Cryptocurrency startup funding to drop 68% year-on-year in 2023

Significant reduction in investment amount by virtual currency VCs

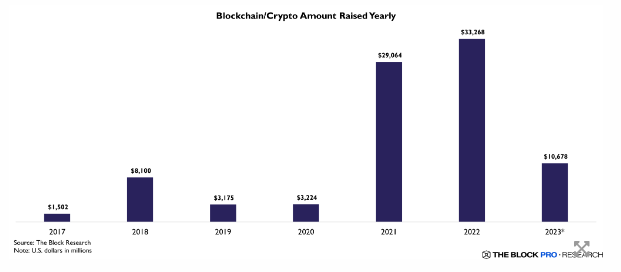

The amount of investment by crypto asset (virtual currency) venture capital companies in blockchain startups will plummet by 68% from approximately 4.8 trillion yen ($33.3 billion) in 2022 to approximately 1.5 trillion yen ($10.7 billion) in 2023. It became. The Block reported.

This year, in particular, the proportion of deals in pre-seed, seed, and Series A funding rounds has increased, while deals in mid- and late-stage rounds have decreased compared to last year.

Source: The Block Pro Research

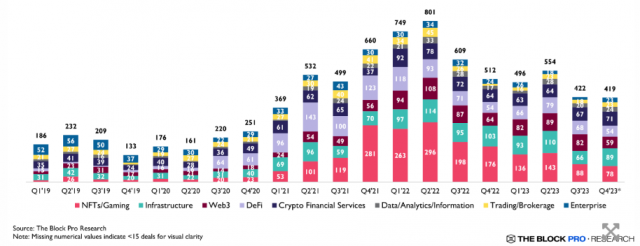

In terms of sectors, the number of transactions continued to be high in the areas of NFT (non-fungible tokens), Web3 games, infrastructure, and Web3. Meanwhile, the number of transactions decreased in other categories such as data, trading and enterprise.

In 2023, the number of transactions by virtual currency venture capital will also decrease. The number of cases decreased from 2,671 in 2022 to 1,819 in 2023, a decrease of 32%.

Source: The Block Pro Research

However, overall, compared to before 2020, the investment amount and number of transactions are higher. The total investment amount for the two years of 2019 and 2020 was approximately 910 billion yen (approximately $6.4 billion). In 2023 alone, the figure will exceed 1.5 trillion yen ($10.7 billion).

Abhishek Saxena of Polygon Ventures opined:

Given the macroeconomic environment, regulatory uncertainty, and the aftermath of recent collapses in the crypto industry, it was expected that funding for crypto startups would decline significantly this year.

Still, many investors and entrepreneurs are surprised by the drastic drop in funding.

The decline in investment activity could also serve as a necessary correction, he continued. He expressed his opinion that it may also have the effect of allowing the industry to review its business and focus on priorities.

connection: US Coinbase digs into next year’s outlook for the virtual currency market

Examples of large-scale financing in 2023

This month, US data center infrastructure company Arkon Energy completed raising approximately 15.6 billion yen for its Bitcoin (BTC) mining business and AI (artificial intelligence) business. It is led by Bluesky Capital Management, an asset management company in the alternative investment space.

connection: US Akron Energy raises 15 billion yen to strengthen Bitcoin mining & AI business

In September, Blockchain Capital, a venture capital that invests in the blockchain field, announced that it had raised approximately 80 billion yen in two new funds. Two-thirds of the funds raised will be allocated to early-stage funds and one-third to opportunity funds.

connection: Blockchain Capital raises over 80 billion yen in 2 funds

Additionally, the Japanese government will reportedly submit a bill to revise the Limited Liability Partnership for Investment (LPS) to the Diet in 2024, relaxing regulations for virtual currency startups to raise funds.

connection: Attention from overseas: Japanese government to ease regulations on funding for virtual currency companies

What is Investment Limited Partnership (LPS)?

A type of investment partnership formed for the purpose of investing in unlisted venture companies. It is common for venture capital firms (VCs) to invest in startup companies in the form of LPS, as they can invest with liability limited to the amount invested.

Virtual currency glossary

Virtual currency glossary

The post Cryptocurrency startup funding to drop 68% year-on-year in 2023 appeared first on Our Bitcoin News.