Expectations are rising for the Bitcoin halving, and investor interest captured by the BitBank survey

Expectations regarding the crypto asset market in 2024

On the 21st, BitBank Co., Ltd. announced the results of a “questionnaire survey regarding the actual state of crypto asset investment and the market.†This survey was conducted online from November 27th to 28th, 2023, and 1,433 people responded.

According to the survey, more than 51% of respondents invested their assets in financial products such as “NISA†and “iDeCo.†In particular, 20.2% invested in NISA and iDeCo, with stocks (17.4%), mutual funds (13.9%), and crypto assets (6.6%) also listed as investments.

Approximately half of the investors invested in crypto assets at less than 5%, indicating that many investors are making modest investments. The main reasons for not investing in crypto assets were “lack of knowledge†at 33.7% and “high risk†at 31.1%.

On the other hand, when respondents engaged in asset management were asked about their expectations regarding the crypto asset market in 2024, “price rise†emerged as the most anticipated item at 20.3%. This was followed by answers such as “the future of crypto assets†and “tax reform for crypto assets.â€

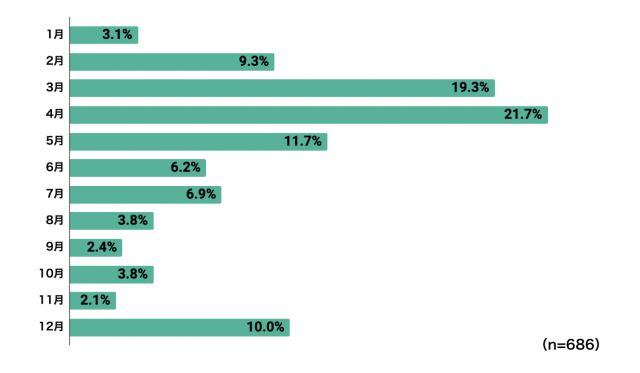

In particular, it has become clear that many investors are expecting the price to rise in April, when Bitcoin’s halving is scheduled.

Source: Bitbank research

Bitcoin halving occurs approximately every four years, or every 210,000 blocks, and the reduction in mining rewards could slow down the pace of BTC issuance and encourage an increase in asset value. The next Bitcoin halving, the fourth, is scheduled for around April 20, 2024, and the mining reward will be reduced from the current 6.25 BTC to 3.125 BTC.

connection:Bitcoin expected to reach all-time high by November next year, with halving and US presidential election likely to be factors in the rise | VanEck Report

Crypto market is regaining its vibrancy

According to BitBank, this survey was conducted against the backdrop of the 2023 Basic Policy on Economic and Fiscal Management and Reform, which was decided by the Japanese government in June 2023. This policy promotes a national strategy to promote sustainable growth through asset management. However, crypto assets are not yet widely recognized as an asset management target, and this is a major challenge for the industry.

After going through a period of stagnation known as “crypto winter†starting in 2022, the crypto asset market is moving toward a new outlook. This period was affected by global instability, macroeconomic uncertainty, and the bankruptcy of a major overseas crypto asset exchange. However, recently, it is expected that a Bitcoin spot ETF will be approved in the United States, and the market is regaining momentum ahead of the Bitcoin halving in April 2024.

connection:Prediction of Bitcoin reaching $125,000 in 2024, Matrixport analysis based on halving

connection:

Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Half-life special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7— CoinPost (virtual currency media) (@coin_post) November 15, 2023

The post Expectations are rising for the Bitcoin halving, and investor interest captured by the BitBank survey appeared first on Our Bitcoin News.