Bitcoin falls below the $40,000 level, and the altcoin market also falls across the board

Macroeconomics and financial markets

Last weekend, on the 24th, in the US NY stock market, the Dow Jones Industrial Average closed 138 points (0.36%) higher than the previous day, and the Nasdaq index closed 49.3 points (0.32%) higher than the previous day. The US stock market has been buying mainly high-tech stocks, and the S&P 500 is hitting new all-time highs every day.

While the market price of crypto assets (virtual currencies) such as Bitcoin fell across the board, crypto assets (virtual currency) related stocks such as Coinbase, which had continued to decline sharply since the beginning of the year, rebounded.

CoinPost app (heat map function)

connection:US S&P 500 continues to set new highs, Nikkei average returns to 36,000 yen level for the first time in 34 years, Bitcoin below 40,000 dollars | 23rd Financial Tankan

connection:Ranking of recommended securities accounts for the stock market that can be used at a profitable price

NISA, virtual currency related stocks special feature

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price fell 2.8% from the previous day to 1 BTC = $40,067. Among the major alts, Ethereum (ETH) was down 4.1% and Solana (SOL) was down 4.5% from the previous day.

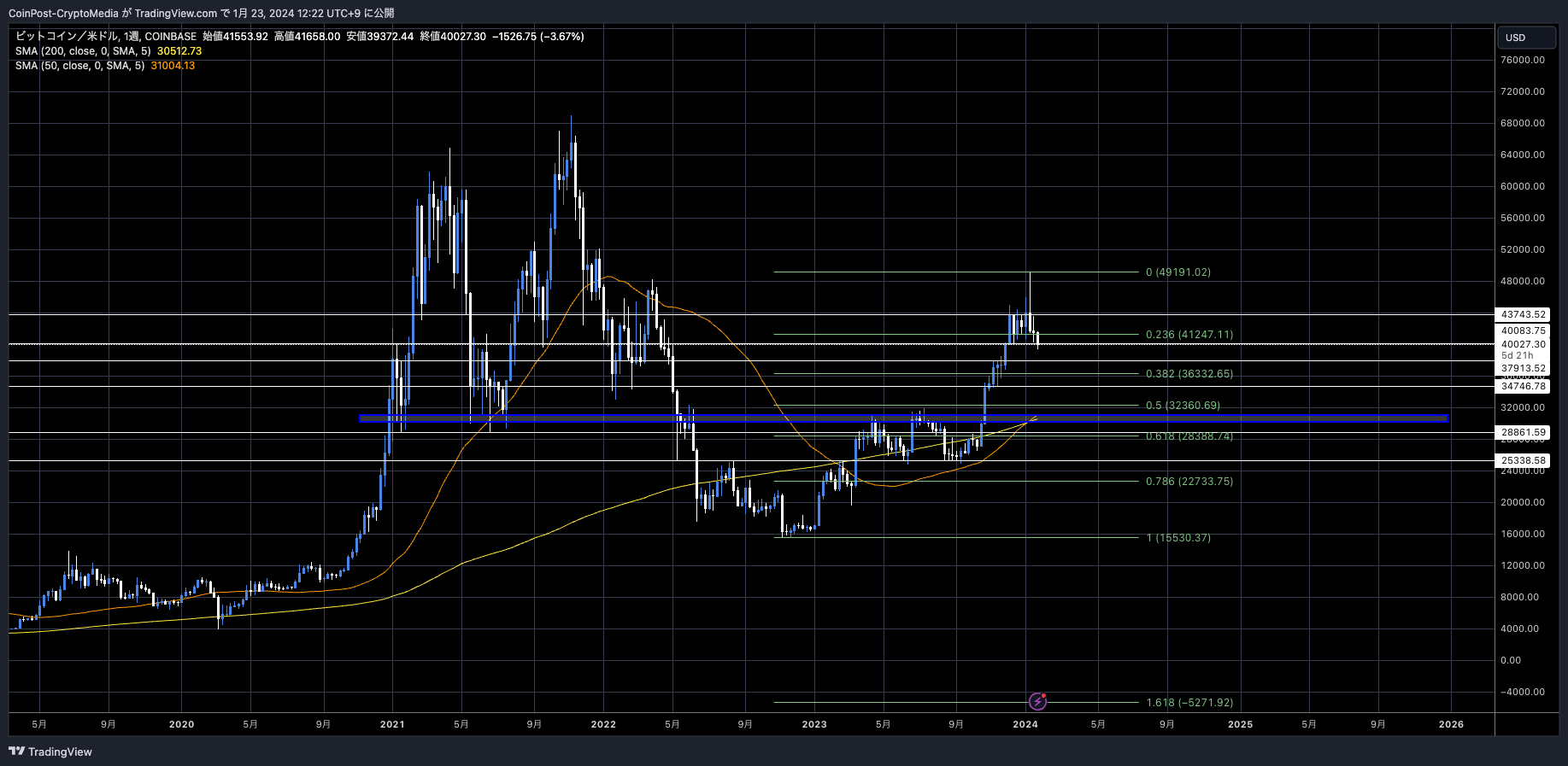

BTC/USD weekly

At one point, it fell below the $40,000 level and fell to $39,372. The drop from the most recent high was $10,000, or about 20%. The halving level is approximately $32,000, but some believe that the decline will stop at the support line of $38,000 or $34,700 before the halving in April of this year.

In the futures market, a loss cut (forced liquidation) of $210 million (31 billion yen) has occurred, the third largest amount since the beginning of the year.

After the approval of Bitcoin ETFs (exchange traded funds), market sentiment deteriorated due to selling of BTC which had soared, and in particular the withdrawal of funds from the alt market due to profit-taking selling was noticeable.

In terms of macroeconomic factors, expectations for an early interest rate cut by the Federal Reserve (Federal Reserve System) have receded, and the rise in US bond yields and the US dollar index (DXY) may also be a headwind.

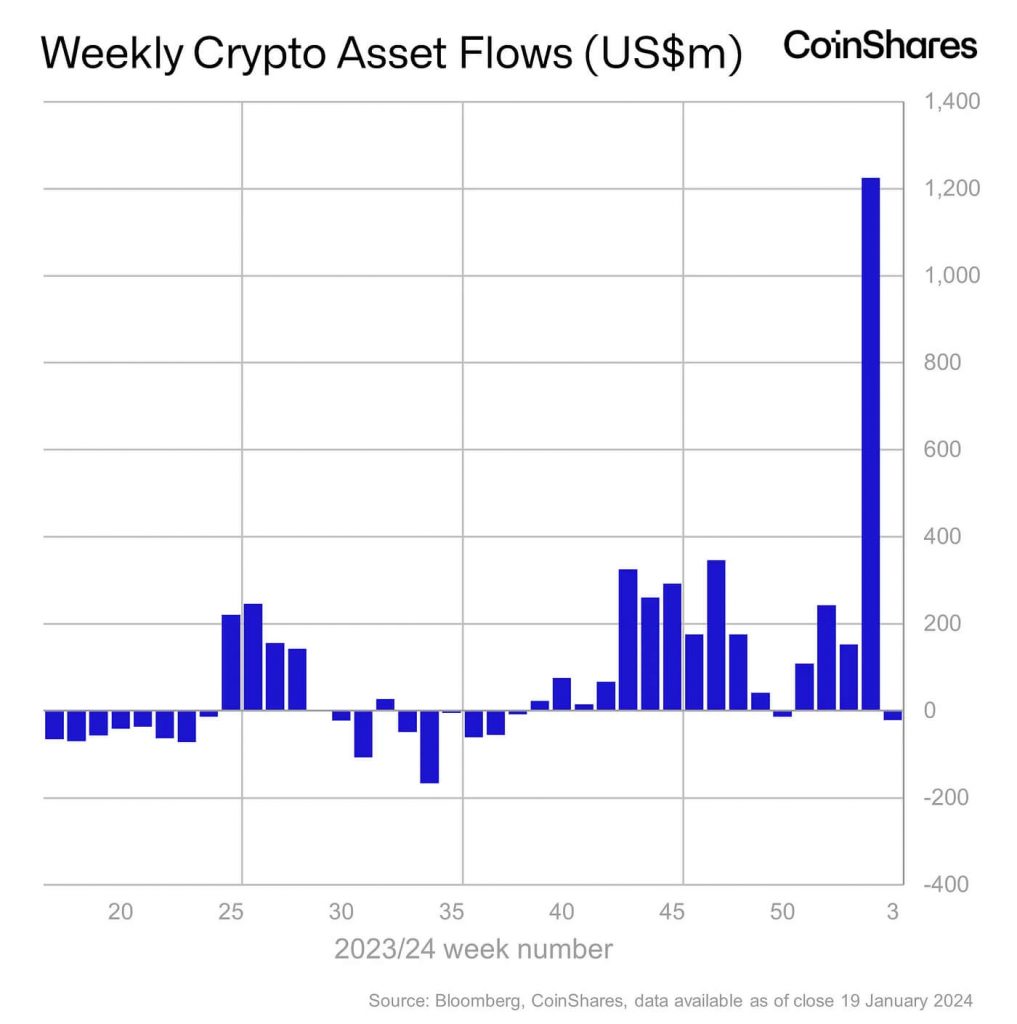

Last week saw $11.8 billion in inflows into exchange-traded funds (ETPs) since the approval of Bitcoin exchange-traded funds (ETPs) on January 11, according to a weekly report from asset management firm CoinShares.

This is approximately seven times the average weekly trading volume in 2023.

There was an outflow from Canada and Europe to the US, where fees are more competitive, and in the US, there was also an outflow of $2.9 billion from existing crypto funds with poor cost performance.

Meanwhile, newly issued Bitcoin ETFs, which are more dominant, have seen massive inflows of $4.13 billion.

The surge in trading activity signals the growing interest of institutional investors and the dominance of exchange-traded products (ETPs).

Recently, the outflow of funds from asset management company Grayscale’s investment product “Bitcoin Trust (GBTC)â€, which was converted into a Bitcoin ETF, has been causing selling pressure in the market.

connection:What is Grayscale’s investment trust “GBTC� Why is the price discrepancy with spot Bitcoin attracting attention?

As a closed-end investment product, GBTC traded at a deep discount to the market price for a long period of time. After converting to ETFs, the relatively high maintenance costs were also disliked, and demand for redemption (cash) appears to have increased rapidly.

According to Adam Cochran’s view, the GBTC sell-off could continue over the next two months.

At the current pace of selling, $GBTC still has enough assets to do this for another 60 days straight.

We’re paying for that spread trade in blood.

— Adam Cochran (adamscochran.eth) (@adamscochran) January 22, 2024

According to QCP Capital, it has recorded an outflow of $1.17 billion since the ETF was approved, including the debt restructuring of GBTC held by FTX, a major crypto asset (virtual currency) exchange that went bankrupt in November 2022. However, as of the 22nd, it appears that they have sold most of their holdings.

FTX Heritage sells $1 billion worth of GBTC after approval of Bitcoin ETF

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

“WebX2024†New IP area will be established where Kodansha, Toho and others will exhibit, ETH Tokyo and DAO Tokyo will also be held at the same time https://t.co/Gs5y7wI1Kx

Date and time: 2024/8/28 (Wednesday) – 8/29 (Thursday)

Location: The Prince Park Tower Tokyo

*The video is “WebX2023†pic.twitter.com/vHZmFbNjwM— CoinPost (virtual currency media) (@coin_post) January 18, 2024

Bitcoin ETF special feature

We have introduced the “Heat Map†function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.â– Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin falls below the $40,000 level, and the altcoin market also falls across the board appeared first on Our Bitcoin News.