Bitcoin market prediction, possibility of range market towards 2024 – Bitfinex analysis

Predicting the transition to a range market

According to the Bitfinex Alpha report published on the 22nd, the crypto asset (virtual currency) Bitcoin (BTC) market will transition to a “range market†in which prices rise and fall within a certain box range toward 2024. I have a point of view.

It cites on-chain metrics, historical trends in market cycles and investor sentiment, and miner trends as evidence.

Market value (blue line), realized value/price (orange line), Z-score (red line): statistical measures that represent the standard deviation of market value and realized value, Source: Bitfinex Alpha (all the same below)

According to the report, the MVRV Z-Score is one of the key metrics in determining whether the value of Bitcoin is overvalued or undervalued. This indicator measures the ratio of Bitcoin’s market value (market capitalization) to its realized value, making it possible to evaluate its value.

An MVRV ratio above 3.7 indicates that Bitcoin is overvalued and tends to portend a market ceiling. This situation is shown in the red area of ​​the chart. Conversely, a ratio below 1 suggests that Bitcoin is undervalued and could indicate a market bottom, which can be seen in the green area of ​​the chart.

Based on the current MVRV value of approximately 1.99 and Z-score of 1.47, the initial rise from the Z-score green zone, which represents times when Bitcoin was undervalued, was seen in June 2019 and July 2016. Bitfinex pointed out that the situation is similar to that of

This means that the market may pull back after Bitcoin reaches the $44,000-$45,000 zone, and that it will not pull back, rather than further intra-price movements at these prices or an immediate rally based on historical data. This suggests one of the reasons why this is expected.

What is realized value?

Bitcoin’s realized value is calculated for each coin based on the last transaction price, and is less susceptible to short-term market sentiment and is considered an indicator of long-term value.

Virtual currency glossary

Virtual currency glossary

connection:“Bitcoin spot ETF may receive inflows from US corporate pension funds†CNBC reports expert opinion

September 2020 level

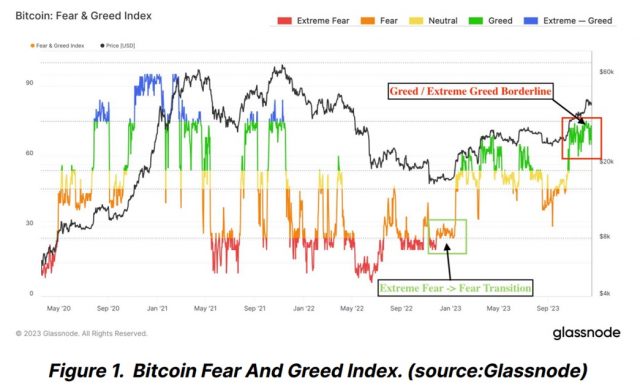

Another important basis is analysis based on the “Fear and Greed Index.†This index measures the emotional trends of the Bitcoin market and reflects investor sentiment. Analyze volatility, market momentum, social media trends, research results, Bitcoin’s market capitalization advantage, and more.

In 2023, Bitcoin’s Fear and Greed Index transitioned from “Extreme Fear†to “Greed.†These fluctuations in sentiment are seen as signs of a change in market direction and are associated with stabilization of prices.

Looking at the example of September 2020, after the index moves into “greedy†territory, the market often experiences a small pullback and moves into a range.

According to Bitfinex, the current (December) market activity may subside and a range market may begin. However, it has also been pointed out that Bitcoin could hit a new all-time high in 2024 as it enters an “extreme greed†cycle.

Bitfinex analysts believe that institutional investor interest in crypto assets is increasing and this will have a significant impact on the market. In particular, the impact that the introduction of Bitcoin spot ETFs will have on the crypto market is attracting attention, and it has been shown that the total market capitalization of the crypto asset market could double its current level, reaching $3.2 trillion.

The company also expects Bitcoin to maintain a favorable position in institutional investor portfolios, especially in the first half of 2024, but the market will undergo significant changes and “money will be diverted to riskier crypto assets.†“This could accelerate the trend,†he said.

connection:Hong Kong begins accepting applications for virtual currency spot ETFs

Virtual currency users expand to 950 million

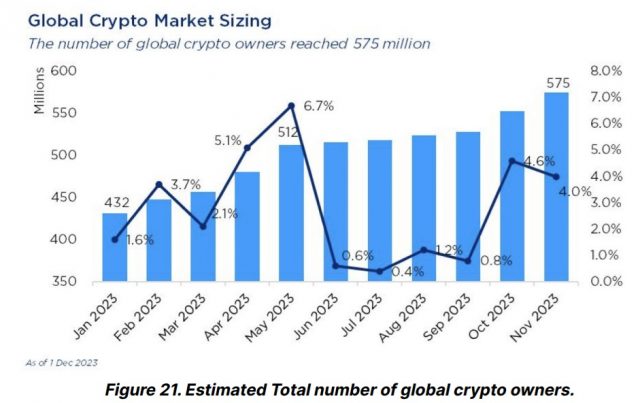

Bitfinex reports that the outlook for the crypto asset market is optimistic, with the number of users expected to grow significantly from 850 million to 950 million by 2024.

The number of crypto asset owners increased from 432 million at the beginning of 2023 to 575 million as of December 1, with an estimated monthly growth rate of 2.8% during this period. .

Based on the 2021 bull market, monthly growth is likely to increase by more than 3.8% to 4.4% through 2024.

Of particular note is the increasing adoption of Bitcoin in economically unstable countries such as El Salvador and Argentina. This suggests that crypto assets are functioning as a hedge against economic instability. Bitfinex predicts that the global adoption of Bitcoin will significantly contribute to the growth and adoption of the crypto asset market by 2024.

connection:El Salvador’s new immigration law brings citizenship to an era with Bitcoin – Report

Half-life special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7— CoinPost (virtual currency media) (@coin_post) November 15, 2023

The post Bitcoin market prediction, possibility of range market towards 2024 – Bitfinex analysis appeared first on Our Bitcoin News.