How Bitcoin can benefit from global stress | CoinDesk JAPAN

Budget deficits, inflation, wars, bank failures, cyber attacks, de-dollarization.

These risks threaten the returns that investors receive from stocks and bonds and pose a major obstacle. Historically, U.S. Treasuries have been a “safe haven†and provided some protection from crises, but from 2021 to 2023, the three-year performance of U.S. Treasuries was -10%, the lowest since at least the 1980s. It was the worst. Similarly, a diversified 60 stocks/40 bonds portfolio lost 16% in 2022, its worst performance in 14 years.

What should investors do in a world of increasing uncertainty?

“Antifragilityâ€

In his book, Antifragility: The Only Way to Survive an Uncertain World, Nassim Taleb examines the unique characteristics of those who profit from anarchy. For example, the immune system becomes more effective after catching a cold. Laws are clarified through litigation. Software becomes “battle-hardened” by hackers who exploit flaws.

What if you could add assets to your portfolio that could benefit from global stress? These are assets that are improved by uncertainty and volatility.

Consider Bitcoin. The Bitcoin network appears to be resistant to stress. When the Chinese government banned Bitcoin mining in 2021, approximately 50% of Bitcoin mining capacity was forced to stop or relocate.

But within seven months, mining capacity was fully restored and is now more than double what it was before China’s ban. In the past 15 months, the world’s second-largest crypto exchange has declared bankruptcy, and the largest exchange has been sanctioned by the U.S. Department of Justice. Still, Bitcoin trading remains unaffected, with trading volumes near all-time highs.

Bitcoin as an asset appears to be becoming increasingly anti-fragile. When Silicon Valley Bank failed on March 10, 2023, stock prices fell the next day due to concerns about the fallout, but Bitcoin rose 20%.

Bitcoin outperforms other asset classes

This “safe haven†price movement is a new phenomenon for Bitcoin, and only time will tell if it persists.

However, Bitcoin has outperformed all other asset classes over the past 1, 3, 5, and 10 years, each of which has included a number of stresses.

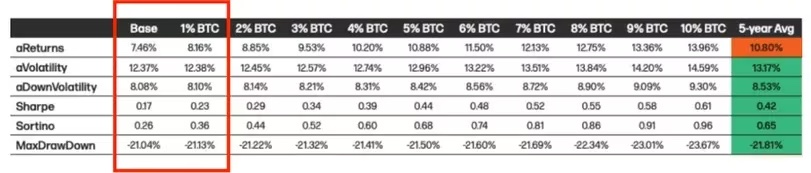

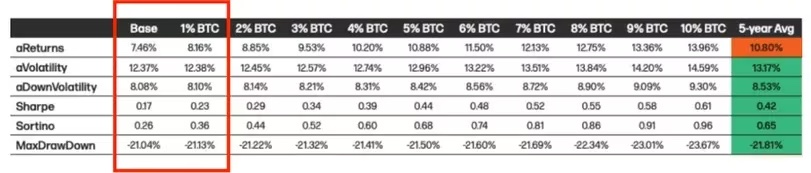

According to a study by Galaxy, over a five-year period from August 2018 to August 2023, if you allocated 1% of Bitcoin to a portfolio of S&P 500 55%/Bloomberg US Agg 35%/Bloomberg Commodity 10%, the volatility The company said it was largely unaffected by the large market decline and achieved high returns and excellent risk-adjusted returns.

Fidelity recently added Bitcoin to its Canadian diversified ETF portfolio, allocating 1% to its Conservative ETF and 3% to its Growth ETF.

With multiple Bitcoin ETFs available in the U.S., including low-fee Franklin Templeton EZBC and iShares IBIT, it’s easy for U.S. investors to follow suit.

Gradually, your portfolio may make more profits.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Ryo Tanaka/Unsplash

|Original text: How Bitcoin Benefits From Global Stresses

The post How Bitcoin can benefit from global stress | CoinDesk JAPAN appeared first on Our Bitcoin News.