9 Reasons the Middle Class is in Trouble and 5 Ways Bitcoin Will Help

On February 5, Barrack Obama signed a farm bill further cutting food stamps for the nation’s most vulnerable. Five years ago, the nation suffered an unnecessary financial shock that sent not only the country’s, but the world’s economy reeling. If you keep your eye only on the Dow Jones and NASDAQ charts, you will think that we have recovered, but the official unemployment rate remains high, and there is broad speculation that the real rate is much higher, but people have given up looking. One wonders that when there is so much hardship, that so little help is being offered to those in trouble.

On February 5, Barrack Obama signed a farm bill further cutting food stamps for the nation’s most vulnerable. Five years ago, the nation suffered an unnecessary financial shock that sent not only the country’s, but the world’s economy reeling. If you keep your eye only on the Dow Jones and NASDAQ charts, you will think that we have recovered, but the official unemployment rate remains high, and there is broad speculation that the real rate is much higher, but people have given up looking. One wonders that when there is so much hardship, that so little help is being offered to those in trouble.

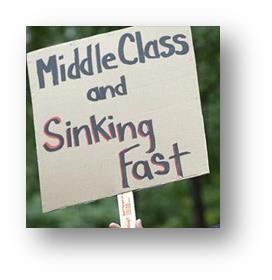

If you doubt that the middle class is in trouble, considering the following:

- Disposable incomes have been shrinking and just saw their biggest decrease since

1974.

- Median household income in the United States have been falling since the economic crisis began.

- The rate of homeownership in the United States has been falling for even longer.

- The number of people who identify themselves has middle class has been steadily declining.

- Fifty-six percent of all Americans now have a subprime credit rating.

- U.S. consumers are $11,360,000,000,000 in debt.

- Over 45 million Americans are living in poverty, a rate of 15 percent.

- Approximately one out of every four part-time workers in America is living below the poverty line.

- Middle class jobs account for 60 percent of the jobs lost during the last recession, but only 22 percent of the jobs created since then.

My parents grew up during the depression and told stories about what it was like. At that time, there was no Social Security, no Medicaid, and no food stamps. There was a tremendous amount of generosity. In those days, if someone knocked on the door asking for a bowl of soup and a cup of coffee, as long as that person was polite and respectful, my grandmother would sit that person down no matter how bare her own cupboard happened to be. On the other hand, if they couldn’t find a generous person, they had nowhere to turn.

When things get this out of whack, there is a need for some disruption to the system to put things back into balance. In the 1930s, it was a combination of the progressive policies of Franklin Roosevelt and the WW2. It’s unclear to me that the new deal broke the depression, the war certainly did that, but the policies put into place certainly created strong middle class that accounted for American growth and prosperity all through my childhood.

For the last decade I have looked for a disruptive movement that would swing the pendulum back in the political sphere, only to be disappointed time and time again. I have stopped looking in the political sphere. I have started looking at trends and movements beyond politics that will upset the carts of international corporations, billionaires in their bubbles, and bought politicians.

That disruption is going to be precipitated by Bitcoin. With Bitcoin, the locus of financial power is going to be wrest from the hands of the comfortable and returned to the afflicted. It will do it in a number of ways:

- Bitcoin will let people bank without banks, avoiding the charges, penalties, conditions, and other inconveniences of working with banks.

- Bitcoin will let people send money anywhere, anytime, in any amount, empowering people across the world as money will be able to flow virtually without friction.

- Bitcoin will let people create and execute contracts, incorporate businesses, and do a variety of other things that now require lawyers, but in the future will require access to the blockchain, which everyone has access to.

- Bitcoin will solve the problem of declining wages, since by its very deflationary nature, the value of Bitcoin rises. A static wage will be a rising wage.

- Bitcoin will solve the problem of retirement for the same reason. People will be encouraged to save, and what they save will be worth more, allowing for a comfortable retirement. (I hear the cries of naysayers claiming that this means that people will hoard. True, they will think before they spend, rather than spending in a panic before their currency loses value, but spend they will).

In short, Bitcoin is creating opportunities in both the short and long term. It is the wave of the future.

Comments are closed.