Bitcoin vs. Yen hits new high; even in the options market, there is limited room for a downside price | Contributed by a bitbank analyst

Virtual currency market prices this week from February 10th (Sat) to February 16th (Fri)

Mr. Hasegawa, an analyst at Bitbank, a major domestic exchange, illustrates this week’s Bitcoin chart and deciphers the future outlook.

- table of contents

-

- Bitcoin on-chain data

- bitbank contribution

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other services

bitbank analyst analysis (contributed by Tomoya Hasegawa)

Weekly report from 2/10 (Sat) to 2/16 (Fri):

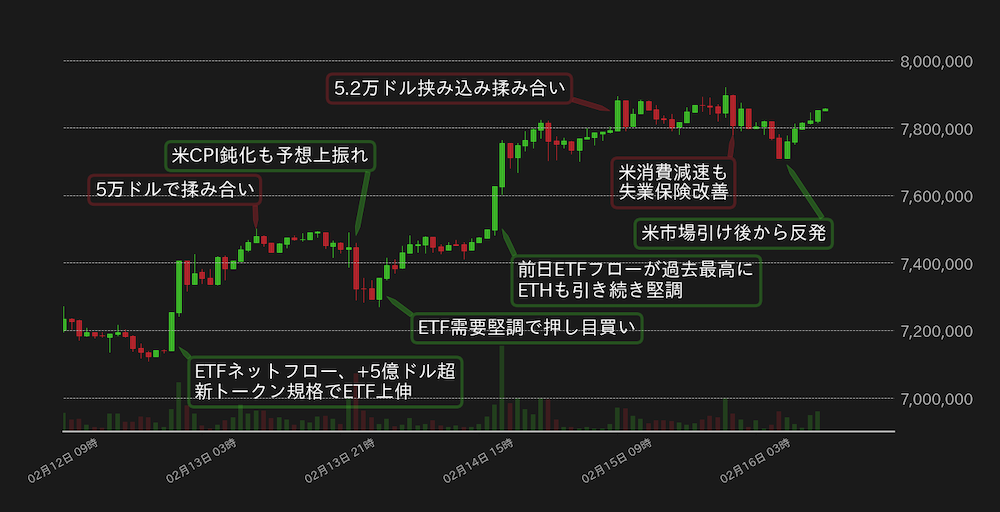

This week’s Bitcoin (BTC) vs. yen continued to trend steadily from last week, hitting an all-time high of 7.798 million yen for the first time in two years and three months.

BTC yen has been following the upward trend since the beginning of the week, recovering from around 7.1 million yen to 7.4 million yen. On this day, the market was supported by the fact that inflows into the US spot Bitcoin ETF exceeded $500 million during all business days, and Ether (ETH), which is attracting attention due to the new token standard ERC-404, remained strong. It became a material.

On the 13th, the market traded at the turning point of $50,000, and then fell back in response to January’s U.S. CPI results, but the net flow of funds to ETFs exceeded $400 million, confirming continued strong demand. As a result, the decline was quickly resolved.

On the 14th, net flows into ETFs for the 13th day amounted to $631 million, which was a new record high despite the upside in the US CPI, which was a positive reaction, and BTC touched 7.8 million yen.

On the other hand, as a result of this, the market price recovered to the $52,000 level, but since the 15th, the price has been hovering around that level, leading to a lack of direction.

[Figure 1: BTC vs. Yen chart (1 hour)]Source: Created from bitbank.cc

Last week, BTC recovered from the decline that occurred immediately after physical Bitcoin ETF trading began in the US, and it was pointed out that it would be easy to see a return to selling soon.However, the flow of funds to ETFs has been increasing since January 26th. Not only has the situation continued, but since February 8th, the net inflow amount has far exceeded the amount of BTC mined in a day (900 BTC = $47 million) ($339 million to $631 million).

Moreover, there was a surprise this week with an upward swing in the US CPI, and even though expectations of an early US interest rate cut by the US Federal Reserve receded on the 13th, the amount of inflows into ETFs hit a new record high, leading to interest rate cuts. This shows that institutional investors’ demand for BTC was strong even in a situation where the risk of postponement became apparent.

BTC has been on a rapid rise in price over the past two weeks, and technically there is a sense of overheating, but if the demand for ETFs continues to be strong, the price will rise at around $52,000. It is expected that the price will take a short break and then move higher again.

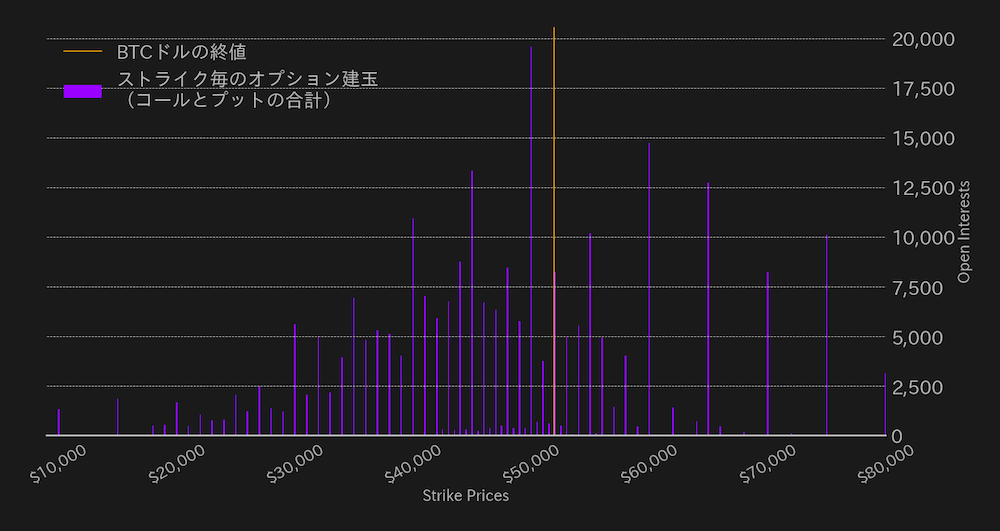

BTC has hit a year-to-date high this week even in dollar terms, and a strike in which open interest is concentrated in the options market is likely to be a guideline for the near-term upside.

Currently, open interest is concentrated at $55,000 and $60,000, and given the recent pace of rise in the market, it is possible for the stock to test $60,000 at the end of the month. On the other hand, even if the market goes into a correction, the maximum potential in the options market is the $50,000 strike, so we think the downside is quite limited.

[Figure 2: Open interest by strike in the BTC option market]Source: Created from Glassnode

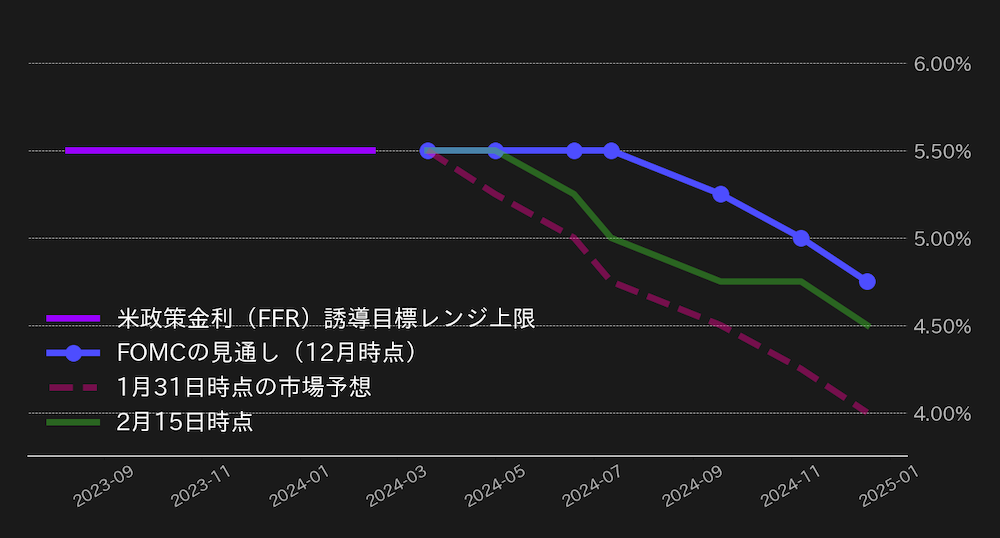

On the other hand, in the FF interest rate futures market, expectations that interest rates would be cut between March and May have significantly receded since the beginning of February, and the majority consensus has recently been for interest rate cuts to begin in June. Until January, the market had been pointing out that the market was expecting too much from the Fed for early interest rate cuts, but as of the 16th, the gap between the market’s policy rate outlook and the FOMC’s outlook has narrowed significantly.

Although there is still a possibility that the start of interest rate cuts will be delayed until the second half of the year, the market’s forecast for year-end rate cuts is 4.75% by the FOMC, compared to 4.5% by the market, narrowing the gap from 75bp in January to 25bp.

In a sense, it is surprising that the market has been able to handle such revisions to the outlook without causing a shock, but the progress in aligning the outlook with the FOMC is a source of reassurance, as it reduces the scope for shocks.

[Figure 3: FF interest rate target upper limit, FOMC’s FF interest rate outlook and market outlook]Source: Created from FRED and FedWatch

connection:bitbank_markets official website

Previous report:Bitcoin recovers from decline after approval of ETF, and CPI on 13th causes caution

The post Bitcoin vs. Yen hits new high; even in the options market, there is limited room for a downside price | Contributed by a bitbank analyst appeared first on Our Bitcoin News.