Ark Invest 2024 Bitcoin market will be in the “early stages of a bull marketâ€

Last year’s optimal Bitcoin allocation was 19.4%

ARK Investment Management (ARK Invest) has expressed strong expectations for the crypto asset (virtual currency) Bitcoin (BTC) in its annual report “Big Ideas 2024.â€

ARK Invest, led by Cathie Wood, pointed out that long-term investing in Bitcoin can offer high returns for institutional investors.

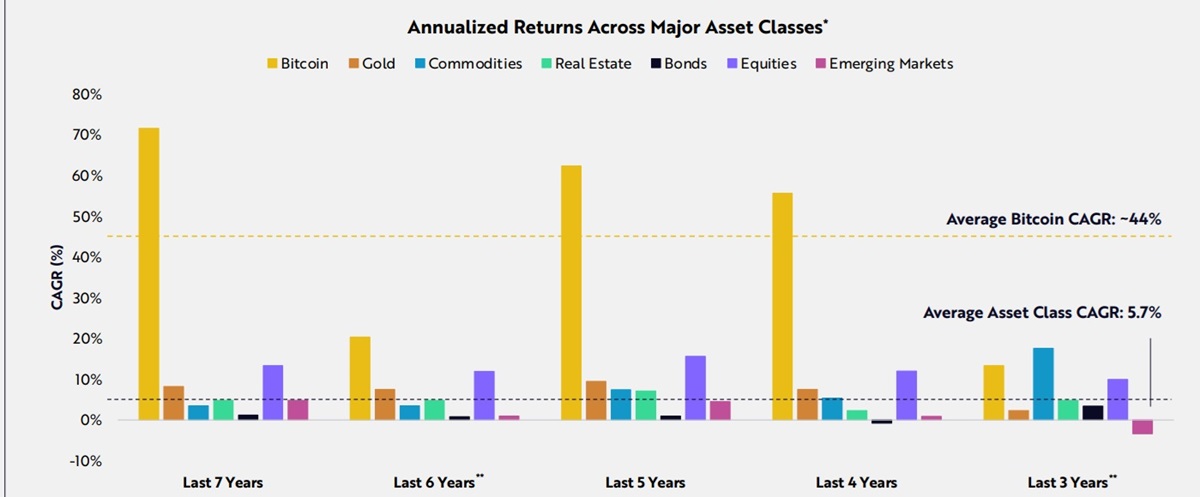

According to the company, Bitcoin has outperformed major asset classes over the past three to seven years, delivering an average return of around 44%. This is approximately 7 times the 5.7% of other major assets, and ARK Invest emphasizes that a long-term investment perspective is the key to Bitcoin investment.

Source: Ark Invest (all below)

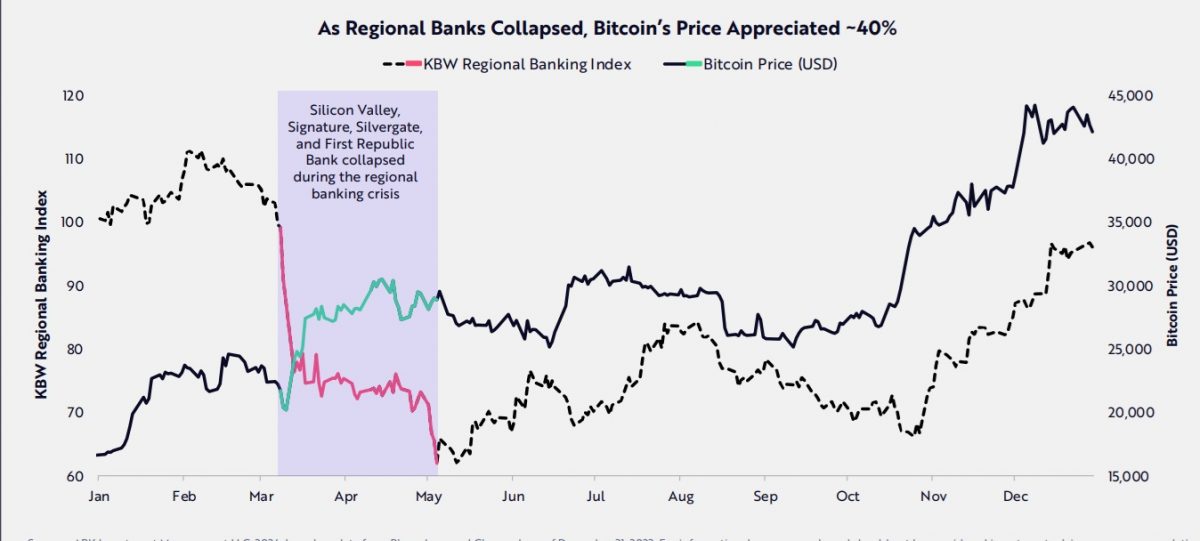

Furthermore, based on the past five years of data, the correlation coefficient between Bitcoin and other asset classes is only 0.27. Due to its low correlation with other asset classes, Bitcoin is credited with acting as an effective hedge against counterparty risk.

In fact, in early 2023, during the historic failure of a local US bank, the price of Bitcoin rose more than 40%, highlighting its role as a hedge against counterparty risk.

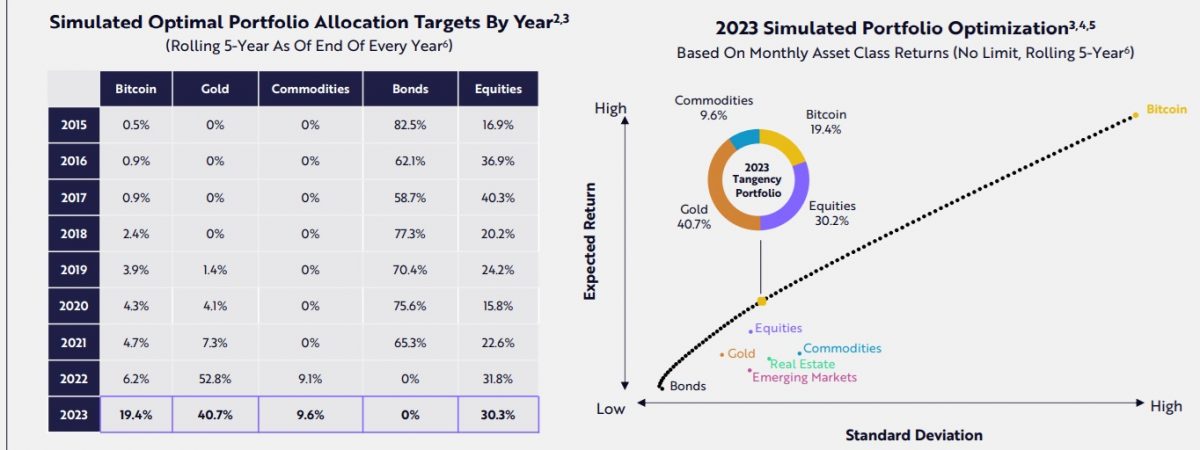

Based on these analyses, ARK Invest assesses that a 19.4% allocation to Bitcoin in the portfolio would have been optimal in 2023 to maximize risk-adjusted returns.

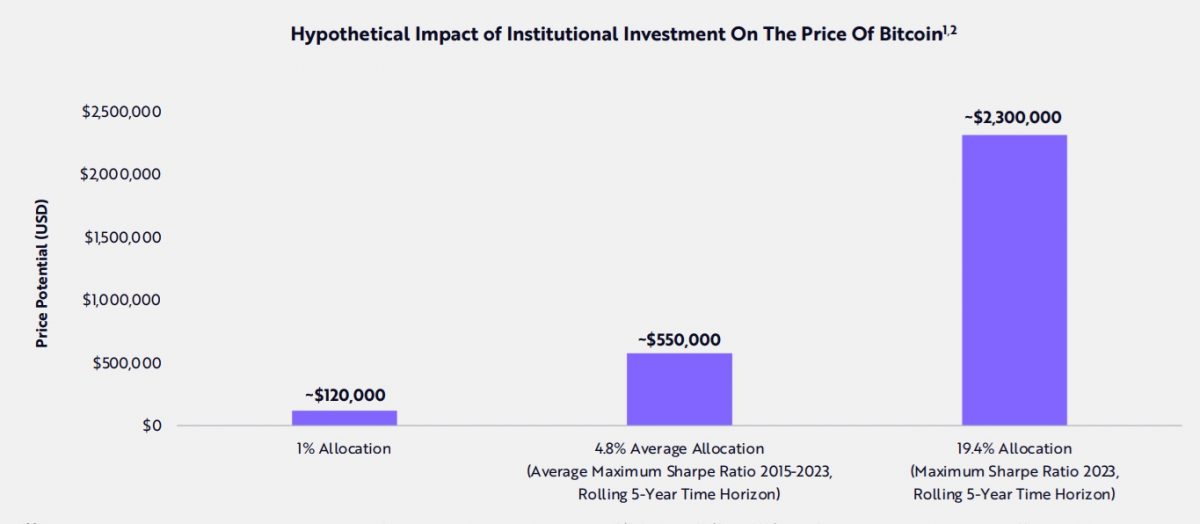

Furthermore, the firm estimates global investable assets at $250 trillion, and says that if an investment firm allocates 19.4% of its portfolio to Bitcoin, its influence could push Bitcoin’s price up to $2.3 million. A trial calculation was shown.

connection:Bitcoin ETF, the impact of capital outflows from GBTC on the market – Bitfinex Alpha

Early stages of a bull market

ARK Invest also notes that the Bitcoin price has exceeded the On-Chain Market Mean for the first time in about four years, and believes that this phenomenon indicates the “early stages of a bull market.†I’m interpreting it. This index is provided by Glassnode and is calculated by comprehensively analyzing various factors such as Bitcoin trading volume and exchange liquidity.

By the end of 2023, the Chicago Mercantile Exchange (CME) has become the world’s largest Bitcoin futures exchange, overtaking Binance. This shows that interest in crypto assets is increasing from traditional finance (TradFi) and that the market dynamics of Bitcoin are shifting towards the US.

Looking ahead to 2024, ARK Invest predicts major movements in the Bitcoin market. The launch of Bitcoin ETFs, the Bitcoin halving, the entry of institutional investors, and regulatory developments are expected to be key drivers and encourage further growth and development of the Bitcoin market.

The Bitcoin spot ETF “ARK 21Shares Bitcoin ETF†by Ark Invest and 21shares was approved by the SEC (U.S. Securities and Exchange Commission) on January 17, 2024 and introduced to the market.

connection:All 11 Bitcoin ETFs listed, SEC approved for first spot ETF in US history

NISA, virtual currency related stocks special feature

The post Ark Invest 2024 Bitcoin market will be in the “early stages of a bull market†appeared first on Our Bitcoin News.