JP Morgan points out that “GBTC selling†has ended, is the downside price of Bitcoin limited?

Macroeconomics and financial markets

On the US New York stock market on the 24th, the Dow Jones Industrial Average closed 242.7 points (0.64%) higher than the previous day, and the Nasdaq index closed 28.5 points (0.18%) higher than the previous day.

In the Tokyo stock market, the Nikkei Stock Average fell by 401.4 yen (1.1%) from the previous day. It appears that futures index selling took the lead.

CoinPost app (heat map function)

connection:Ranking of recommended securities accounts for the stock market that can be used at a profitable price

NISA, virtual currency related stocks special feature

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price rose 0.07% from the previous day to 1 BTC = $40,072.

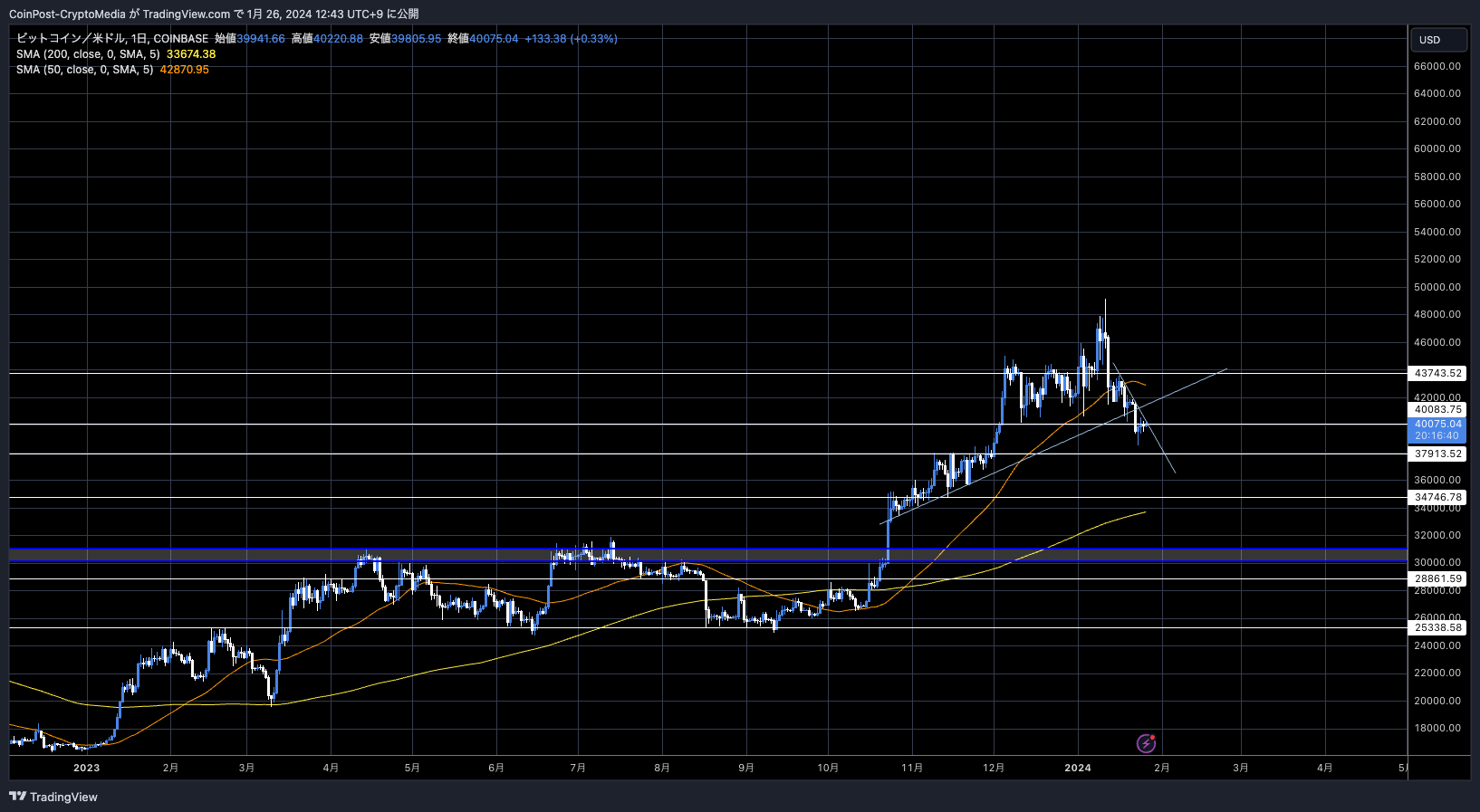

BTC/USD daily

Although the decline temporarily stopped with a -20% drop from the recent high of $49,100, the top price is heavy once the trend is broken. In the near term, the test will likely be whether the price can break out of the downward trend line and settle above $40,000. If the price continues to fall, we will have to wait and see if there is any rebound momentum near the support line at $38,000.

The U.S. Department of Justice has filed a notice of sale in court of 2,934 BTC (worth $129 million) seized from the dark web “Silk Road.â€

connection:US government plans to sell 17.8 billion yen worth of Bitcoin related to Silk Road

The US government has announced that it plans to auction off $130 million worth of Bitcoin that was previously seized in connection with the Silk Road incident.

In addition, regarding the huge profit-taking sales associated with the ETF conversion of Grayscale’s investment trust Bitcoin Trust (GBTC), which is said to be the main reason for the recent decline, a JPMorgan analyst said, “GBTC selling has almost ended, and BTC “The downward pressure on prices is beginning to weaken.â€

connection:JP Morgan analysis: Is Grayscale’s GBTC profit selling almost over?

On the 24th, the largest single-day outflow of $429 million was recorded. The cumulative amount of outflows reached $4.4 billion.

Grayscale’s Bitcoin ETF has higher trust fees compared to Bitcoin ETFs such as BlackRock’s IBIT, the largest asset management company, and Fidelity’s FBTC, which appears to have led to a continued shift in funds.

In light of intensifying competition, major asset management company CoinShares has announced a significant reduction in management fees for Bitcoin exchange-traded products (ETPs) in Europe from 0.98% per year to 0.35% per year. CoinShares’ financial products account for 40% of the European cryptocurrency ETP market share.

Competitor WisdomTree last week decided to lower fees on its Bitcoin and Ethereum ETPs from 0.95% to 0.35%.

On the other hand, the Bitcoin market has been under selling pressure following the approval of the Bitcoin ETF, but there is a deep-rooted view that the approval will be positive in the long term. Excluding the large outflows from the Bitcoin Trust ETF (GBTC), net inflows to Bitcoin ETFs (Exchange Traded Funds) amounted to $5.2 billion, representing an excess of $824 million in inflows.

Regarding the Ethereum spot ETF (exchange traded fund), the US SEC (Securities and Exchange Commission) has announced that it will postpone its decision on Grayscale Investments’ application and seek public comment. Comments must be submitted within 21 days and the review period after publication in the Federal Register can be extended for up to 35 days.

On the 25th, the SEC notified the commencement of proceedings regarding whether to approve NYSE Arca’s examination decision to list the shares of Grayscale Ethereum Trust.

connection:SEC postpones decision on Grayscale Ethereum spot ETF conversion application again

Market analysis

Michaël van de Poppe has a bullish view on the market.

“Bitcoin (BTC) recorded a 20% correction in the 10 days after the ETF was approved. Even if it falls further, it is likely to stop falling at 1 BTC = $36,000 to $39,000, and rise again towards the halving market. There is a strong possibility that this will continue.â€

#Bitcoin is getting toward the final stages of this correction.

We’re seeing volatility decrease from here, as the markets have witnessed a 20% correction in 10 days.

The range-low is still $36-39K, and upward momentum to the halving is likely from here. pic.twitter.com/2i5WzczD1a

— Michaël van de Poppe (@CryptoMichNL) January 25, 2024

Analysts at Deribit, a major derivatives exchange, said, “The recent increase in the put-call ratio in the options market indicates a growing demand for risk hedging in anticipation of short-term declines.†He hinted at bearish sentiment for options expiring tomorrow, but said he sees relative upside expected over the long term.

“WebX2024†New IP area will be established where Kodansha, Toho and others will exhibit, ETH Tokyo and DAO Tokyo will also be held at the same time https://t.co/Gs5y7wI1Kx

Date and time: 2024/8/28 (Wednesday) – 8/29 (Thursday)

Location: The Prince Park Tower Tokyo

*The video is “WebX2023†pic.twitter.com/vHZmFbNjwM— CoinPost (virtual currency media) (@coin_post) January 18, 2024

Bitcoin ETF special feature

We have introduced the “Heat Map†function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.â– Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post JP Morgan points out that “GBTC selling†has ended, is the downside price of Bitcoin limited? appeared first on Our Bitcoin News.