A professional explains the year-end Bitcoin market as expectations for ETF approval increase | Contributed by Virtual NISHI

*This report was written by Virtual NISHI, a crypto analyst at the crypto asset exchange SBI VC Trade.@Nishi8maru) contributed to CoinPost.

Bitcoin Market Report (December 6th to December 12th)

The price of Bitcoin has skyrocketed since December 5th. Although there was a slight stagnation towards the end of December due to tax sales pressure and year-end dollar demand, there are still strong expectations for the approval of ETFs such as ARK Invest and 21 Shares, which have a final application decision deadline of January 10th. It has been hovering around the highest level since the beginning of the year. (Bitcoin price at the time of writing is around $43,600)

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

At your feet

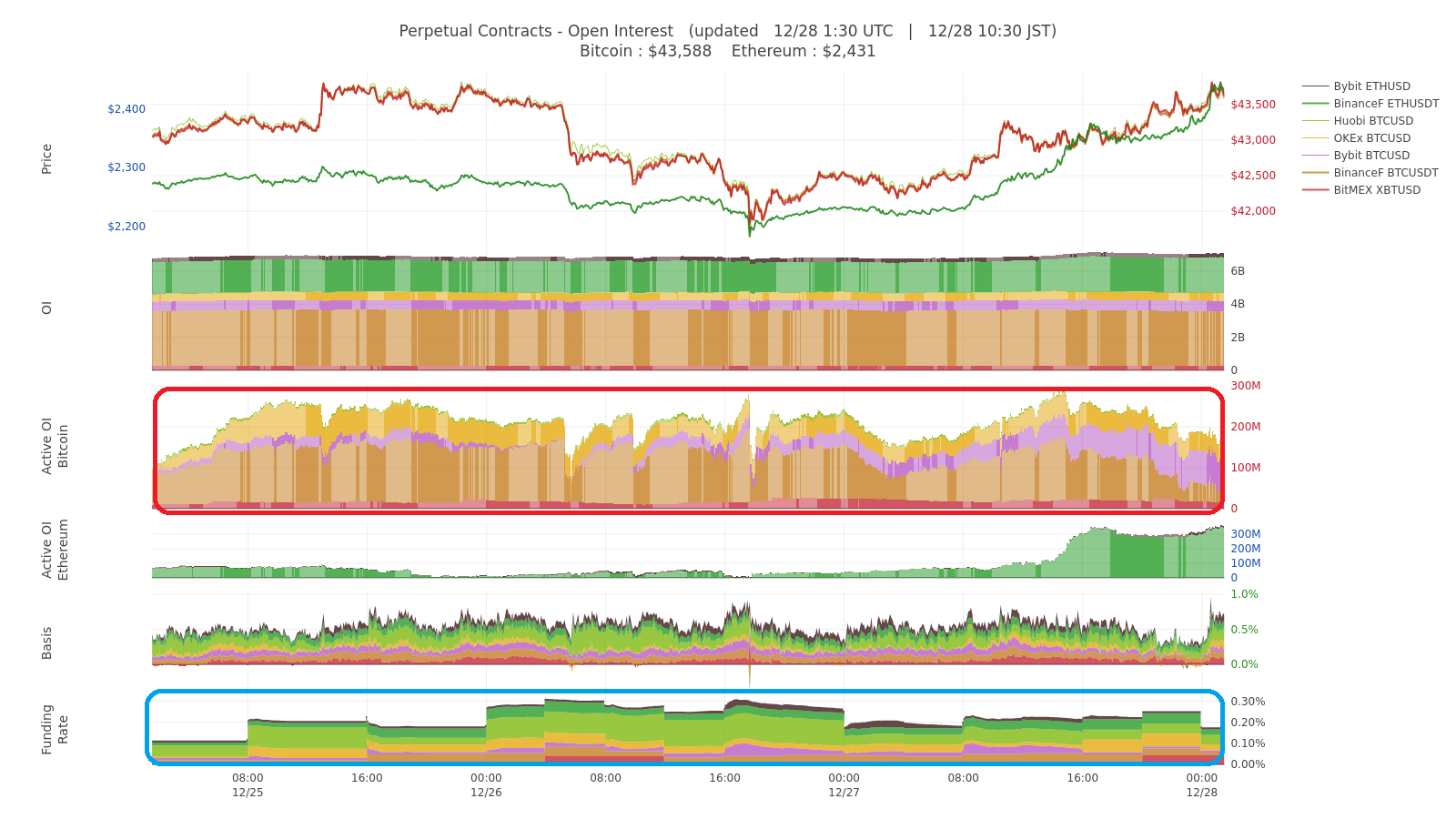

The active OI (unsettled open interest) of Bitcoin market orders continues to be at a high level (red frame in the image below), and the price is likely to fluctuate wildly.

Also, considering the increase in the funding rate, it can be seen that long positions are continuously increasing (blue frame in the image below).

source:BTC Status Alert

spot market

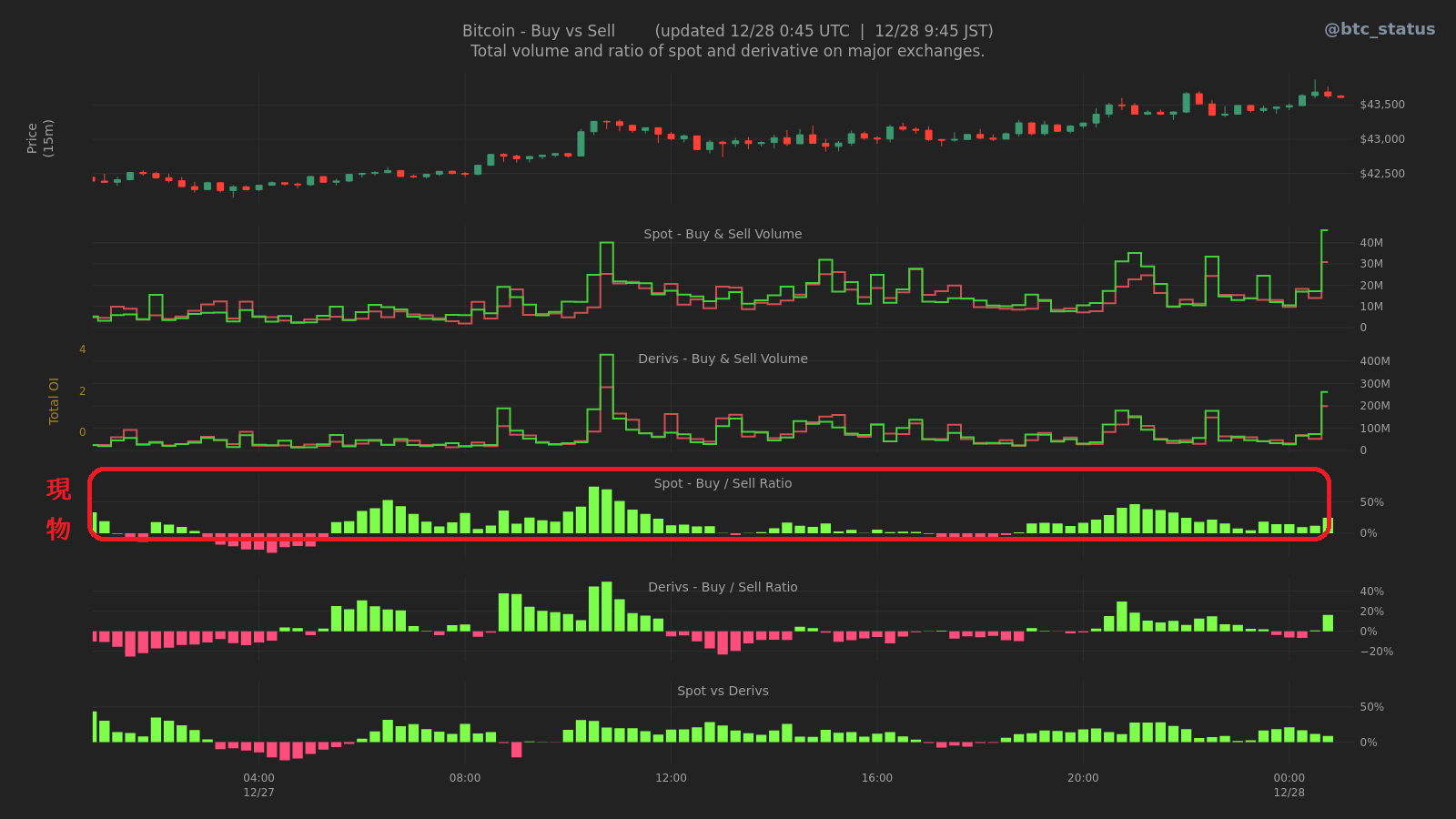

Looking at market trading, it can be seen that the spot market continues to be bought (red frame in the image below).

source:BTC Status Alert

derivatives market

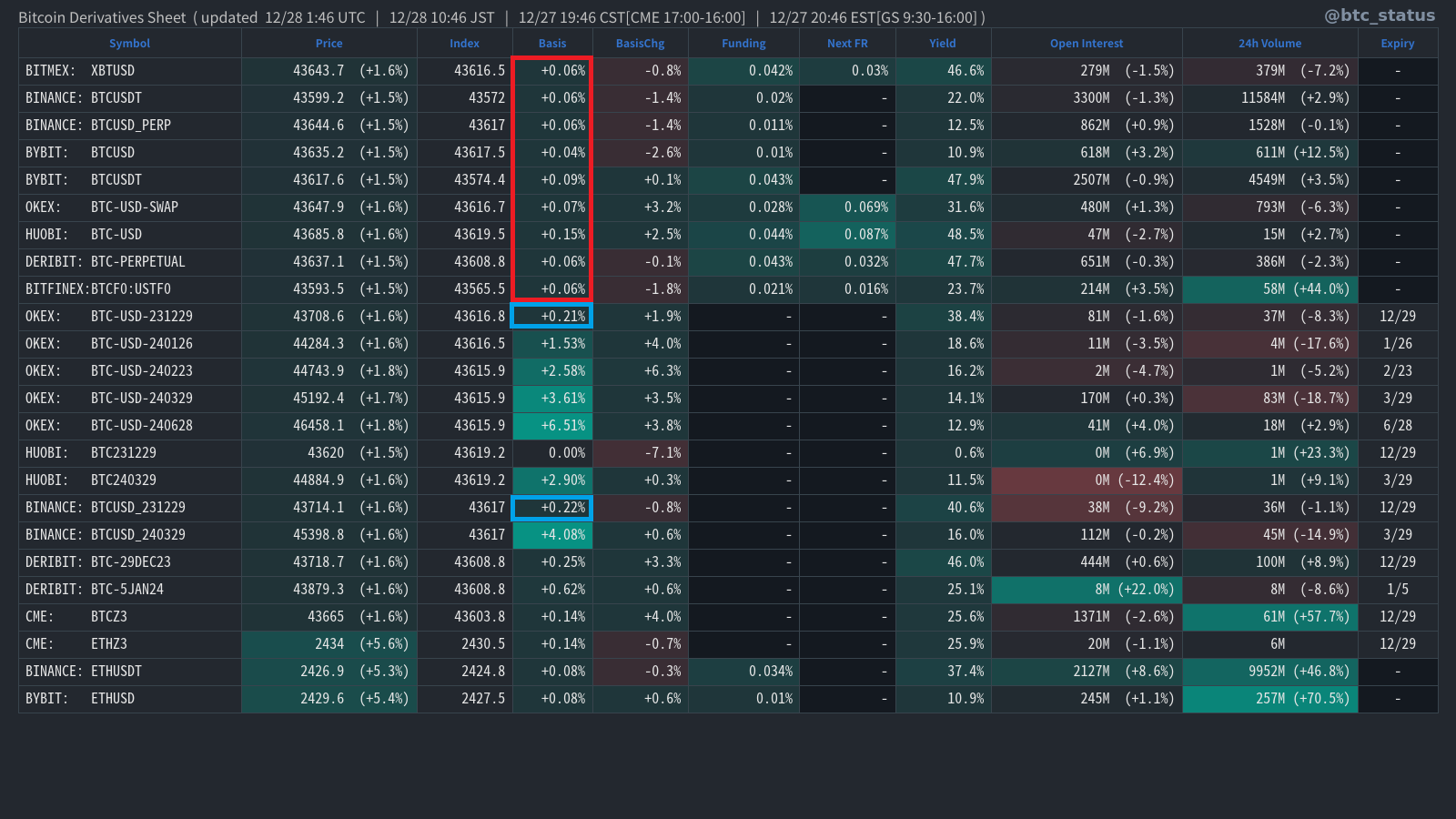

Perpetual futures in the recent derivatives market have been trending at higher prices than spot prices, and are slightly overbought (red frame in the image below).

In addition, futures prices, which reach SQ on December 29th, are higher than spot prices, suggesting that short-term supply and demand conditions seem to be slack (blue frame in the image below).

source:BTC Status Alert

options market

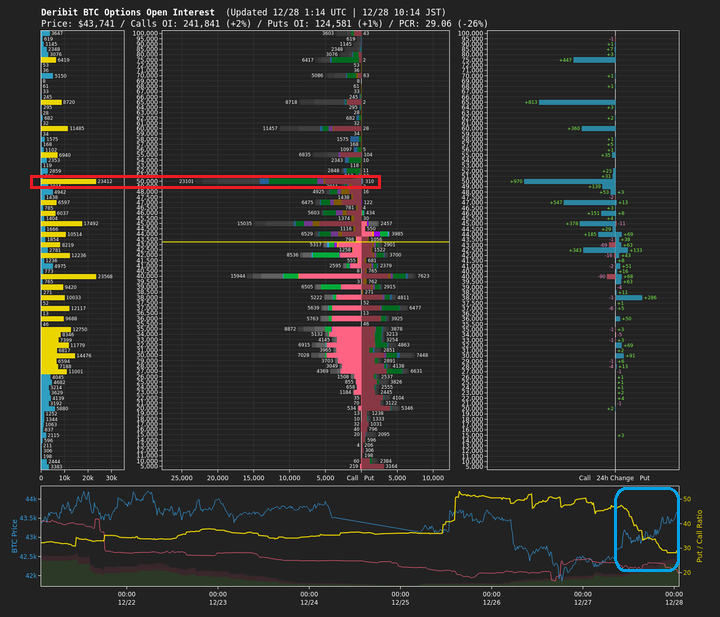

In the option market, which is traded in spot delivery, open interest is concentrated in the $50,000 price range (red frame in the image below), which is higher than the current price, and within this, open interest on the exercise date of January 26th is increasing. This suggests that options market participants expect prices to rise in the short to medium term.

In addition, the PCR ratio has recently fallen sharply (blue frame in the image below), which can be interpreted as a shift in the attitude of market participants to a more bullish position.

source:BTC Status Alert

futures market

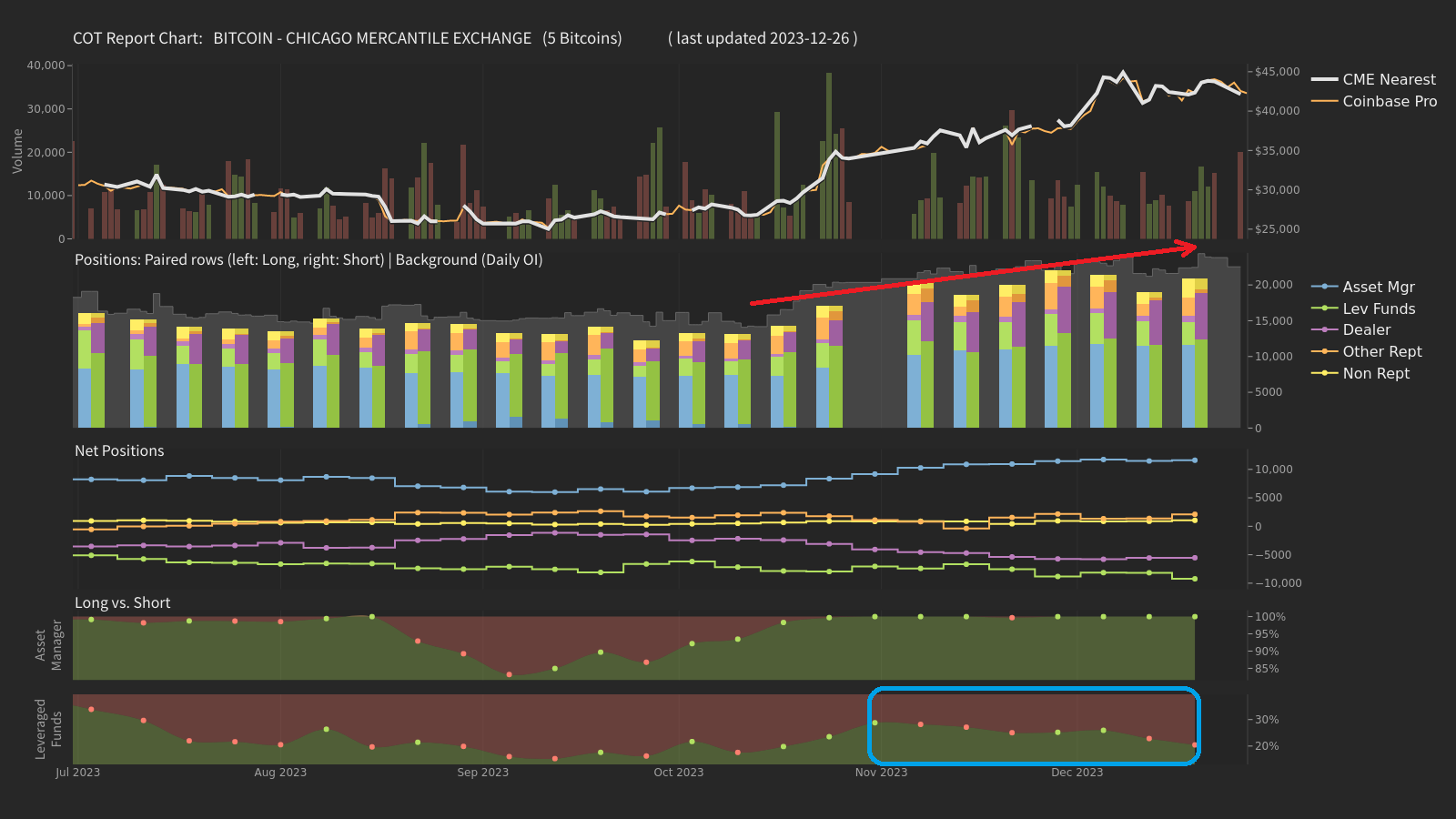

OI in the futures market (CME) has been on an increasing trend since mid-October, when prices skyrocketed (red arrow in the image below), indicating that capital inflows continue.

Looking at the breakdown, the proportion of short positions is increasing for “Leveraged Funds†that aim for profit from price differences (blue frame in the image below).

source:BTC Status Alert

External environment

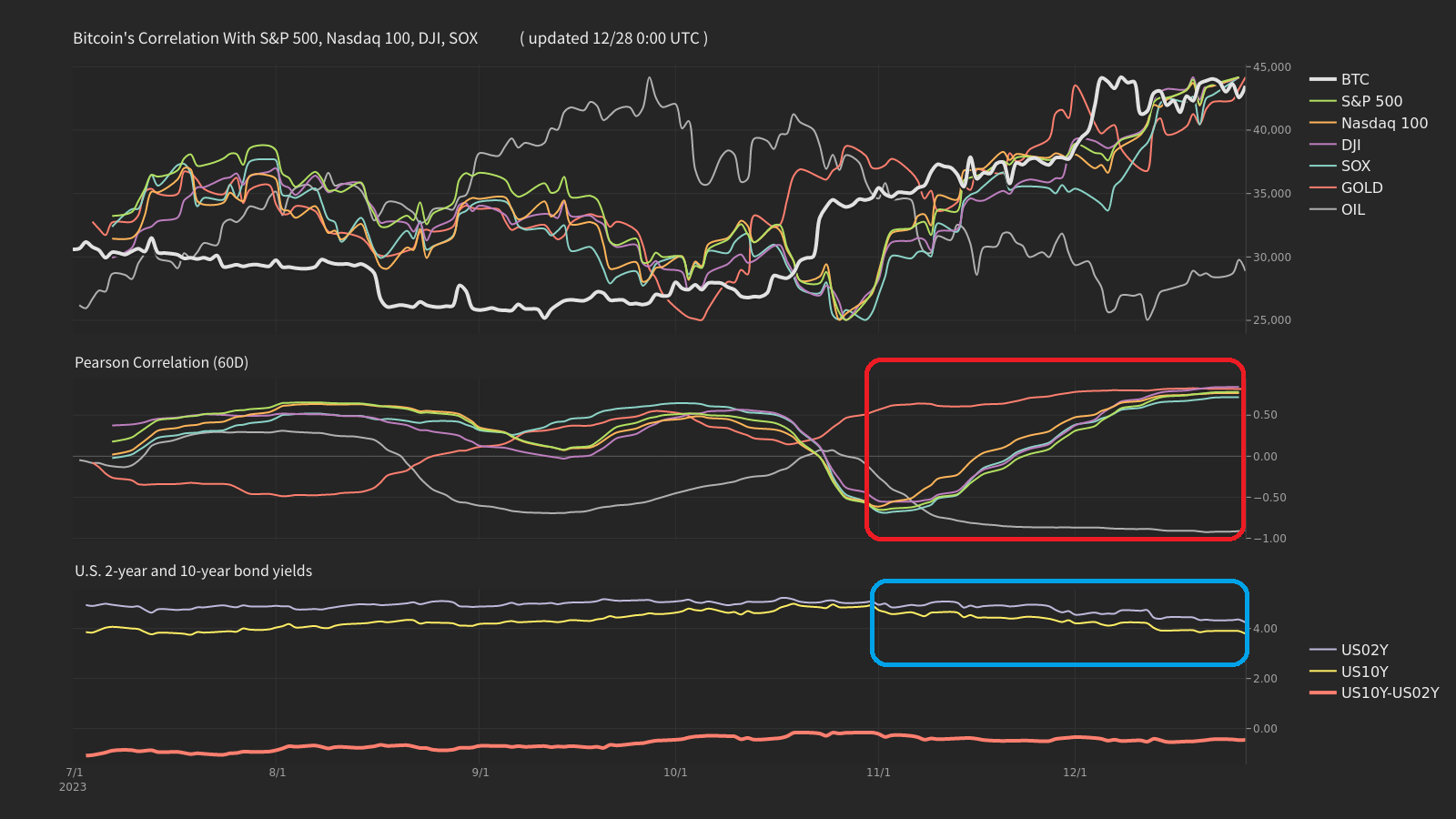

The data shows that since November, the rise in Bitcoin prices has been accelerating at the same time that U.S. interest rates turned from rising to falling (blue frame in the image below).

As for the correlation with other assets, the correlation with gold is quite strong at +0.8, and since December, the correlation with US stock indexes such as the S&P 500 (+0.78) has also increased (red frame in the image below).

source:BTC Status Alert

On-chain environment

The hash rate has decreased significantly, and the next difficulty level is predicted to be 14.85% easier.

Latest Crypto Indicators

December 29th

December 29th

Bitcoin Major SQ

January 2nd

January 2nd

United States America PMI (Purchasing Managers Index) released in December

A crypto economic index calendar that never existed in the world.

It has been carefully created to give Japanese traders an absolute advantage. https://t.co/cYcebDABgO

— Virtual NISHI (@Nishi8maru) March 26, 2020

Summary

In the Bitcoin market, there is a sense of overheated buying in the derivative market and other areas in the short term.

However, despite the price remaining close to the year-to-date high, the options market has seen an increase in open interest of $50,000, which is about 15% higher than the current price, and market participants are looking forward to the ETF’s approval. It can be seen that this is expected.

Image source: Tainoko Lab

We have introduced the “Heat Map†function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.â– Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU— CoinPost (virtual currency media) (@coin_post) December 21, 2023

The post A professional explains the year-end Bitcoin market as expectations for ETF approval increase | Contributed by Virtual NISHI appeared first on Our Bitcoin News.