Overheated bulls exit as Bitcoin falls 4% ─ Funding rate normalizes | CoinDesk JAPAN

Bitcoin (BTC) fell sharply on December 11th, validating the caution shown by the options market last week.

The 4% drop to $42,000 cooled the overheated perpetual futures market, paving the way for a steady rally toward the end of the year.

Perpetual futures are futures that do not expire, with a funding rate mechanism that helps tie the price to the index price. The funding rate is the periodic payment of assets between long (buy) and short (sell) holders, calculated and collected by exchanges every eight hours. A positive funding ratio means that perpetual futures are trading at a premium to the spot price. A negative value means the opposite.

High funding rates above 0.10% are generally considered to represent excessive bullish leverage or overcrowding of long positions.

According to Velo Data, funding rates for Bitcoin, Ethereum (ETH), and other major crypto assets (virtual currencies) remained consistently at the 0.15% mark late last week, suggesting an overheated leveraged market. Ta.

The market-wide decline in early Asian time has normalized the situation, with funding rates for most coins remaining in healthy territory below 0.1%.

This indicates that overleveraged traders have exited the market. Costs associated with funding rates and leverage become burdensome when momentum stalls, forcing overleveraged traders out of the market and causing small bullish/bearish fluctuations.

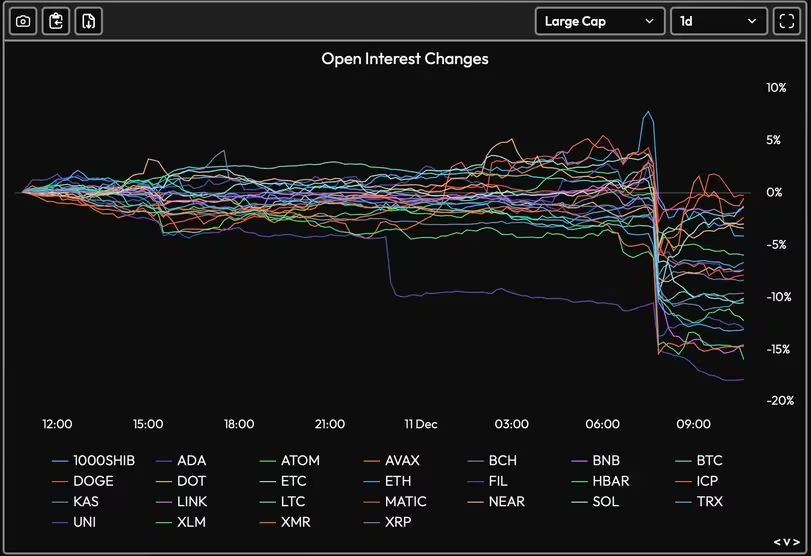

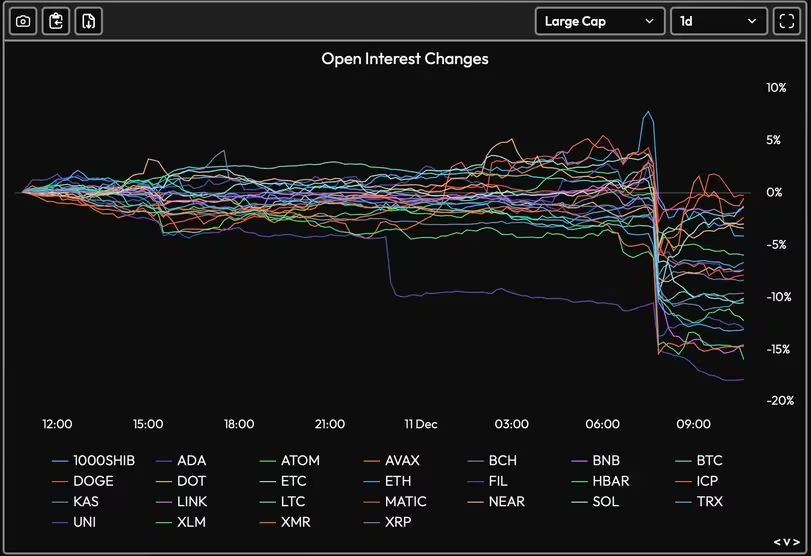

The market-wide decline in notional open interest, or dollar value locked in open futures contracts, suggests the same thing. At the time of article, open interest in Stellar Lumens (XLM), Uniswap (UNI), Chainlink (LINK), and Monero (XMR) showed double-digit declines over the past 24 hours.

Bitcoin and Ethereum open interest decreased by 1.3% and 6.7%, respectively.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Velo Data

|Original text: Bitcoin’s 4% Drop Cools Overheated Funding Rates, Data Show

The post Overheated bulls exit as Bitcoin falls 4% ─ Funding rate normalizes | CoinDesk JAPAN appeared first on Our Bitcoin News.