Traders prefer Bitcoin even as Ethereum ETF awaits | CoinDesk JAPAN

- The current prices of Ethereum and Bitcoin futures indicate that traders expect Ethereum to underperform Bitcoin in the coming months.

- It remains unclear whether a Spot Ethereum ETF will go live this year, as the U.S. Securities and Exchange Commission has not yet clarified whether Ethereum is a security or a commodity.

- Market makers are likely to trade against the rise in Ethereum’s price, capping the upside.

Standard Chartered announced a week ago that the U.S. Securities and Exchange Commission (SEC) could approve an Ethereum (ETH) spot exchange-traded fund (ETF) in May. He said it could skyrocket to $4,000 in three months and surpass Bitcoin (BTC).

However, traders continue to prefer BTC over ETH and are expecting a continued decline in the ETH/BTC ratio in the coming months, according to futures data. .

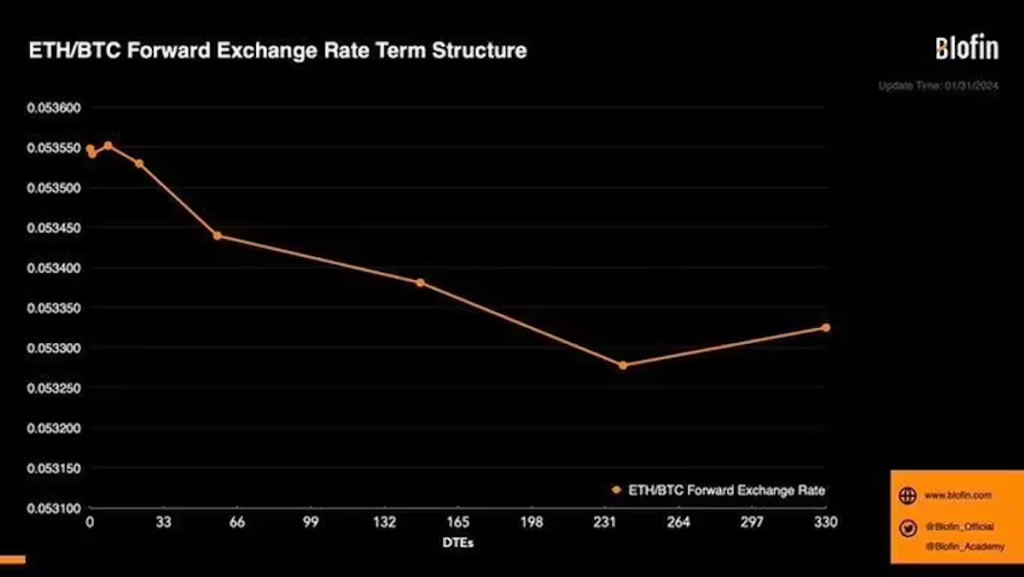

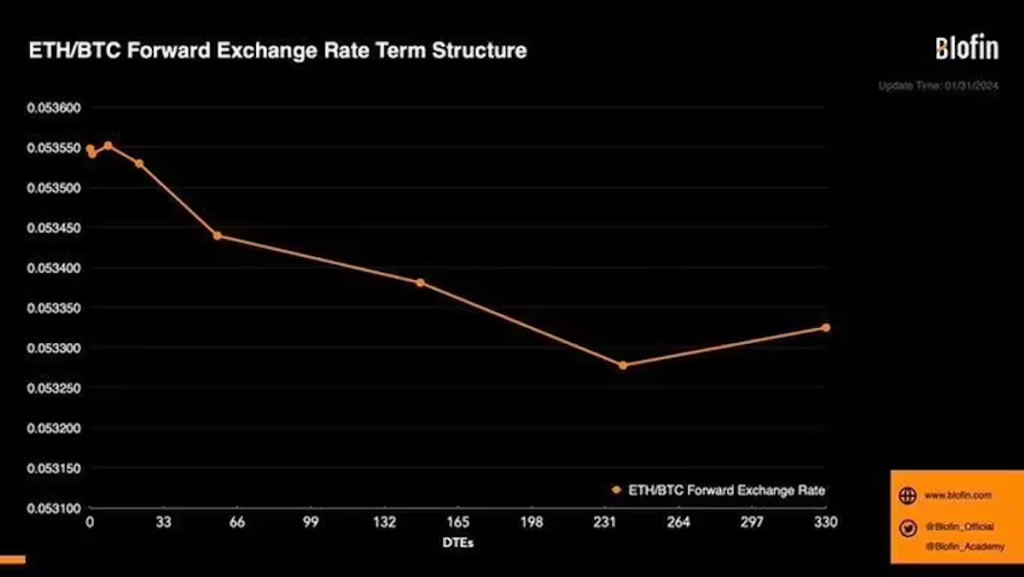

The ETH/BTC futures term structure, which calculates the ratio of the prices of Ethereum futures and Bitcoin futures at various maturities, is currently trending downward, according to data tracked by cryptocurrency management company Blofin. It has become.

“The downward-sloping term structure means traders expect ETH to perform weaker than BTC over time,†said Blofin volatility trader Griffin Ardern. . “This shows that investors are relatively bullish on BTC’s performance.â€

The ETH/BTC ratio surged 17% to 0.059 a few days after the SEC approved a Bitcoin spot ETF. Ethereum’s outperformance primarily stemmed from expectations that regulators will soon approve spot Ethereum ETFs. Although that hope is still alive, the ETH/BTC ratio has since retreated to 0.053.

Futures traders may be concerned that the SEC will classify Ethereum as a security or commodity. When the SEC sued Binance and Coinbase for securities law violations in mid-2023, it did not mention Ethereum, making the crypto asset considered a commodity, a necessary condition for spot ETF approval. The market is confident that it will.

Investment banking giant JPMorgan is skeptical that the SEC will classify Ethereum as a commodity by May, and sees a less than 50% chance of approval for an ETH spot ETF this year. .

“Ethereum’s proof-of-stake status could put it in a different asset classification than Bitcoin, and there is a lot of uncertainty around spot ETFs,†said a Singapore-based institutional investor. Cryptocurrency trading firm QCP Capital said in a note dated January 29, “Options Vol-cast.†“More uncertainty also means more volatility.â€

The SEC recently postponed its decision on BlackRock and Fidelity’s ETH spot ETF applications. Bloomberg analyst James Seyffart said the postponements could continue, with the next key deadline being May 23.

Spot Ethereum ETF Delays will continue to happen sporadically over the next few months. Next date that matters is May 23rd https://t.co/2zBBvHkrVk

— James Seyffart (@JSeyff) January 24, 2024

Ardern said the perception of Ethereum’s relatively weak performance likely stems from concerns about possible hedging activity by market makers.

Ardern points out that the continued selling of high-strike call options and bullish bets on Ethereum leaves market makers with net-long gamma exposure. Therefore, market makers are likely to hedge their exposure back to neutral by selling Ethereum as the price rises. This hedge could limit upside.

“One reason investors expect ETH performance to be relatively weak is that a large amount of covered calls dominate the ETH options market, with market makers holding record positive gamma. “We are,†Ardern said.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Blofin

|Original text: Traders Prefer Bitcoin to Ether Despite Developing Spot ETH ETF Narrative

The post Traders prefer Bitcoin even as Ethereum ETF awaits | CoinDesk JAPAN appeared first on Our Bitcoin News.