A New Peer-to-Peer Bitcoin Exchange: An Interview with Coingrounds’ Saif Altimimi

Editors Note: As has happened all too often, Coingrounds fell victim to a falling out between its partners and also a hack. The project is now defunct.

Although this site never saw the light of day, Bitcoin Warrior remains committed to seeking out worthwhile projects and promoting them. Not all of them will succeed, but some of them will, and that is how the Bitcoin economy will grow.

There is nothing like making a face-to-face trade with Bitcoin. It’s kind of exciting meeting other, like-minded bitcoiners and proving the ease and usefulness of the currency. It’s on that experience that myriad Meetup groups, Satoshi Squares, and LocalBitcoins.com have built themselves on. It’s still possible to meet a lot of bitcoiners who say that the only way to trade is face to face.

But that’s not what Bitcoin is all about. If I wanted to meet face to face to make an exchange, why not just use fiat or a commodity like gold. Even a stamp collection! Part of the utility of Bitcoin is that it can be transferred instantly, anywhere in the world, without the need for a third party like a bank, wire service, or other payment system. It may be fun to trade Bitcoin person-to-person, but there is no really good way to do the same thing online.

Of course we have the exchanges, but those are very inefficient. They have high fees and long lag times. This causes distortions in the market  and is contrary to what Bitcoin can be.

and is contrary to what Bitcoin can be.

For example, buyers who go to the big exchanges are often forced to go through an identity verification process, and then may still be asked to wait days before they receive their coins. This waiting period may protect the exchanges, but it imposes a severe cost on the buyer while they wait for their coins. Bitcoin is volatile, and there are thing that that buyer may have wanted to do if they had been able to get there coins immediately.

On the other side of the equation, there are sellers who have a large number of bitcoins that they want to liquidate. They are usually faced with high fees and other artificial restrictions that the exchanges may place on them.

What we really need is a way to make a LocalBitcoins.com that’s for the digital space.

Coingrounds is a new peer-to-peer exchange that will be coming on line soon that is hoping to fill this niche in the Bitcoin economy.

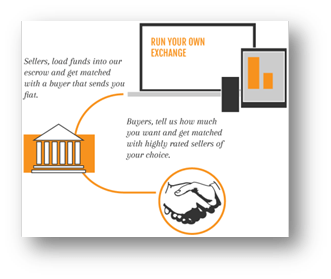

With Coingrounds, the seller will be able to create a sell order which will automatically be matched with a buyer. In making the deal, the seller and buyer will decide on the details of the sale, including how fiat payment is to be made. The seller will then send the bitcoins to an escrow wallet hosted by Coingrounds. Once the seller confirms that they have received payment, the bitcoins are immediately released to the buyer.

Sellers will have a selection of payment options to choose from, with non-reversible payment methods preferred. Top-ranked members, though, will have other options unlocked as they have proven themselves with the community and will have a reputation to protect.

Once the deal is complete, both the buyer and the seller will be encouraged to rate each other so that future sellers and buyers can be sure that they are working with someone who is has a proven history and solid reputation.

Coingrounds is the brainchild of Saif Altimimi, an entrepreneur living in Waterloo, Canada. He is a proven entrepreneur who has previously created Scholarpanda (AKA Notewagon and Coursemondo). This note-sharing site, focused primarily on students, has seen considerable success including raising 500,000 dollars in capital.

Saif says that he first became interested in Bitcoin over a year ago and began investing, using primarily BTC-e. What really interested him in Bitcoin were questions that he had developed over how fiat money is created and manipulated by governments. In an email exchange I had with him, he described his introduction to Bitcoin like this:

Saif says that he first became interested in Bitcoin over a year ago and began investing, using primarily BTC-e. What really interested him in Bitcoin were questions that he had developed over how fiat money is created and manipulated by governments. In an email exchange I had with him, he described his introduction to Bitcoin like this:

If you look at the state of the world economy today, policies of quantitative easing are imposing an invisible tax on citizens.

Fiat money today is subject to political manipulation and that is having a profound effect on everyday people. I became incredibly fascinated with Bitcoin on the premise that it’s a decentralized currency. It’s the first time in history that you can send money from Tokyo to Toronto in a matter of minutes without passing it through any bank or government body. Its function as a protocol replaces the need for a central bank and allows users to put their trust in math and not false belief.

The transparent nature of the currency also lets any user access the public ledger and rest at ease knowing the system is self-regulated. This capability as a protocol may have profound implications – only time will tell how disruptive this could really be, but we won’t have the problem of some politician somewhere deciding to print more money out of thin air, devaluing our money. Bitcoin has a thriving ecosystem of innovators and entrepreneurs building out its infrastructure. Problems are being solved and a better experience is being created. I think we are still in the early days of Bitcoin and, just like those working on the Internet in the 90s, we are building cool stuff for tomorrow. Who knows how powerful this will turn out to be?

The challenge that Saif has set for himself and his cofounders, Silfax (a developer and prominent member in the BTC community) and Edwin Safarian (a designer and UX/UI engineer), is to create a trust network between buyers and sellers. One way they are hoping to achieve this is by offering early sellers strong service, 0% promotional fees, and other early adopter incentives.

The challenge that Saif has set for himself and his cofounders, Silfax (a developer and prominent member in the BTC community) and Edwin Safarian (a designer and UX/UI engineer), is to create a trust network between buyers and sellers. One way they are hoping to achieve this is by offering early sellers strong service, 0% promotional fees, and other early adopter incentives.

Fraud and regulation are both natural concerns when creating a new Bitcoin exchange, and these have brought down many of Coingrounds’ predecessors.

Saif says that they are going to avoid many of the money transfer regulations that are plaguing other businesses by merely facilitating, and not making, the transfers. Once the deal has been struck, it is the responsibility of the buyer to pay the seller outside the system—in much the same way, Saif says, that someone might pay for something off of Craigslist. This feature, in-and-of-itself, has the possibility of solving some of the liquidity problems that US bitcoiners have.

That isn’t to say that they are ignoring the regulatory side of things. Coingrounds has retained Matthew Brugoyne from McLeod Law LLP, a firm that also contributes to Coindesk, to keep the endeavor compliant.

They are doing a number of things to counter possible fraud on the exchange. First and foremost are the escrow and rating system already described. On the technical side, they are planning on opening the system up to white-hat hackers. Saif says that they have put a lot of thought into how the system might be hacked, “but getting real testers to try and break the system is valuable to us.” Coingrounds is planning on a money-back policy for any hacks against the system. When asked again why any bitcoiner should trust Coingrounds, Saif had this to say:

From day one we are committed to being a transparent company. Our team is public, our location is public, and we engage with people making inquiries publically. I also think the trust factor comes with experience – we’re a team that has extensive experience building companies. With that being said, we understand that we need to prove ourselves by offering a great service to our customers. It will be a hard to build trust from day one – but we believe that as more successful transactions are completed, the trust factor should not be an issue. This is just the nature of any new business.

When asked how Coingrounds distinguishes itself from other exchanges, especially new entrants like the much-heralded Coinfloor, Saif said:

When asked how Coingrounds distinguishes itself from other exchanges, especially new entrants like the much-heralded Coinfloor, Saif said:

Coinfloor offers similar services to any traditional exchange. Building another centralized exchange is tough because the market is extremely saturated – unless Coinfloor can guarantee faster/easier transactions for UK customers, there’s no need for the customers to go through the hassle of redoing the verification. Coinfloor is also focusing on a much smaller market size (the UK). Our system allows us to scale much faster as the cost to do so is minimized by nature of the system.

Coingrounds will be doing a private beta run in mid-November and will be opening to the general public by the end of November.

11/05/2013: Bitcoin Warrior is dedicated to promoting Bitcoin related businesses, charities, and organizations. If you would like to have your organization profiled on BitcoinWarrior.net, please contact us at [email protected]. Please follow us on twitter at Bitcoin_Win.

Please leave a comment!

Comments are closed.