Bitcoin order book shows highest liquidity since October | CoinDesk JAPAN

- Bitcoin order book is the most liquid since October 2023, with a 2% market depth.

- US-based exchanges are leading the rise in global order book liquidity.

As predicted in December 2023, the US-based Bitcoin (BTC) Spot Exchange Traded Fund (ETF), approved in January 2024, will not only increase the price of crypto assets (virtual currencies). It also affects order book liquidity, or the ability to trade at stable prices.

These effects are becoming more pronounced now, a month after roughly a dozen ETFs began trading.

As of early February 20th, Bitcoin’s 2% market depth (the total amount of buy and sell orders within 2% of the market price) on 33 centralized exchanges was $539 million (approx. It rose to 80.85 billion yen (exchanged at 1 dollar = 150 yen). This is the highest level since October and is up about 30% since the spot ETF hit the market on January 11, according to data tracked by Paris-based Kaiko.

The deeper and more liquid the market, the easier it is to buy and sell in large quantities without affecting the price, and the lower the slippage (the difference between the price at which a trade is offered and the price at which it is executed).

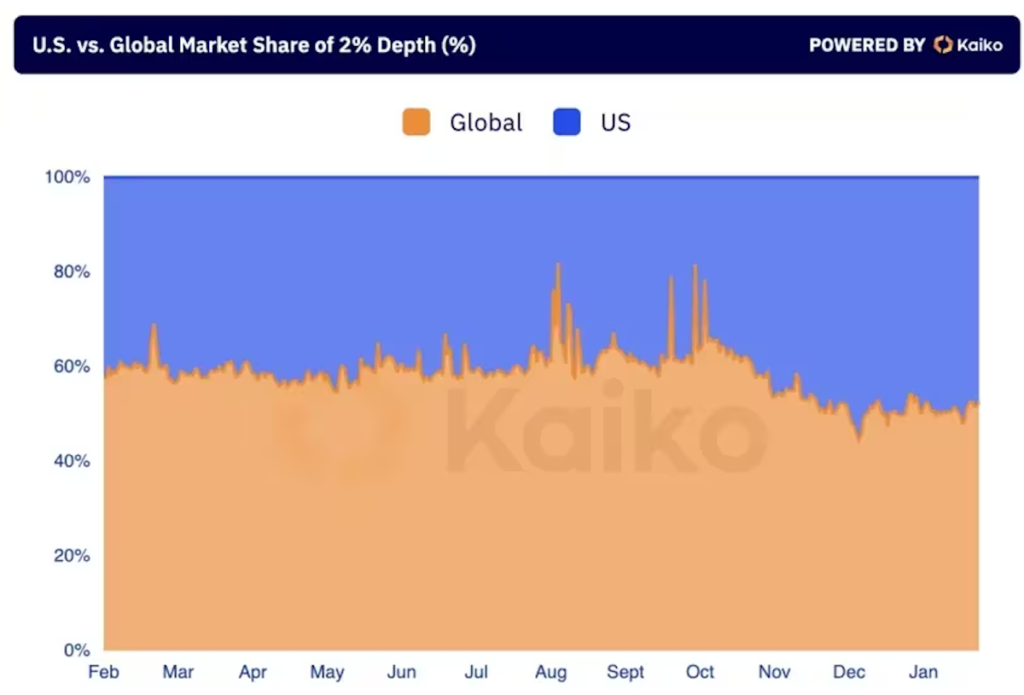

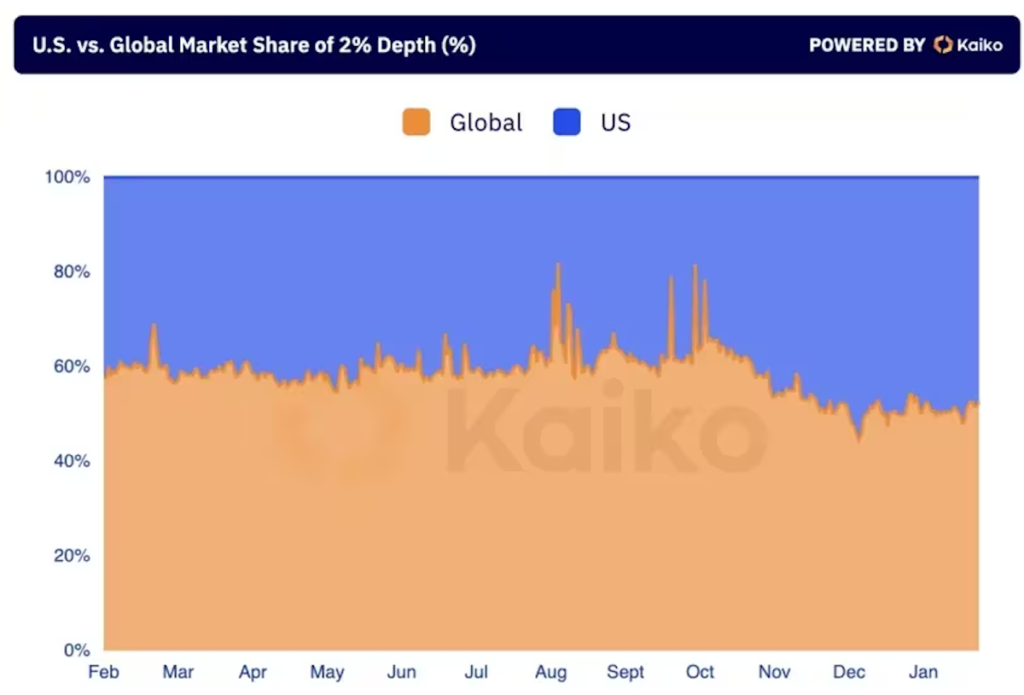

According to Kaiko, US-based exchanges have been driving the increase in the depth of the global Bitcoin market.

Since spot ETF expectations swept the market in October, American exchanges’ share of the global 2% market depth has increased from 14.3% to 48%.

Although market depth has improved, Sam Bankman-Fried’s crypto exchange FTX and its affiliate Alameda Research will go bankrupt in November 2022. This is still well below the previously observed level of over $800 million (approximately 120 billion yen).

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Kaiko

|Original text: Bitcoin Order Books Are Most Liquid Since October as Market Depth Nears $540M

The post Bitcoin order book shows highest liquidity since October | CoinDesk JAPAN appeared first on Our Bitcoin News.