it was 2.1 million BTC, but as of February 15th, it had decreased to 2 million BTC.

CryptoQuant

Related: Points to note about virtual currency IEOs Domestic and international examples and how to participate

Related: Explaining the advantages of staking and accumulation services and the advantages of virtual currency exchange “SBI VC Tradeâ€

We have introduced the “Heat Map†function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.â– Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin, which has reached a new all-time high in yen, what risks does it face from recent selling pressure? appeared first on Our Bitcoin News.