83.6% of Bitcoin supply is unrealized gain, the highest level since November 2021, when it hit an all-time high

Macroeconomics and financial markets

Last weekend, on the 24th, the Dow Jones Industrial Average closed 117.1 points (0.33%) higher than the previous day, while the Nasdaq index closed 15 points (0.11%) lower.

At the Tokyo stock market on the 27th, the Nikkei Stock Average was down 145 yen (0.43%) from the previous business day.

connection:Virtual currency Bitcoin briefly reaches the $38,000 level, Coinbase stock price returns to May 2022 level | 25th Financial Tankan

connection:Stock investment recommended for virtual currency investors, “10 representative virtual currency stocks in Japan and the United Statesâ€

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price fell 1.03% from the previous day to 1 BTC = $ 37,348.

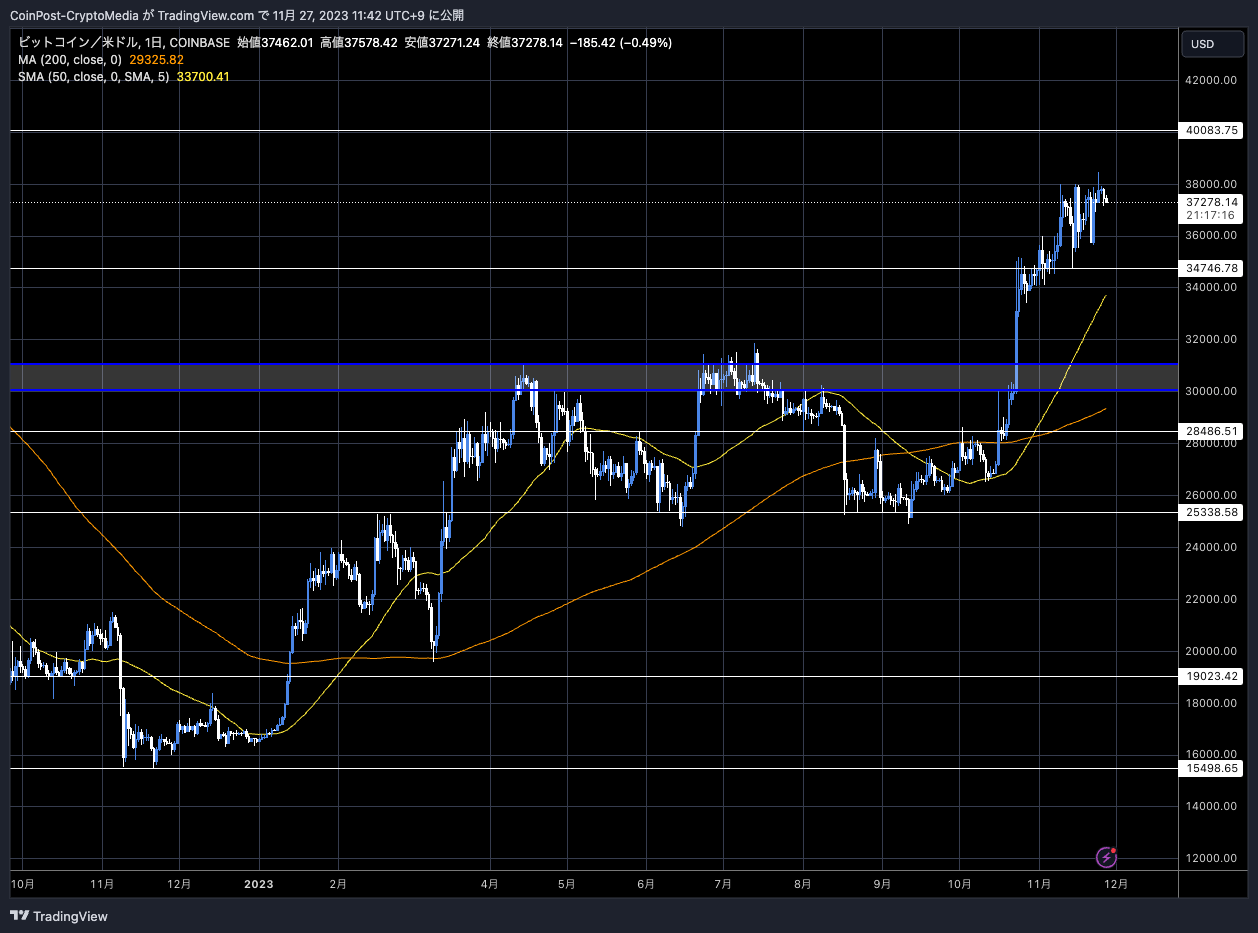

BTC/USD daily

It briefly topped $38,000 over the weekend.

Major alto prices also generally fell. In the game-related market, STEPN (GMT), which had been soaring ahead of the alpha version test of BCG’s new GasHero, fell in reaction, while Axie Infinity (AXS) rose 19.4% from the previous day, and investors continued to look around.

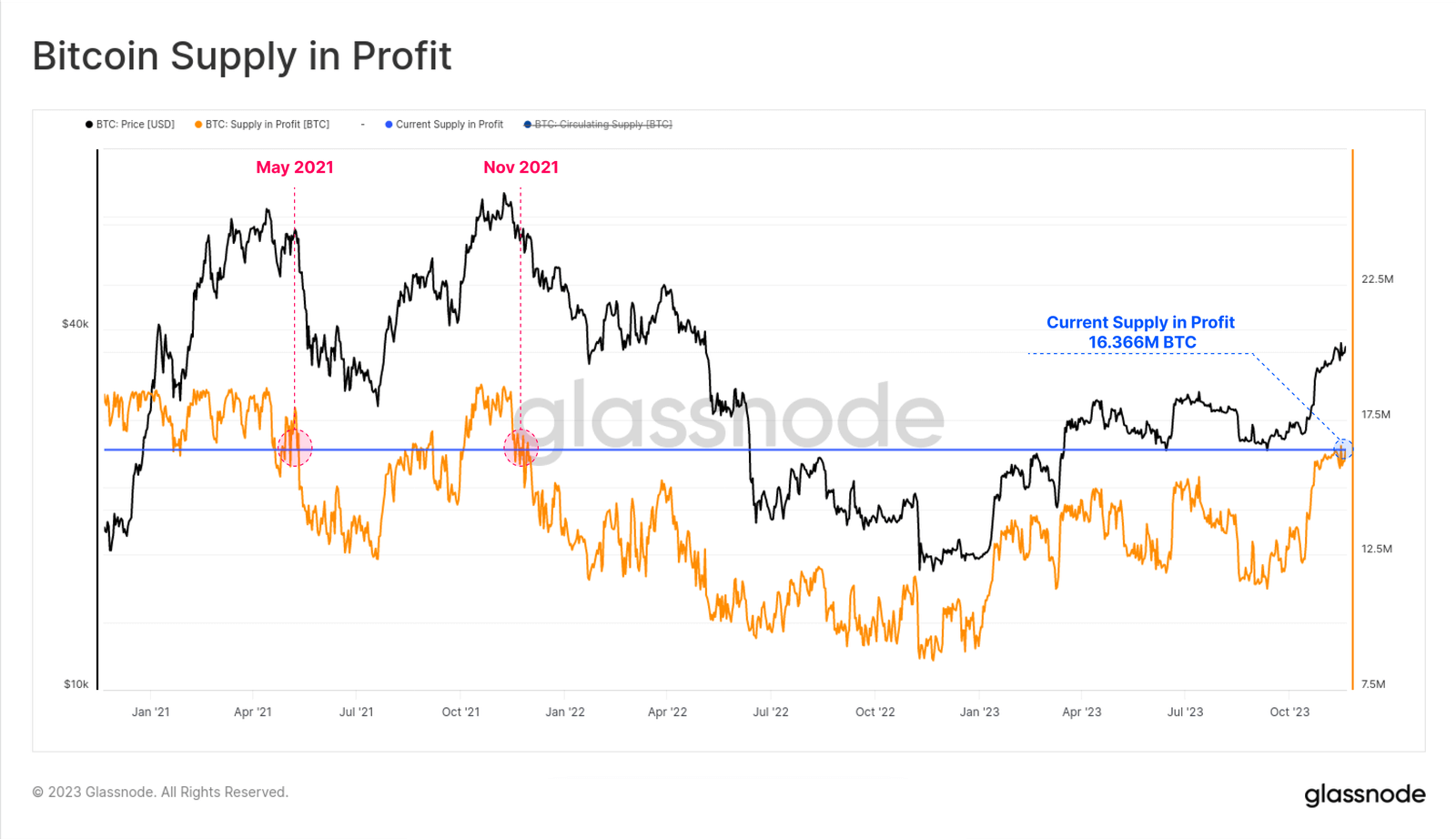

According to recent data from Glassnode, due to the recent market rise, more than 16.36 million BTC, or 83.6%, of the total supply of Bitcoin (BTC) circulating in the market has become an unrealized gain.

glassnode

This is the first time that Bitcoin has reached the same level since November 2021, when it was approved as the first Bitcoin futures ETF (exchange traded fund) in the US and hit a record high of $69,000 per BTC. This is well above the historical average (74%) and historically coincides with the early stages of a bull market.

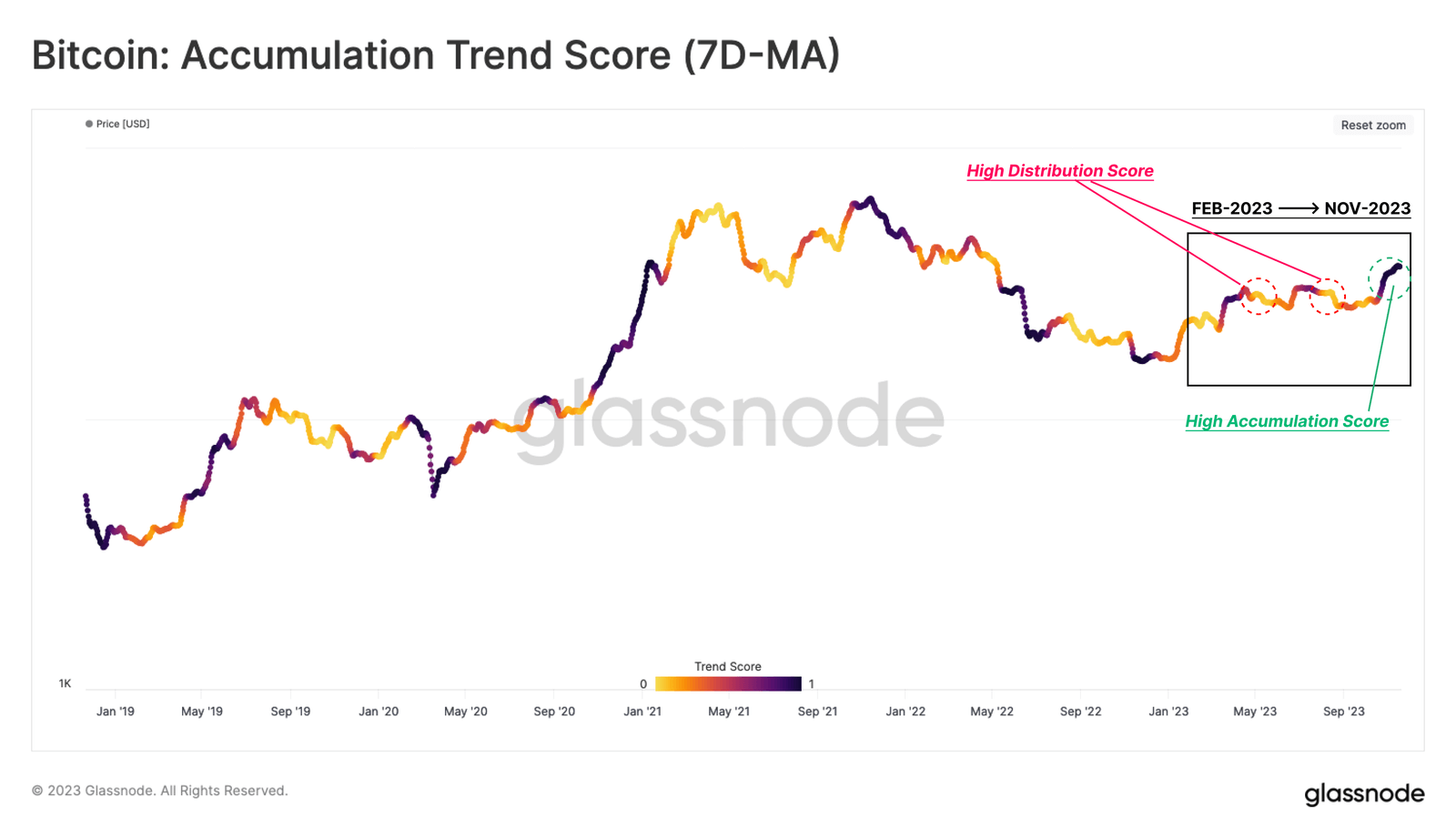

Additionally, the Accumulation Trend Score, an on-chain indicator that tracks wallet balances, highlighted a trend in net inflows compared to the beginning of the year, when net outflows were noticeable.

glassnode

Regarding this point, Glassnode pointed out that “obvious changes have occurred since late October 2023.†It is said that investors of all wallet sizes, not just whales (large investors), are attempting to significantly increase their holdings.

The background to this is the ever-increasing expectation that the US SEC (Securities and Exchange Commission) will approve the listing of Bitcoin spot ETFs (exchange traded funds).

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

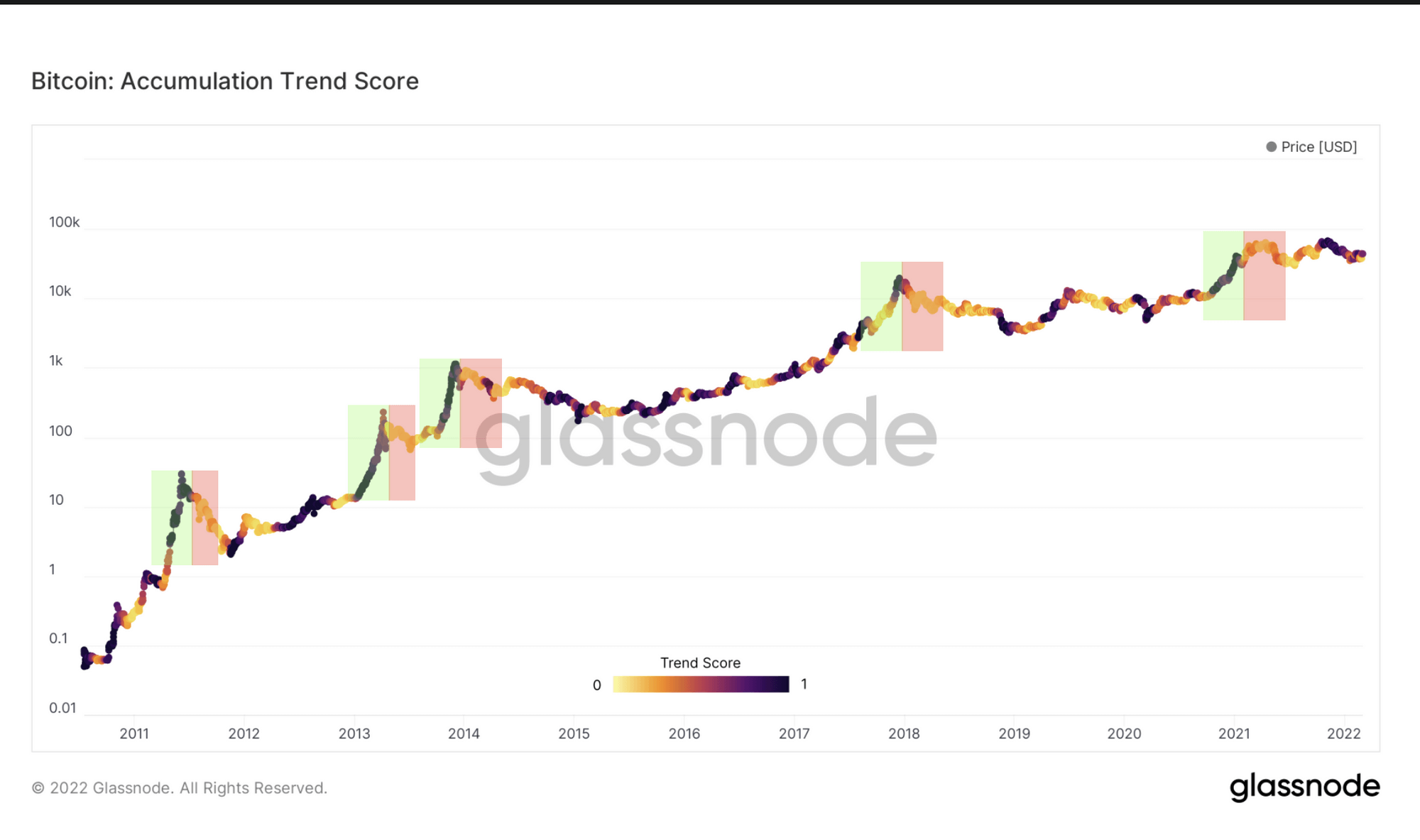

If both Bitcoin’s market price and accumulation trend score rise, it suggests that large investors are buying, and positive price fluctuations are likely to be maintained. (Green) On the other hand, when the ratio cools, retail investors are unable to maintain their holding behavior, and the price tends to level off, eventually losing momentum. (red)

glassnode

A high score during a major correction suggests that large investors are starting to stock up and the bottom is near.

glassnode

connection:What is the exchange-traded fund “Bitcoin ETF� | Why BlackRock’s application is attracting attention

altcoin market

The governance token DYDX of dYdX, a decentralized exchange specializing in perpetual futures, is worth 150 million DYDX, which is equivalent to 30% of the lock-up for related parties such as employees, initial investors, and consultants (advisors). is scheduled to be unlocked on December 1st, and a certain amount of selling pressure is expected.

The unlock was originally scheduled for early February, but has been postponed.

After unlocking on December 1st, 40% of the total supply will be unlocked every month for six months, and 20% is expected to be unlocked the following year.

Bitcoin ETF special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7— CoinPost (virtual currency media) (@coin_post) November 15, 2023

Click here for a list of past market reports

The post 83.6% of Bitcoin supply is unrealized gain, the highest level since November 2021, when it hit an all-time high appeared first on Our Bitcoin News.