“Regulatory developments in each country contributed to restoring trust in digital assets†PwC summarizes 2023

Contributing to restoring trust in virtual currencies

Price Waterhouse Coopers (PwC), one of the world’s four largest accounting and consulting firms, has released a report on the regulatory status of crypto assets (virtual currencies) around the world. He summarized that throughout 2023, remarkable progress was made in global virtual currency regulation.

For those navigating #crypto in 2024, it’s not just about weathering the storm – but building a foundation for a thriving ecosystem, where clear regulatory guidance acts as the cornerstone of renewed stability.

Explore the full report: https://t.co/r1PfpudCW0 pic.twitter.com/zmg59be6VH

— PwC (@PwC) December 22, 2023

Matt Blumenfehud, Web3/Digital Assets Leader at PwC in the US, points out that “the development of regulatory and legal frameworks over the past year has contributed to restoring confidence in digital assets,†and comments on the outlook for 2024. He said so.

For industry players around the world, 2024 is not just about overcoming challenges. It is about building the foundations of a thriving ecosystem, where clear regulatory guidance serves as the cornerstone of new stability.

The report highlights the European Union’s (EU) crypto-asset market regulation MiCAR (The Markets in Crypto-Assets Regulation) as one of the major developments. MiCAR is a comprehensive regulatory and supervisory framework that goes beyond the jurisdictions of EU member states and was officially approved in June 2023.

connection:EU officially approves comprehensive virtual currency regulation proposal MiCA, to enter into force in stages

The report also assessed the regulatory situation in 43 countries around the world and provided an individual overview of the situation in each country.

Countries with advanced regulations

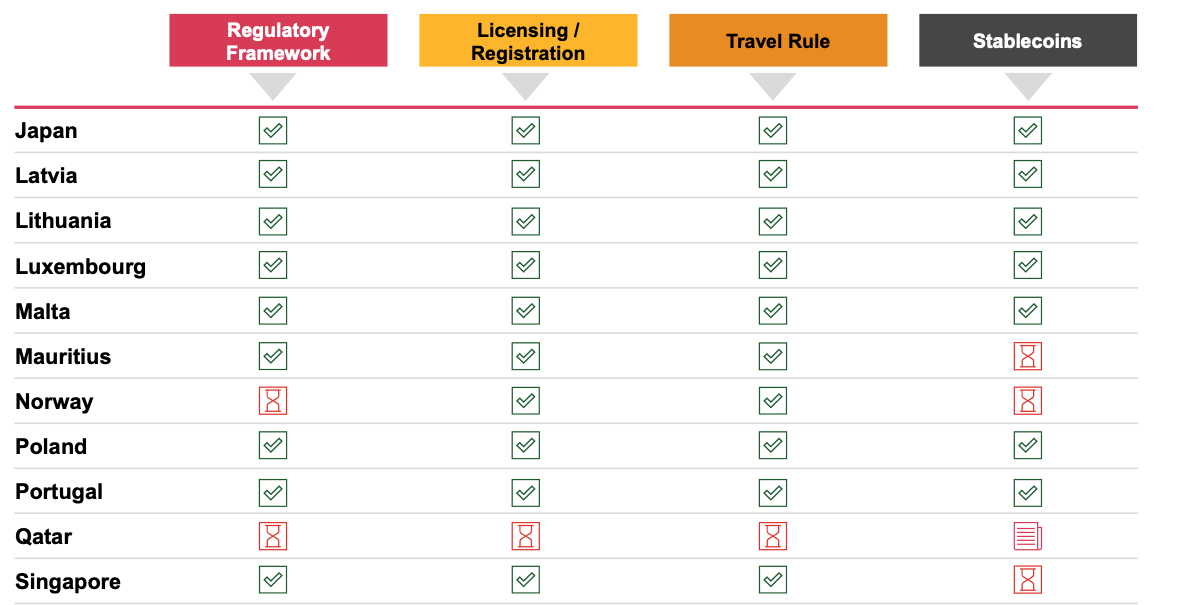

PwC has compiled a list of the status of 43 countries in four areas as of January 2024: virtual currency regulatory framework, license/registration introduction, travel rules, and stable coins. The situation in each country reflects the influence of the EU’s MiCAR.

The following 24 countries, including Japan, have cleared all four criteria.

Austria, Bahamas, Bulgaria, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Ireland, Italy, Japan, Latvia, Lithuania, Luxembourg, Malta, Poland, Portugal, Slovakia, Spain, Sweden, Switzerland

The only countries/regions where stablecoin regulations were not established were Hong Kong, Singapore, the United Arab Emirates (UAE), and Mauritius.

Hong Kong, which aims to become a global hub for cryptocurrencies, has indicated that it hopes to have guidelines for stablecoin issuers in place by mid-2024.

connection:Hong Kong stablecoin issuance guidelines to be released next year

In Singapore, the central bank announced its final regulatory approach for stablecoins in August this year. It applies to single-currency stablecoins that are tied to the value of the Singapore dollar or G10 currencies issued in Singapore.

connection:Central Bank of Singapore announces regulatory framework for stablecoins

As mentioned above, in Hong Kong, Singapore, and Mauritius, activities are already underway to develop regulations, such as discussions and deliberations regarding stablecoin regulations, while in the UAE, the development and consideration of a regulatory framework is still underway. It doesn’t seem to have started.

In the EU, MiCAR’s stablecoin regulations are scheduled to come into effect in July 2024.

What is G10 currency?

The currency most used for trade in international financial markets, exchange transactions, and settlement of international transactions. US dollar (USD), euro (EUR), British pound (GBP), Japanese yen (JPY), Australian dollar (AUD), New Zealand dollar (NZD), Canadian dollar (CAD), Swiss franc (CHF), Norwegian krone (NOK) ) and the Swedish Krona (SEK).

Virtual currency glossary

Virtual currency glossary

US, UK and Canada lag behind

According to PwC, the general regulatory framework and stablecoin regulations are underdeveloped in the US, UK, and Canada.

The United States lacks a comprehensive and cohesive federal licensing and registration process for digital assets. Much of the guidance regarding licensing and/or registration is provided by courts as cases are resolved and judgments rendered.

In the United States, the Securities and Exchange Commission (SEC), the regulatory authority in particular, has been criticized for cracking down on virtual currencies without providing clear regulatory guidelines. In November, Representative Tom Emmer introduced a bill to protect the cryptocurrency industry from SEC enforcement. It passed the House of Representatives.

connection:U.S. House of Representatives passes industry protection bill banning use of funds used to crack down on SEC crypto companies

Although unregulated, US dollar-denominated stablecoins make up a major part of the virtual currency market, and the market capitalization of stablecoins hit a new all-time high this year, reaching 18.6 trillion yen (131 billion yen). dollar) has been reached. (Coingecko data)

In the United States, the “Payment Stablecoin Clarification Act†was submitted to Congress in July of this year, and passed by the House Financial Services Committee at the end of the same month, but the Federal Reserve Board (FRB) in August Announced strengthened supervision of banks regarding stablecoin handling. There are no prospects for the bill to become law, as the members of Congress who submitted the bill sent a letter of protest to the Federal Reserve.

connection:U.S. House of Representatives members protest against Fed over stricter regulation of virtual currency stablecoins

The National Defense Authorization Act, which sets the framework for the defense budget for fiscal year 2024 (October 2023 to September 2024) announced on December 6, does not include any provisions regarding virtual currencies, and does not include any provisions regarding virtual currencies. It was removed from the list.

connection:U.S. Congress rejects virtual currency-related provisions in National Defense Authorization Act

The post “Regulatory developments in each country contributed to restoring trust in digital assets†PwC summarizes 2023 appeared first on Our Bitcoin News.