Bitcoin has fallen below the 6 million yen level, wary of further depreciation | Contributed by bitbank analyst

Virtual currency market prices this week from 1/20 (Sat) to 1/26 (Fri)

Mr. Hasegawa, an analyst at Bitbank, a major domestic exchange, illustrates this week’s Bitcoin chart and deciphers the future outlook.

- table of contents

-

- Bitcoin on-chain data

- bitbank contribution

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other services

bitbank analyst analysis (contributed by Tomoya Hasegawa)

Weekly report from 1/20 (Sat) to 1/26 (Fri):

This week’s Bitcoin (BTC) vs. yen price has seen a heavy uptick, falling below the milestone of 6 million yen for the first time this year.

At the beginning of the week, the BTC market price fell as the Asian stock market fell due to the downturn in Chinese economic indicators, and the market started to decline rapidly due to sell-offs, testing below 6 million yen.

Furthermore, on that day in the U.S. time, it was discovered that FTX had sold $1 billion worth of GBTC (Grayscale Spot Bitcoin ETF), causing the value to fall below 5.9 million yen.

By Tokyo time on the 23rd, the following day, BTC had recovered to 5.9 million yen in what appeared to be a self-sustaining rebound, but there was a sell-off at the $40,000 level, and at one point it fell below 5.8 million yen.

On the other hand, due to the market decline in the first half of the week, the dollar-denominated BTC rebounded from last November’s high of $38,400, and with the rise in US stocks as an ally, the BTC yen recovered to the $40,000 level, or around 6 million yen. Since then, although US economic indicators showing the strength of the economy have weighed on the market, there has been a positive impression that the outflow of funds from GBTC has slowed down, and the market has been in a tussle over the milestone level.

[Figure 1: BTC vs. Yen chart (1 hour)]

Source: Created from bitbank.cc

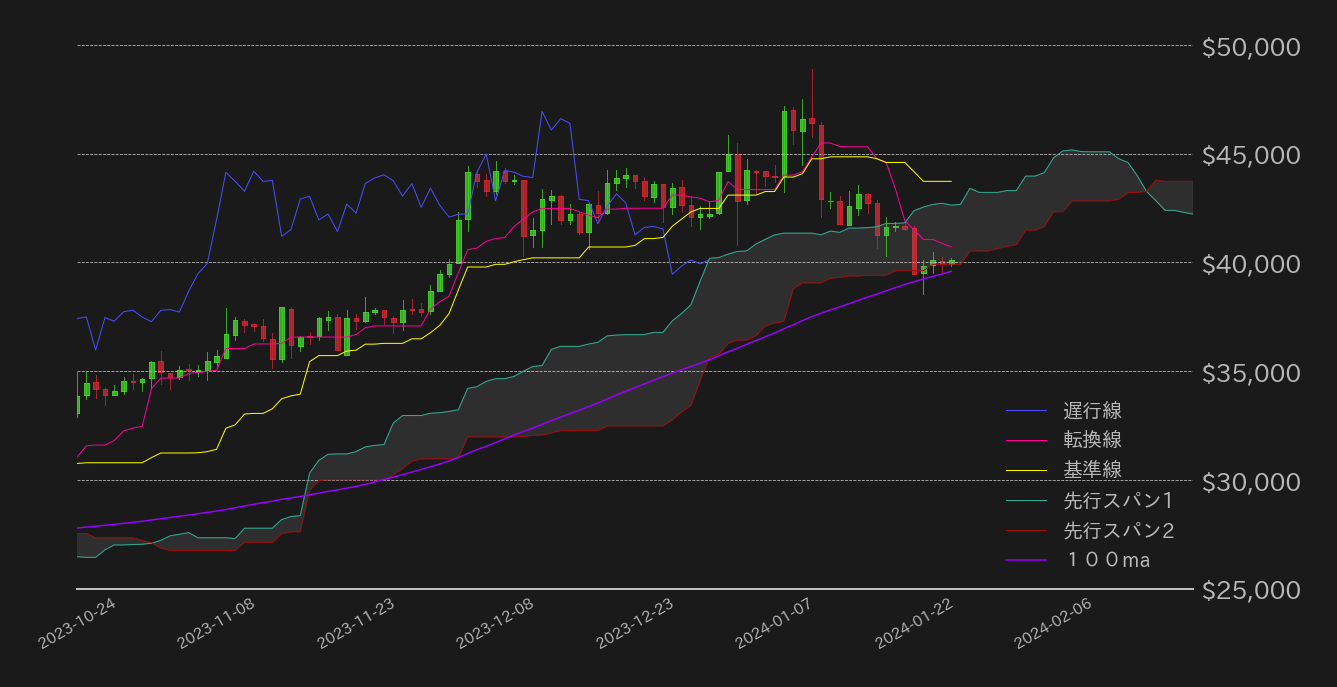

At one point, BTC fell well below $40,000 this week, but once the CME window was filled, it returned to around $40,000. On the technical side, the situation is that it is barely maintaining the cloud lower limit of Ichimoku Kinko Hyo and the 100-day moving average (ma), and if these technical supports are broken, BTC will look for a lower price. comes into view (Figure 2).

[Figure 2: BTC vs. USD Ichimoku balance table and 100-day moving average (daily)]

Source: Created from Glassnode

This week, the preliminary US GDP growth rate for the fourth quarter was 3.3%, much higher than market expectations, and showed the resilience of personal consumption, but the Personal Consumption Expenditures (PCE) price index for the same period was The rate was 1.7%, down from 2.6% in the previous quarter, indicating that inflation is steadily slowing down.

Given these mixed results, BTC has failed to show a sense of direction, but the PCE price index for December is scheduled to be announced on the 26th, and depending on the results, the market price could break below the support mentioned above. Development is expected.

In fact, the consumer price index (CPI) and retail sales for December have exceeded market expectations, so is it possible that the PCE price index will be similarly strong?

In terms of near-term downside targets, we believe that the appropriate price range is $38,000 (approximately 5.617 million yen), which became a market resistance in November last year, and the -2σ Bollinger Band ($37,800 ≒ 5.587 million yen).

In addition, as economic indicators for December turned out to be strong, the US Federal Reserve (FRB), which had been taking a more cautious stance until the end of last year, will once again take a stance on the market at next week’s US Federal Open Market Committee (FOMC) meeting. It has also been pointed out that there is a possibility that this will put a check on expectations for an early interest rate cut, and we should be wary of further corrections in the BTC market.

connection:bitbank_markets official website

Previous report:Bitcoin is developing without a sense of direction, with heavy upside and limited downside room

The post Bitcoin has fallen below the 6 million yen level, wary of further depreciation | Contributed by bitbank analyst appeared first on Our Bitcoin News.