Ethereum is Poised to Hold $1800- Will ETH Price Break Above Resistance Line?

The post Ethereum is Poised to Hold $1800- Will ETH Price Break Above Resistance Line? appeared first on Coinpedia Fintech News

The crypto market has recently met a sharp collapse, creating panic selling among investors. The Securities and Exchange Commission (SEC) has recently filed lawsuits against two major cryptocurrency exchanges, Binance and Coinbase, leading to a significant downturn in the market. This bearish momentum has created a bloodbath in the crypto arena, with Ethereum (ETH) gaining attention. However, despite the negative news, the ETH price continues to show positive momentum, leaving investors on the edge of the next price level.

Ethereum’s On-Chain Data Provides Bullish Confidence

Ethereum whales, or large non-exchange holders, have been steadily acquiring more of the cryptocurrency this year, now owning an unprecedented 31.8 million ETH, valued at over $59.6 billion. This trend, noted by analytics firm  santiment

On-Chain

, occurs amidst recent market instability due to U.S. regulatory actions.

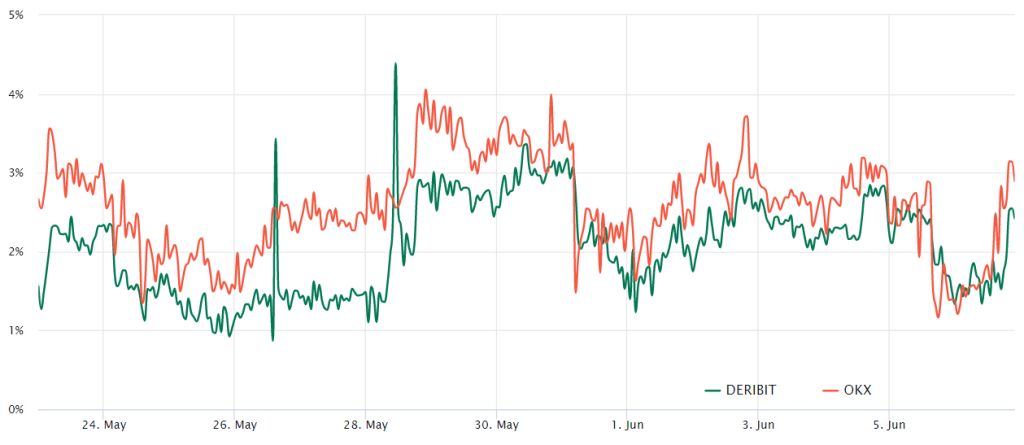

Quarterly futures of Ether are favored by large investors, known as whales, and arbitrage desks. These fixed-month contracts usually carry a small premium over the spot markets, suggesting that sellers demand a higher price for postponing settlement.

Consequently, in a robust market, ETH futures contracts should exhibit a 4 to 8% annualized premium. This condition, referred to as contango, is a common occurrence not exclusive to cryptocurrency markets.

Based on the futures premium, also referred to as the basic indicator, it appears that professional traders have been steering clear of leveraged long positions or bullish bets. However, even when the price retested the $1,780 mark on June 6, it wasn’t sufficient to shift the sentiment of these large investors and market makers towards a bearish outlook.

Also Read: Will Bitcoin and Ethereum Encounter a ‘Cruel Summer’? Here are Important Levels to Watch

What To Expect From ETH Price Next?

In the last two days, Ether’s (ETH) price fell below the resistance line of its descending wedge pattern, but the bears failed to capitalize on this momentum, indicating demand at lower price points.

Following the bearish breakout, bullish traders pushed the price back above the moving averages, but they faced significant selling pressure near the $1,895 level. Currently, sellers are trying to keep the ETH price below the resistance line, and if successful, this could lead to a further drop in ETH’s price to the support line of the pattern.

As of writing, ETH price trades at $1,851, declining over 0.5% in the last 24 hours. Currently, the RSI level hovers near the 50-level, creating a stable region for Ethereum. However, if the ETH price fails to hold its current trend, it may drop to the immediate support level of $1,760, below which the next support will be $1,610.

Conversely, if the price breaks above the resistance line, it would imply that the bulls have converted this line into a support level. Ethereum price may then initiate an upward momentum toward $2,000 and eventually touch the resistance at $2,115.