A professional explains the Bitcoin market where $50,000 is considered in the options market | Contribution: Virtual NISHI

*This report was written by Virtual NISHI, a crypto analyst at the crypto asset exchange SBI VC Trade.@Nishi8maru) contributed to CoinPost.

Bitcoin Market Report (December 6th to December 12th)

Bitcoin’s price has been increasing rapidly since December 1st.

The reasons for this are: (1) U.S. interest rates fell due to the remarks of the Federal Reserve Chairman on December 1st, (2) large amounts of funds flowed into both CME and options due to the decline in U.S. interest rates, and (3) USDT was sold due to reports of Hezbollah and Hamas freezing funds. In addition to the purchase of Bitcoin, which is a safe asset in the crypto market, the following four factors had an impact: (4) The 30-day rule for hedge funds (November 30th) has passed and market selling pressure has decreased. it seems to do.

Additionally, positions in the options market are becoming more volatile (Bitcoin price is around $43,700 at the time of writing).

At your feet

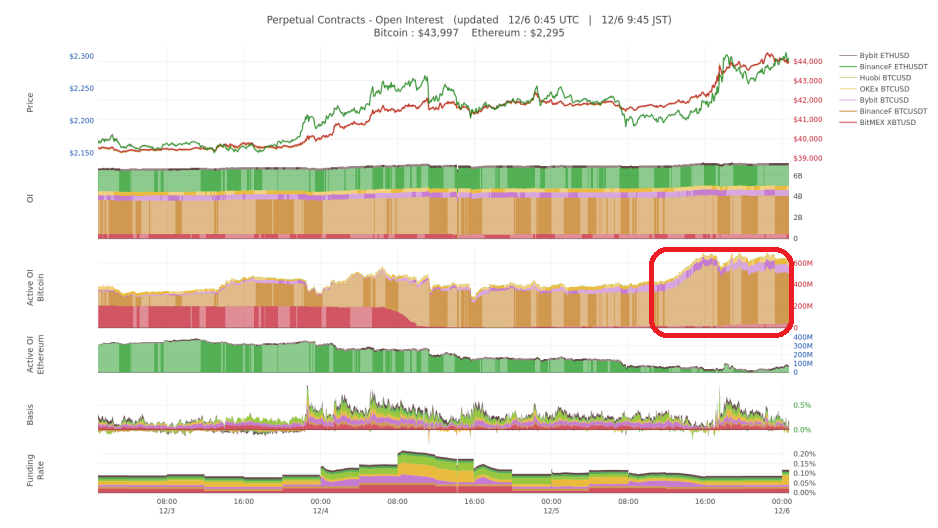

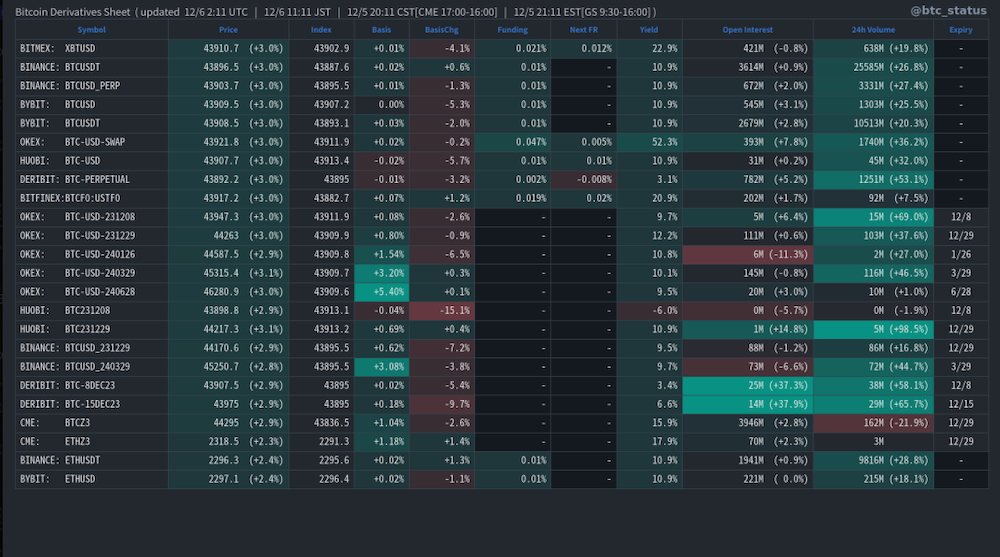

The active OI (unsettled open interest) of Bitcoin market orders is at a high level (red frame in the image below), and the price is likely to fluctuate wildly. Considering the recent increase in the funding rate, we can see that long positions are increasing.

source:BTC Status Alert

spot market

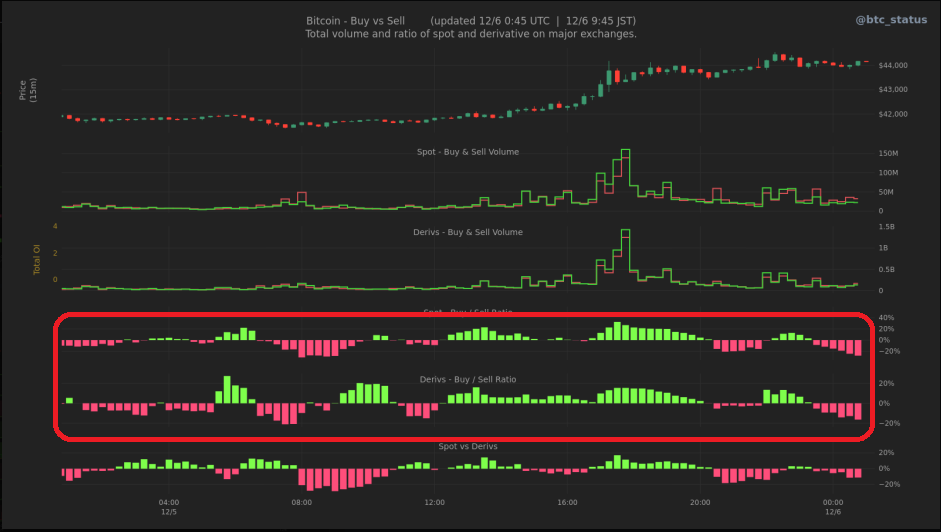

Looking at market trading, we can see that spot stocks are traded in a well-balanced manner with derivatives.

source:BTC Status Alert

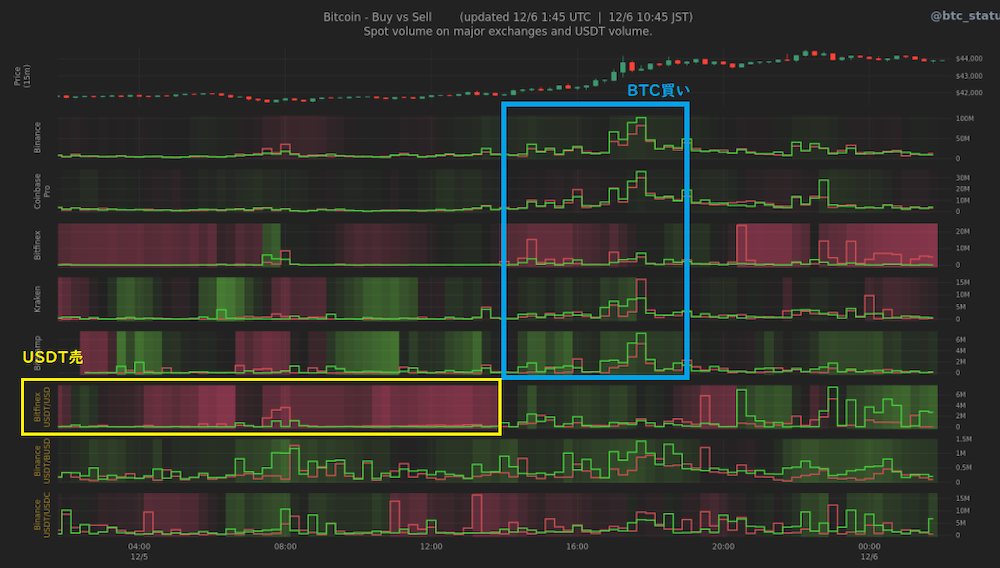

Furthermore, since the suspicion of money laundering in the Middle East using USDT, market selling of USDT has occurred intermittently, and this is thought to be connected to the buying of Bitcoin.

source:BTC Status Alert

derivatives market

The derivatives market is in a neutral state with almost no price difference from the cash market.

source:BTC Status Alert

options market

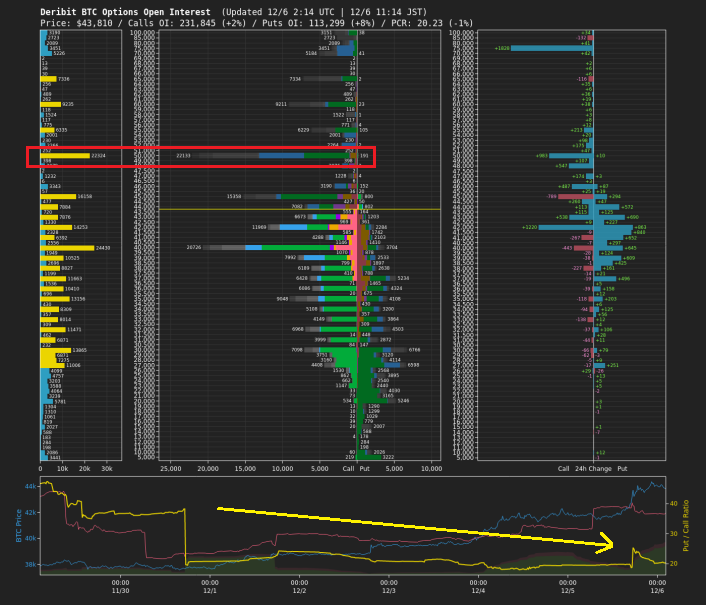

In the options market, which is traded in spot delivery, open interest has rapidly increased to $50,000, which is a higher price range than the current price (red frame in the image below), so options market participants are anticipating an increase. It is thought that there are.

In addition, since December 1st, the PCR ratio has fallen sharply (yellow arrow in the image below) and has continued to remain low, so market participants are not bullish despite the rapid rise in prices. It can be assumed that nothing has changed.

source:BTC Status Alert

futures market

The OI of the futures market (CME) has been increasing since mid-October, when prices skyrocketed (red arrow in the image below), indicating that capital inflows continue. Looking at the breakdown, the proportion of short positions in “Leveraged Funds†that aim for price differential profits is increasing (red frame in the image below)

source:BTC Status Alert

External environment

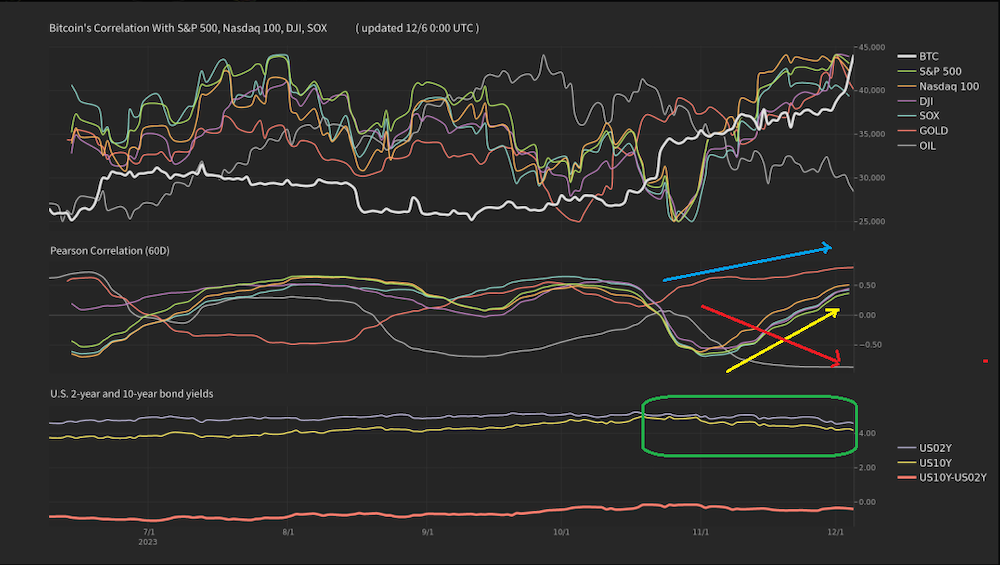

Since November, the correlation with gold has become quite strong at +0.8 with other assets (blue line in the image below). The correlation with the US stock index is also gradually increasing (+0.37 with the S&P 500 ). On the contrary, there is a strong inverse correlation with crude oil, with a correlation of -0.87 (red line in the image below).

This data also shows that Bitcoin started to rise after the rise in US interest rates came to a halt and began to trend downward.

source:BTC Status Alert

On-chain environment

The hash rate is decreasing, and the next difficulty is expected to be 9.05% easier.

Latest Crypto Indicators

December 6th Horizen:ZEN v4.1.1 upgrade

US ADP employment statistics released

December 7th BNB Smart Chain:v1.2.15 Upgrade

December 8th US employment statistics released

December 12th Chainlink: Staking v0.2 released

Aptos (APT) token unlock

US Consumer Price Index (CPI): November 2023 results

A crypto economic index calendar that never existed in the world.

It has been carefully created to give Japanese traders an absolute advantage. https://t.co/cYcebDABgO

— Virtual NISHI (@Nishi8maru) March 26, 2020

Summary

Although the Bitcoin market continues to soar, there is no sign of overheated buying in the derivatives market. Capital inflows into the derivatives market are also strong, and in the options market in particular, open interest has increased by $50,000, indicating that market participants are expecting a rise.

However, since the price of Bitcoin has been on the rise throughout this year and sharply increased in the latter half of the year, it is thought that physical Bitcoin may be sold at the end of the year as a tax measure.

Image source: Tainoko Lab

The post A professional explains the Bitcoin market where $50,000 is considered in the options market | Contribution: Virtual NISHI appeared first on Our Bitcoin News.