“78% of institutional traders have no plans to trade cryptocurrencies†JP Morgan survey

Attitude survey for institutional investors

US financial giant JP Morgan has released the 2024 edition of “The e-Trading Edit,” an attitude survey targeting more than 4,000 institutional traders. Questions regarding crypto assets (virtual currency) are also included.

First, regarding handling of virtual currencies, 78% of traders answered that they have no plans to trade virtual currencies or digital assets at this time. This is up from 72% in 2023.

Additionally, 9% of traders are currently trading cryptocurrencies and digital assets, an increase of 1% from 8% last year. Additionally, 12% said they plan to trade cryptocurrencies or digital assets in the future.

Some analysts cite the lack of uniform regulation in the cryptocurrency market as a factor inhibiting investor participation.

In the United States, the Securities and Exchange Commission (SEC) is currently suing exchanges including Coinbase and Binance for offering unregistered securities.

Criticism has been voiced from the cryptocurrency industry and some SEC officials, saying that there are no clear guidelines for determining whether certain tokens are securities.

connection: Bloomberg Senior Litigation Analyst “Coinbase has the upper hand in lawsuit against SEC, 70% chance of successâ€

Additionally, although there are several moves in the U.S. Congress to draft legislation to clarify virtual currency regulations, no comprehensive legislation has yet been enacted.

connection: “Regulation at the US federal level is needed” Treasury Secretary Yellen emphasizes stablecoin regulation bill in Congress

The results of this survey suggest that despite the approval of Bitcoin (BTC) spot ETFs, large inflows of funds from institutional investors who have not previously handled virtual currencies are not expected immediately. .

JPMorgan analysts have long predicted that cash ETFs would become a zero-sum game, with liquidity draining away from other products such as Bitcoin futures.

connection: JP Morgan: “More than 5 trillion yen will flow into Bitcoin spot ETF from other products.â€

What is Bitcoin ETF?

An Exchange Traded Fund that includes Bitcoin as an investment. An investment trust is a financial product that collects money from investors into a single fund and invests it in stocks, bonds, etc. The system is such that the investment results are distributed according to each investor’s investment amount. Among investment trusts, ETFs are listed on stock exchanges, so they can be bought and sold like stocks.

Virtual currency glossary

Virtual currency glossary

connection:

Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

AI gains attention

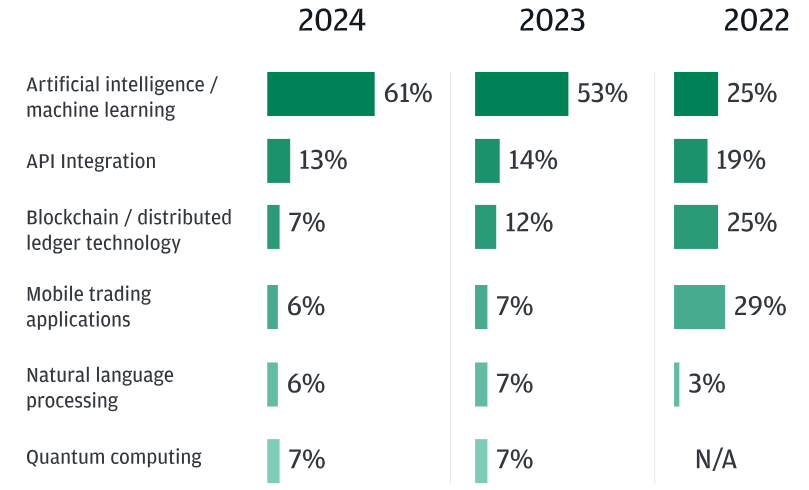

JPMorgan also asked respondents, “Which technology will have the biggest impact on trading over the next three years?”

Source: JP Morgan

61% of traders cited “artificial intelligence (AI) and machine learning†for this. This is an 8% increase compared to last year. On the other hand, the response for “blockchain/distributed ledger technology†decreased from 12% last year to 7%.

Additionally, inflation (27%) was cited as the number one factor influencing financial markets in 2024, followed by the US presidential election (20%), recession risk (18%), and geopolitical conflicts (20%). (14%), followed by a disconnect between markets and the economy (14%).

connection:Virtual currency-related policies will be one of the issues in the US presidential election in November 2024

The post “78% of institutional traders have no plans to trade cryptocurrencies†JP Morgan survey appeared first on Our Bitcoin News.