Ark’s Bitcoin strategy is also successful as GBTC’s negative deviation reaches single digits

GBTC market price becomes appropriate

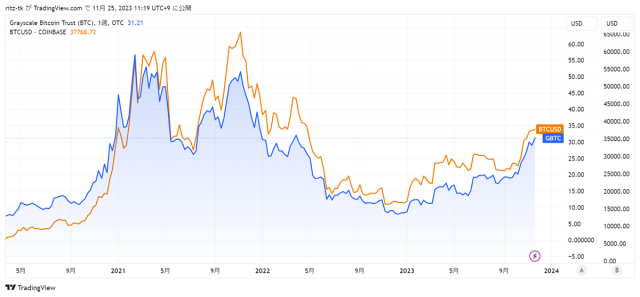

On the 24th, the discount (negative deviation) rate to net asset value (NAV) of the Bitcoin investment fund “GBTC†managed by crypto heritage (virtual currency) asset management company Grayscale Investments narrowed to -9.77%.

This shows that the discount rate, which at one point had widened to -45%, has improved significantly, and is thought to be due to progress in applications for conversion to ETFs.

Source: YChart

This rate represents how low the market price of GBTC is compared to the actual value of Bitcoin held in trust, and it is the first time since July 2021 that it has fallen below 10%.

GBTC is a closed-end, Bitcoin-linked investment trust whose shares cannot be redeemed, and is traded on the US unlisted stock market OTC Market (OTCQX). Through this trust, investors can invest in Bitcoin through their brokerage account without having to physically buy, sell, or hold Bitcoin.

GBTC used to trade at a higher price (premium) than its net asset value during bull markets, but it sometimes trades at a discount price during bear markets, especially in November 2022 after FTX.com filed for bankruptcy protection in the United States. On April 19th, the discount was up to -45%.

Grayscale meets with US SEC

Grayscale has been in conflict with the U.S. SEC (Securities and Exchange Commission) over its proposed application to convert GBTC into an open-end ETF, but in a court case in August of this year, the SEC’s stance was “arbitrary and “It’s a fickle thing,†and the judgment was in favor of the grayscale side. The SEC did not appeal, and it was reported that the two sides held a meeting on the 20th of this month.

Expectations are high that the ETF will be approved for listing, and GBTC’s stock price has risen about 25% over the past month, hitting a closing price of $30.45 at the close of the U.S. market on the 24th.

BTC, GBTC USD chart Source: TradingView

connection:Bitcoin investment trust GBTC’s “negative divergenceâ€, the background to the rebound

Ark tries to rebalance

Meanwhile, Cathie Wood’s Ark Investment Management is reducing its GBTC stock allocation. On the 22nd, the company sold 36,168 shares (worth 164 million yen) from the ARK Next Generation Internet ETF (ARKW). Prior to this, on the 21st, 32,980 shares (equivalent to 149 million yen) were sold, for a total of approximately 300 million yen.

Ark Investments continues to take a strategic approach to investing in Bitcoin and the crypto market. Earlier this month, ARKW sold 139,506 shares (equivalent to approximately 567 million yen) of GBTC stock and 113,326 shares (equivalent to approximately 837 million yen) of Block Inc., whose Bitcoin sales commission revenue increased 22% in the third quarter. Bought across three funds.

In the month since October 23, ARKW has sold a total of 697,768 GBTC shares, but still holds 4.3 million GBTC shares (worth approximately $131.8 million). GBTC ranks third in ARKW’s portfolio after US exchange Coinbase and streaming service Roku, making up 9.2% of the total.

Expectations are high in the market for the SEC to approve the listing of a physical Bitcoin ETF. Multiple asset management companies have filed, and the SEC also met with BlackRock earlier this week. The price of Bitcoin (BTC) has also shown a positive response, increasing by 9.1% in the past month to trade at 5,649,194 yen. Year-to-date, it’s up 160%.

Bitcoin ETF review list Source: Bloomberg Intelligence

Bitcoin ETF special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7— CoinPost (virtual currency media) (@coin_post) November 15, 2023

The post Ark’s Bitcoin strategy is also successful as GBTC’s negative deviation reaches single digits appeared first on Our Bitcoin News.