Bitcoin tax-saving selling at the end of the year is dominant, or Korean “Kimchi Premium†rises against the backdrop of soaring alto prices

Macroeconomics and financial markets

On the US New York stock market on the 26th, the Dow Jones Industrial Average closed 159.3 points (0.43%) higher than the previous day, and the Nasdaq Index closed 81.6 points (0.54%) higher.

Among crypto assets (virtual currency)-related stocks, the stock prices of Coinbase and MicroStrategy, which had been soaring, fell by about 1-2%.

CoinPost app (heat map function)

connection:Cryptocurrency-related stock decline, news of China’s deregulation of online gaming, Ethiopian debt default, etc. | 27th Financial Tankan

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price fell 2.6% from the previous day to 1 BTC = $42,337.

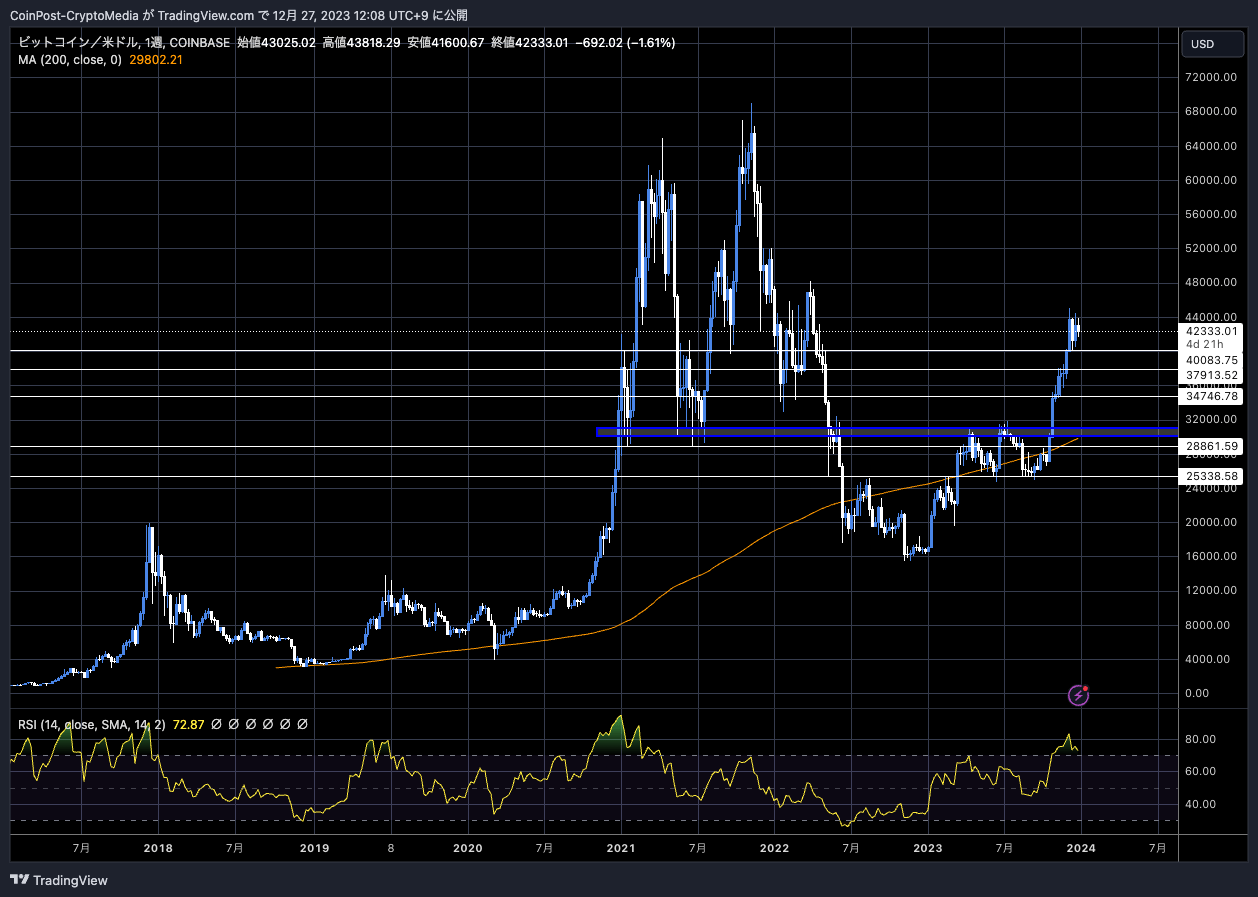

BTC/USD weekly

Will the top price be likely to be heavy near the year-to-date high of 1 BTC = $44,000? In the alto market, Solana (SOL), which had a strong sense of overheating due to its steep rise, fell 9.5% from the previous day, and Avalanche (AVAX) fell 10.1%, favoring profit-taking selling.

Among the major alts with the highest market capitalization, Binance’s BNB, which announced the handling of “Sleepless AI (AI)†in its new Launchpad (IEO), rose 5.5%, and Polygon (MATIC) rose 8.3%. You can farm AI tokens by staking BNB, FDUSD, and TUSD into separate pools.

connection:AI companion game “Sleepless AIâ€, Binance’s new virtual currency launch pool BNB rises more than 10% from the previous day

It appears that a combination of profit-taking selling to adjust their holdings in anticipation of weak trading during the year-end and New Year holidays, portfolio rebalancing by institutional investors, and tax-loss selling at the end of the year led to a shift toward selling.

Tax payments for tax returns due in March of the following year (April in the US) are calculated based on profits up to December 31 of the previous year. Tax-loss selling is a strategy in which investors use the recognition of unrealized losses caused by falling asset prices to make tax adjustments and reduce their tax burden.

Going forward, the focus is likely to be on the extent to which the market has factored in the approval of a Bitcoin spot ETF (exchange traded fund), and how much institutional investor capital will flow in if it is approved.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

kimchi premium

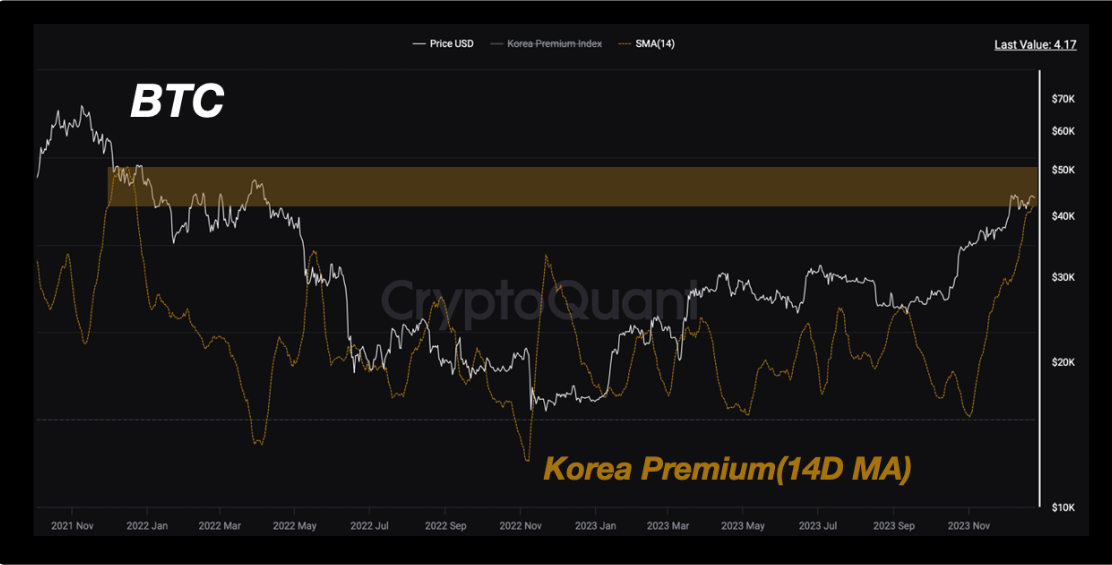

According to an analysis by SignalQuant posted on data analysis company CryptoQuant, the price divergence of South Korea’s premium index (14-day moving average) has sharply increased in the past two weeks, and speculation fever in the South Korean market is rapidly increasing. This was confirmed.

If the Korean market’s price diverges further from the US market and global comparisons, it is sometimes referred to as a “kimchi premium,†and it may create arbitrage opportunities. The premium value is already expected to reach a level comparable to the peak of the Bitcoin price in the fourth quarter of 2021, and there is a sense of overheating.

CryptoQuant

The background is that South Korea’s largest crypto asset (virtual currency) exchange, Upbit, has seen a series of sudden spikes immediately after its listing.

At the end of last month, the Binance Launchpad (IEO) stock SPACE ID (ID) soared 30% at one point, and on the 18th of this month, the Japanese public blockchain “Astar Network (ASTR)†was listed, The price has doubled.

connection:Cryptocurrency ASTR (ASTR) price soars by about 90% at one point due to listing on South Korea’s largest company Upbit

According to CCData, a digital asset data company, South Korea’s global market share has significantly expanded from 5.2% at the beginning of the year, reaching 12.9% in November this year.

According to the opinion of CryptoQuant’s head of marketing, this is partly due to the significant lack of a futures market for individual investors, and the focus is on low market capitalization alts (grass coins) with high volatility (price fluctuation). The environment is such that it is easy to hit.

According to a survey conducted by the Korea Financial Intelligence Unit (KoFIU) in October this year, the number of Korean cryptocurrency investors is expected to reach approximately 6 million in the first half of 2024, which is the largest number in the country. This corresponds to more than 10% of the population.

Among them, the exchange with the highest market share is Upbit, the largest in South Korea, with an 80% share, so it is easy to see listing on Upbit as a good thing. Second place is Bithumb, which accounts for 15% to 20% of the Korean market share.

altcoin market

Avalanche (AVAX) is up 111% from the previous month. Both the Relative Strength Index (RSI) and Stochastics are at overbought levels, with the stock slightly down 8.5% from the previous day.

BENQI, which provides liquid staking using Avalanche-based DeFi protocol, has soared in price, and financial giant JP Morgan has used Avalanche in proof of concept for RWA (Real Asset Tokenization) and has entered into a partnership initiative. It was seen as a material.

connection:JP Morgan uses Avalanche for RWA proof of concept AVAX +22% from previous day

Avalanche (AVAX) was listed on Coincheck, a major domestic crypto asset (virtual currency) exchange, in December of this year.

connection:What is Avalanche that even beginners can understand? Explanation of noteworthy points and future prospects

In other markets, Axie Infinity (AXS) soared 28.3% from the previous week (-9.3% from the previous day). Game-related stocks may also be at the brunt of the cyclical trend.

We have introduced the “Heat Map†function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.â– Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin tax-saving selling at the end of the year is dominant, or Korean “Kimchi Premium†rises against the backdrop of soaring alto prices appeared first on Our Bitcoin News.