Bitcoin plummets, loss cut of 40 billion yen, major alts also fall in reaction

Macroeconomics and financial markets

On the US New York stock market on the 8th of last week, the Dow Jones Industrial Average closed 130.4 points (0.36%) higher than the previous day, and the Nasdaq Index closed 63.9 points (0.45%) higher.

On the 12th of this week, the US Consumer Price Index (CPI), which influences the monetary policy decisions of the Federal Reserve System, will be announced, and at 4:00pm on the 14th, the FOMC (Federal Open Market Committee) and Chairman Powell will be announced. will refrain from holding a press conference.

In the futures market, 98.4% predict that interest rates will be left unchanged, but the market will also be paying close attention to the post-FOMC interest rate forecast distribution map (dot plot) that predicts the future outcome. While the market mood is improving with the suspension of interest rate hikes factored in, if there is any hint of further interest rate hikes in the future, this could lead to a sudden change in market prices.

connection:Expectations for an early interest rate cut are slightly set back due to strong U.S. employment statistics. Cryptocurrency-related stocks rise significantly as Bitcoin rebounds | 8th Financial Tankan

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price fell 3.48% from the previous day to 1 BTC = $42,049.

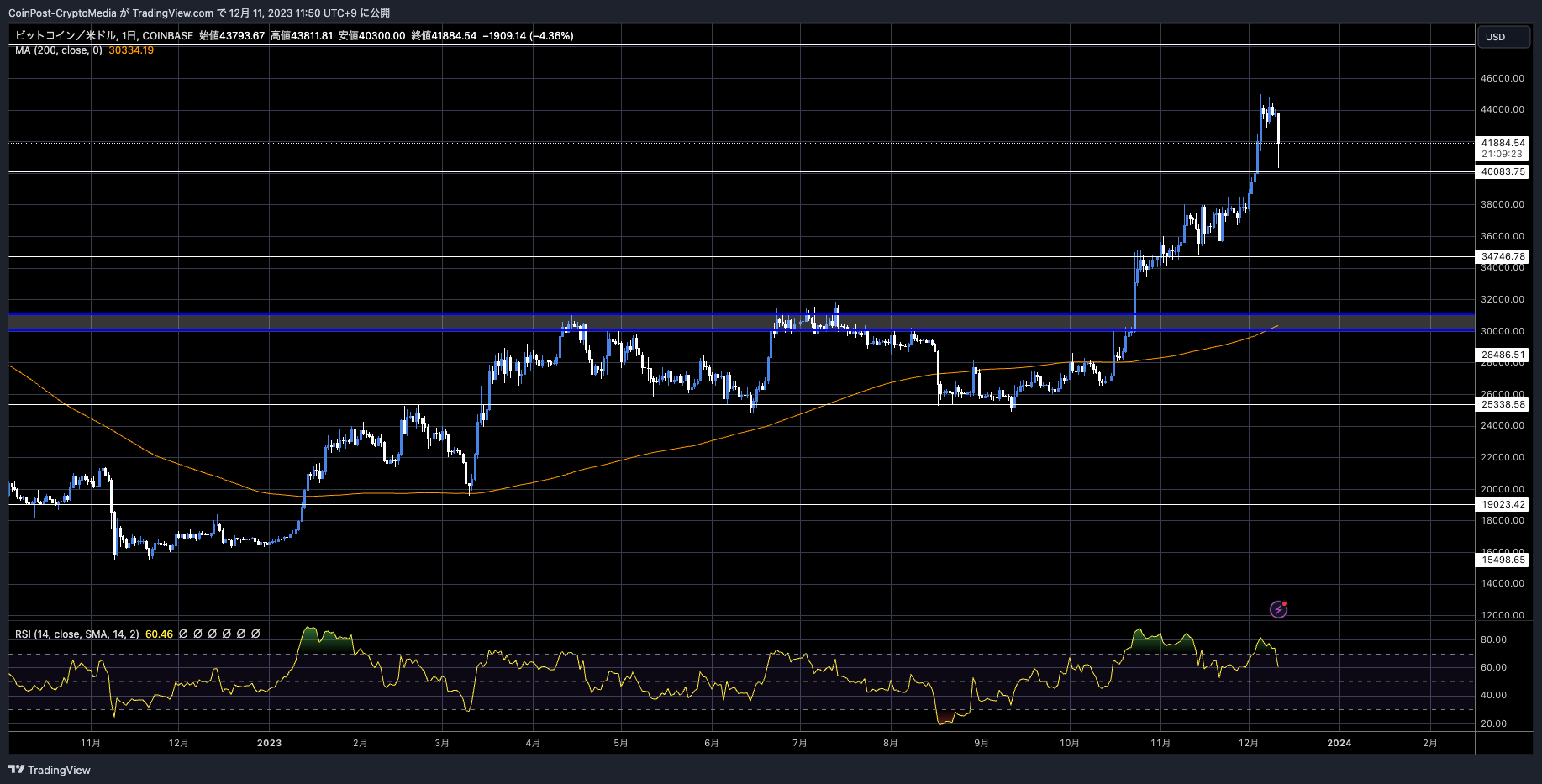

BTC/USD daily

At one point, the price plummeted to $40,300.

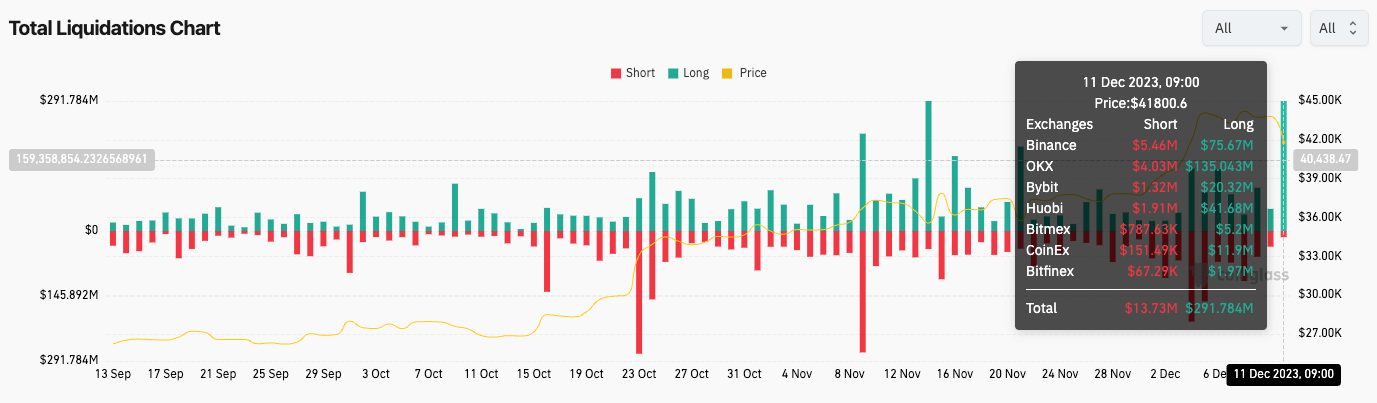

In the derivatives market, long positions worth $290 million (42.3 billion yen) were forced to be liquidated.

coin glass

The current liquidation amount is at the same level as on the 14th of last month, making it the largest amount in the past three months.

Among the major alts, Ethereum (ETH) fell 4.5%, XRP fell 6.3%, and Solana (SOL) fell 3.2%. Among the major alts, Polkadot (DOT) is down 7.3%, and Chainlink (LINK) is down 8.8%, with the highest rate of decline. For the time being, there is a risk that volatility (price fluctuation) will increase and market uncertainty will increase.

Bitbank analyst Hasegawa wrote in an article for CoinPost over the weekend, “The daily Relative Strength Index (RSI) is at an overbought level, making it easy for profit-taking to occur, and the U.S. Treasury yields are rapidly increasing. “If it rebounds, it could put downward pressure on the BTC price.†He was of the view that “the current upward trend in market prices will not continue for long.â€

connection:Bitcoin soared to 6.5 million yen this week, but be wary of price range adjustment risk | Contributed by bitbank analyst

On-chain analyst Willy Woo pointed out the opening in the daily candlesticks of CME (Chicago Mercantile Exchange) Bitcoin futures. He hints at a possible correction to 1BTC = $39,700.

The #Bitcoin CME Gap at 39.7k…

By my count 28 out of 30 gaps have been filled on CME daily candles (93%). The other unfilled gap is pictured in the lower left of this chart also. pic.twitter.com/EyccaJTTkr

— Willy Woo (@woonomic) December 7, 2023

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

altcoin market

During the capital inflow phase into the alt market last weekend, Solana (SOL), which attracted interest due to the airdrop of the staking pool’s governance token “JTO†and its new listing, continued to rise to the $77 level at one point. On the 11th, the price fell by 2.3% compared to the previous day due to the sharp fall in BTC.

connection:Coinbase newly lists Jito’s governance token “JTO†on the first day of airdrop

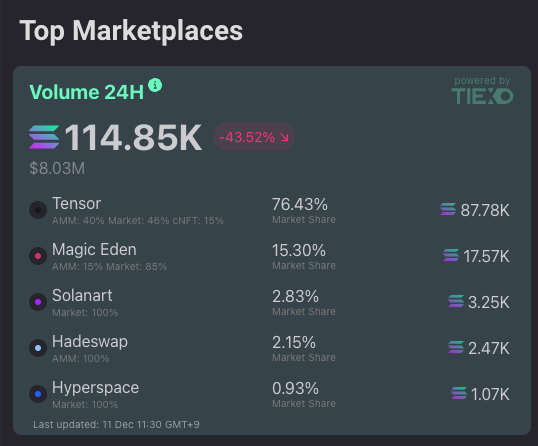

In the Solana-based NFT marketplace, “Tensorâ€, which is seen as Solana’s version of “Blurâ€, has emerged, surpassing the major NFT marketplace “Magic Eden†with a monthly transaction volume of $1 million.

History has been made.@solana flips @etherum for NFT sales.https://t.co/T9HL2i0hlC pic.twitter.com/oSYbYGXCkC

— ◢ J◎e McCann

(@joemccann) December 9, 2023

Due to expectations for airdrops, Tensor’s market share continued to grow significantly to 76.4% as of the 11th, ahead of Magic Eden’s 15.3% and Solanart’s 2.83%.

tiexo

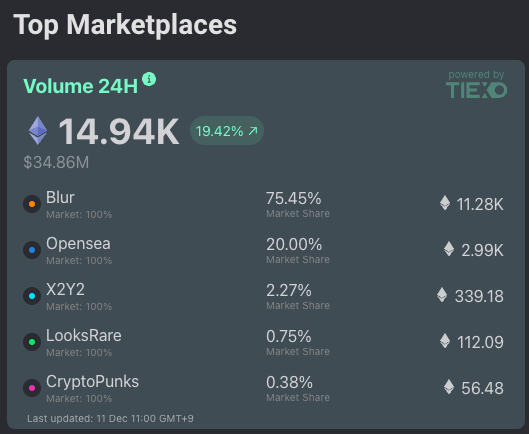

Furthermore, in the Ethereum-based NFT marketplace, “Blur†has a 74.5% share, far exceeding “OpneSeaâ€â€˜s 20.0% share.

On the 5th, the NFT marketplace “MOOAR†operated by Find Satoshi Lab (FSL), the developer of STEPN, rapidly increased its trading volume with the introduction of MOOAR Box incentives, taking the lead among Solana-based NFT marketplaces. .

FSL is conducting a beta test of Gas Hero, and the increased demand for high-value assets such as hero badges is also seen to have boosted trading volume.

It’s official! We’ve surpassed TensorSwap & Magic Eden & now reign as #1 in 24-hour trading volume on Solana!

Talk about a #MOOAR power move!

#MOOARBox pic.twitter.com/GxVaEqDqOo

— MOOAR | Phase 3 loading… (@mooarofficial) December 5, 2023

connection:Find Satoshi Lab, developed by STEPN, begins closed beta testing of the next work “Gas Heroâ€

Bitcoin ETF special feature

Due to the soaring price of Bitcoin, the number of downloads and MAU of the CoinPost official app is rapidly increasing.

In addition to virtual currency news, crypto indicators can also cover future materials. By using the My Coin function and Crypto Alert, you can quickly check for sudden rises and falls in altcoins.â– Explanatory article https://t.co/9g8XugH5JJ pic.twitter.com/gYtpheMykj

— CoinPost (virtual currency media) (@coin_post) December 6, 2023

[Recruitment]

CoinPost, Japan’s largest crypto asset media, is currently recruiting human resources due to business expansion (possible full-time positions)Editorial Department: Student interns interested in web3 and writers familiar with crypto assets

Sales department: Those who are good at English conversation and those with sales experience are welcome.

webX management: People who have strong research skills and are good at English conversation https://t.co/UsJp3v7P39— CoinPost (virtual currency media) (@coin_post) November 24, 2023

Click here for a list of past market reports

The post Bitcoin plummets, loss cut of 40 billion yen, major alts also fall in reaction appeared first on Our Bitcoin News.