Will Grayscale Bitcoin ETF continue to sell after 9000 BTC transfer?

A total of 11,000 BTC sold?

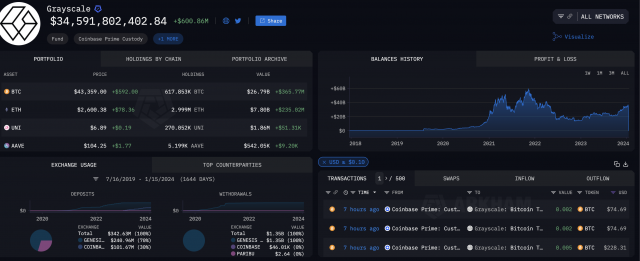

It appears that BTC outflows (fund outflows) are continuing from Grayscale’s Bitcoin spot ETF “GBTCâ€.

According to Arkham Intelligence, a blockchain data analysis service, it was confirmed that a total of 9,000 BTC (57.4 billion yen), with 1 transaction = 1,000 BTC, was sent to a Coinbase account before the stock market started trading on Tuesday.

This transfer follows last week’s 2,000 BTC, bringing the total outflow to date to 11,000 BTC. Currently, Grayscale’s Bitcoin holdings are 617,853 BTC.

Source: Arkham

GBTC currently has the highest management fee (1.5%) among the 11 Bitcoin ETFs, and large investors and traders who acquired GBTC at a low price when it went negative are likely to turn to Bitcoin ETFs with lower fees such as BlackRock and Fidelity. It is believed that they are selling it in order to switch cars.

Source: Bloomberg

connection: Cryptocurrency market has fallen sharply after approval of Bitcoin ETF, selling pressure due to Grayscale’s GBTC etc.

Last week, Anthony Scaramucci, the founder of US investment fund Skybridge Capital, which also invests in Bitcoin, said that the sale of his holdings in GBTC will spur the fall in the Bitcoin (BTC) market after the approval of Bitcoin ETF (Exchange Traded Fund). He said that he believed that the Meanwhile, the company said it expects this selling pressure to be resolved within six to eight business days.

For the third day, total trading volume for the U.S. Bitcoin ETF was around $1.8 billion, a significant drop from last Friday’s $3 billion.

connection: Over 100 billion yen inflows into Bitcoin spot ETF in 2 days, BlackRock leads the way

connection:

Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

The Nikkei Stock Average temporarily reached the 36,000 yen level, the highest since the bubble economy in about 34 years. The “New NISA†effect has been pointed out as one of the reasons for the rise in stock prices.

New NISA special feature | Explaining the benefits of accumulated investment, the appeal of expanding the tax-free investment limit, and stock selection for beginners https://t.co/LNkkEgh3Z3

— CoinPost (virtual currency media) (@coin_post) January 15, 2024

The post Will Grayscale Bitcoin ETF continue to sell after 9000 BTC transfer? appeared first on Our Bitcoin News.