The reality and misconceptions surrounding the transparency of crypto assets: On-chain tracking contributes to investor protection and dissemination | CoinDesk JAPAN

Market is revitalized due to increased interest

Cryptoassets are attracting widespread interest from individuals to startups looking to leverage blockchain technology, with some companies allocating a portion of their balance sheets to assets like Bitcoin (BTC).

However, recent talk has centered largely on the possibility that the U.S. Securities and Exchange Commission (SEC) will allow Bitcoin exchange-traded funds (ETFs) to be traded in the United States by early 2024.

Canada has had Bitcoin ETFs for several years, and Europe recently launched its first ETF, but there is a much larger market in the United States. ETF approval in the U.S. opens the door for large financial institutions to enter the market, with recent ETF applications including BlackRock, VanEck, Fidelity, and Franklin Templeton. Names are listed.

Beyond ETFs, financial institutions like JPMorgan are experimenting with blockchain technology using a “forked†version of Ethereum called Quorum (later sold to ConsenSys). JPMorgan is currently reportedly considering blockchain-based deposit tokens to speed up cross-border payments.

Various aspects of crypto assets

Crypto assets, and the currently popular term “digital assets,†have different meanings to different people. A good place to start is to understand how this technology and digital assets can benefit you.

There are many knowledgeable people online, so it’s important to carefully evaluate educational sources. Reputable programs are available online through professional organizations like the CIO Institute and universities like Massachusetts Institute of Technology (MIT) and Cornell University.

Some types of digital assets are best suited as a means of transaction, such as stablecoins, which are pegged to a specific fiat currency and provide stable value. These provide a means of accessing the global financial system.

In developing countries, access to dollar-denominated assets can be a literal savior. Some people use it for daily payments, while others simply want to preserve their assets.

Others view specific digital assets as investment opportunities. For example, Fidelity Digital Assets recently reviewed its valuation of Bitcoin, highlighting the differences between the broader “crypto token†ecosystem and Bitcoin as a digital asset.

Super bulls like Michael Saylor and his company MicroStrategy, who adopted the “Bitcoin Strategy†in 2020, use cash flow and debt to buy Bitcoin and balance it out. It is held on the sheet. MicroStrategy has thoroughly outperformed the market since then.

Skepticism exists—some justified, some based on misconceptions

Unfortunately, there is a growing recognition that crypto assets are highly anonymous and difficult to trace, making them easy to use for crimes and illegal activities.

Other concerns include regulatory uncertainty, price volatility, and ecosystem disruption due to multiple bankruptcies. There have also been allegations and convictions of fraud, Ponzi scheme, and embezzlement of funds.

You’ve probably seen the news about dark web criminals and hackers asking for payments in crypto assets such as Bitcoin. Due to such reports, there is a widespread perception that crypto assets are a haven for criminals and terrorists.

However, an analysis of criminal activity conducted by Chainalysis shows that 0.24% of all crypto transactions in 2022 were illegal.

For reference, the market capitalization of crypto assets is approximately $1.3 trillion (approximately 195 trillion yen, converted at 1 dollar = 150 yen) as of the fourth quarter of 2023. The United Nations Office on Drugs and Crime estimates that the amount of money laundered annually is about 2-5% of global GDP, or between $800 billion and $2 trillion, which is more than the market capitalization of crypto assets.

Of course, this does not mean that crimes do not occur. According to Chainalysis, in 2022, sanctioned parties committed criminal acts worth $20 billion in illicit activities, including the use of crypto assets, fraud, and theft.

Criminals use sophisticated approaches, but can be traced

Although blockchain transactions are pseudo-anonymous, they are recorded as part of the transaction in a fully traceable end-to-end audit trail and stored in a permanent transaction ledger.

Cryptocurrency transactions recorded in the ledger can be uniquely identified, allowing law enforcement to trace relationships between specific addresses, wallets, and entities. These relationships can be used by law enforcement to identify connections to regulated “on-ramps†and reveal connections to real-world entities.

On-chain monitoring systems for major networks like Bitcoin and Ethereum are becoming more sophisticated and rapidly improving. This will continue to weed out bad actors.

Tracking assets is as much an art as it is a science, and it’s being perfected through the use of tools created by companies like Chainalysis, Elliptic, TRM Labs, and CipherTrace.

Experts are using these tools to analyze and track transactions and take advantage of on-chain data to track crypto assets to get a complete picture.

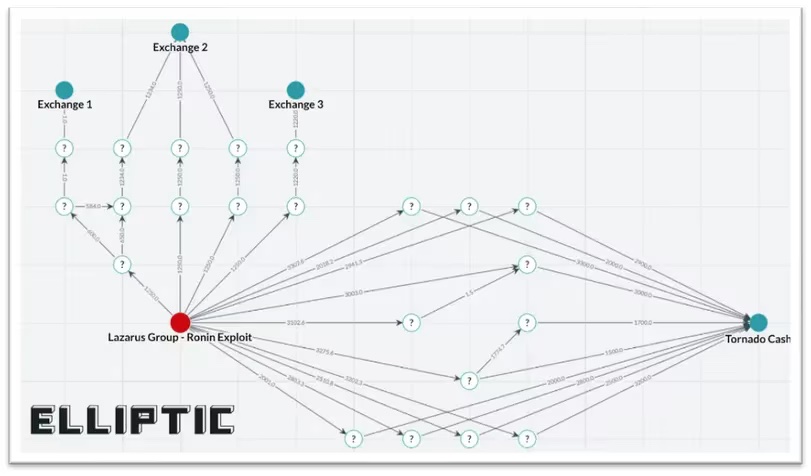

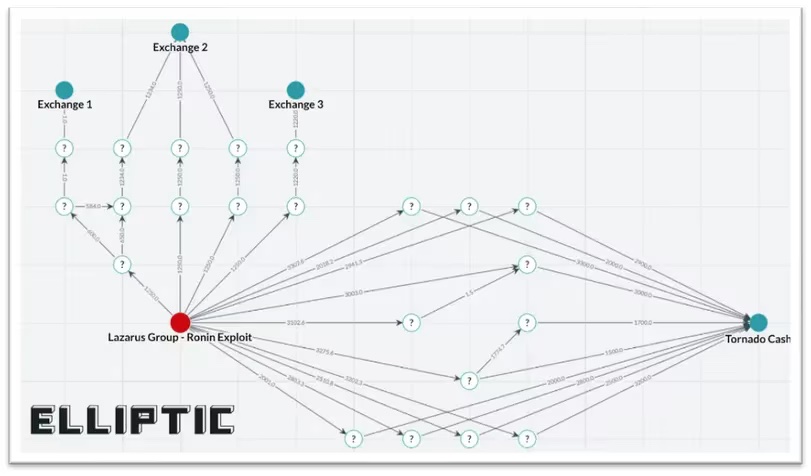

Axie Infinity’s Ronin Bridge, a popular Metaverse gaming platform used to transfer digital assets onto the chain, was the site of a $615 million Ether (ETH) and stablecoin transaction last year. I experienced one of the biggest crypto asset hacks in which USD coin (USDC) was stolen. U.S. authorities have pointed to links to the North Korean hacking group Lazarus Group.

The culprit first exchanged USDC to ETH through a decentralized exchange (DEX). DEXs typically do not perform KYC/AML (Know Your Customer/Anti-Money Laundering) compliance checks. Centralized exchanges (CEXs), which are under the watchful eye of regulators, have begun conducting such checks in recent years. Interestingly, as you can see in the graph below, the perpetrators then proceeded to launder $16.7 million worth of ETH through three centralized exchanges.

But as centralized exchanges began cooperating with law enforcement, criminals turned to decentralized mixer Tornado Cash. Tornado Cash was later sanctioned by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) and lost a lawsuit challenging the validity of the sanctions.

“Elliptic investigators are tracking these stolen funds and labeling addresses associated with this attacker in our systems,†Elliptic said.

Elliptic’s graphs show how complex on-chain activity is analyzed and tracked. This case shows how Lazarus laundered the funds he stole after the Ronin hack.

“Criminals are realizing that blockchain is a treasure trove of information and a terrible place to commit illegal activities,†said Kevin Madura of consulting firm AlixPartners. People should understand that the properties of a network like Bitcoin and the ecosystem surrounding it actually benefit those who do good.â€

From individual investments to institutional investors and corporate interests—on-chain tracking is essential for investor protection

In conclusion, the growing interest in crypto assets, especially the potential SEC approval of Bitcoin ETFs in the US, will continue to gravitate malicious actors and hackers to crypto assets. And on-chain tracking becomes a key element of investor protection.

However, it is important to note that despite concerns about illegal activity, the proportion of criminal activity in crypto asset trading is relatively small.

Furthermore, while crypto assets are often associated with illegal activity due to their pseudo-anonymity, the reality is that these transactions are recorded end-to-end on a fully traceable and immutable ledger, where has a built-in audit trail.

This makes it possible to trace relationships between specific addresses, wallets, and entities, making it much easier to trace fraudulent activity throughout the transaction chain. This is enabled by the blockchain record itself and powered by on-chain analytical tools.

Given the ever-evolving nature of blockchain technology, dynamic crypto markets and regulations, investors are investing time to learn and understand crypto assets that are likely to become the new future of global finance, trade and commerce. It will be important to do so.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Crypto for Advisors: Cryptocurrency Transparency Truths vs. Myths

The post The reality and misconceptions surrounding the transparency of crypto assets: On-chain tracking contributes to investor protection and dissemination | CoinDesk JAPAN appeared first on Our Bitcoin News.