Bitcoin recovers to $43,000 level with significant rebound from last week

Macroeconomics and financial markets

In the US New York stock market on the 29th, the Dow Jones Industrial Average closed 224 points (0.59%) higher than the previous day, and the Nasdaq Index closed 172 points (1.1%) higher.

Among US crypto assets (virtual currency) stocks, Coinbase rose 5.7%, MicroStrategy rose 3.7%, and Marathon Digital rose 3.5%.

CoinPost app (heat map function)

connection:Ranking of recommended securities accounts for the stock market that can be used at a profitable price

NISA, virtual currency related stocks special feature

Virtual currency market conditions

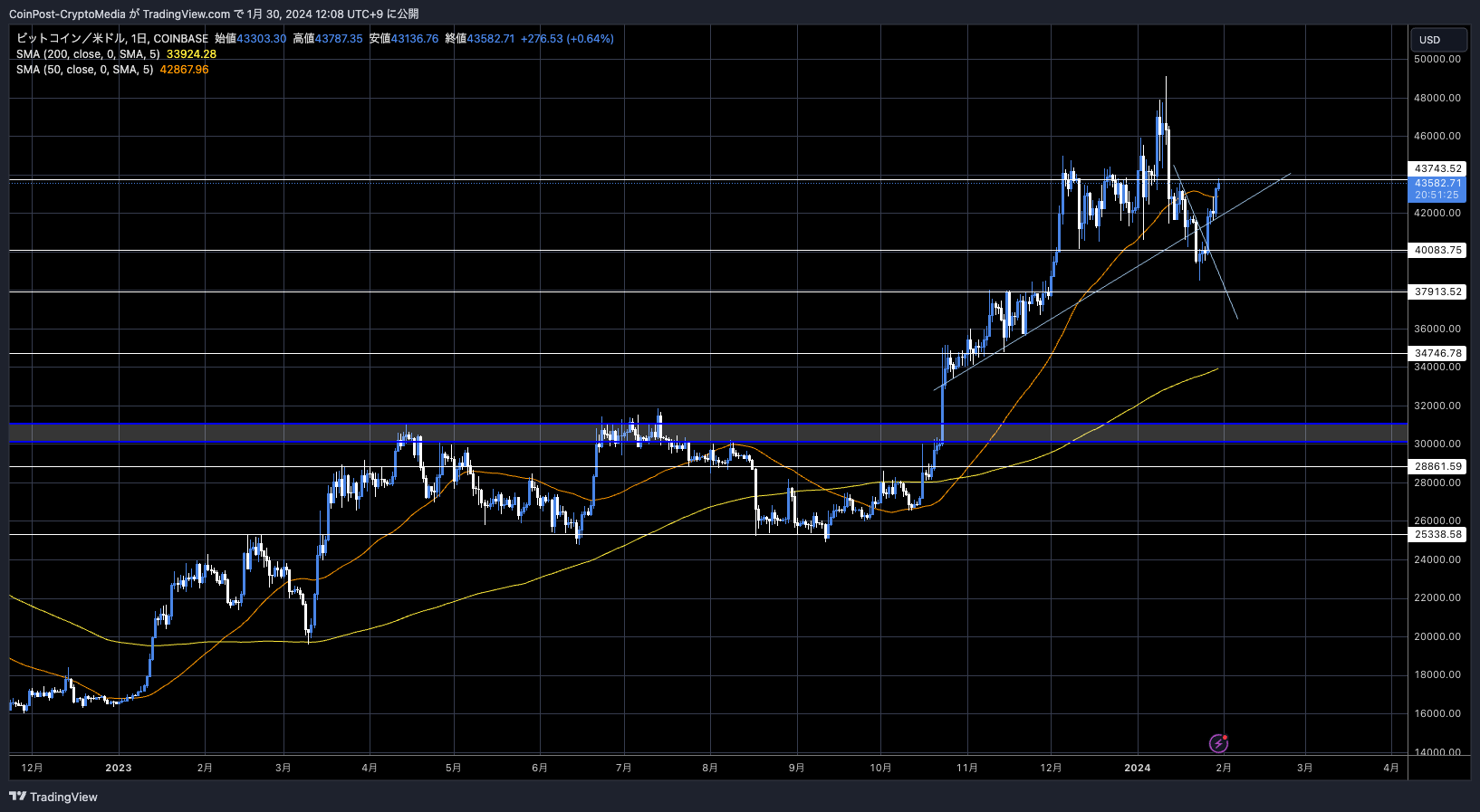

In the crypto asset (virtual currency) market, the Bitcoin price rose 2.7% from the previous day to 1 BTC = $43,558.

BTC/USD daily

Although $44,000 is a sell-back line, the rebound since the 23rd has been gaining momentum, and the momentum to buy back altcoins is returning.

Ethereum (ETH) rose 1.8% from the previous day, Solana (SOL) rose 5.2%, Cardano (ADA) rose 7.4%, and among domestic stocks, Astor (ASTR) continued to rise by 6.0%.

The crypto asset (virtual currency) market, which had been trending towards selling, has been on the decline due to a round of profit-taking selling after the approval of a Bitcoin spot ETF (exchange traded fund) and a decline in selling pressure from the Grayscale Bitcoin Trust (GBTC). , is already beginning to show signs of revival.

Michael van de Poppe said, “Assuming we see an end to the correction phase after the ETF approval, we will see a consolidation (with countervailing buying and selling) for some time to come.†He expressed his view that “After that, 1 BTC = 1 BTC = $48,000 to $50,000 level, and the altcoin market may outperform.â€

The range is still relatively clear on #Bitcoin.

Assuming we’ve seen the end of the correction after the ETF launch, it seems likely that we’re going to consolidate from here.

Perhaps another run to $48-50K and time for #Altcoins to outperform. pic.twitter.com/yivYaVwOxa

— Michaël van de Poppe (@CryptoMichNL) January 29, 2024

Analyst Negentropic said, “During this rally, $660 million of short positions were sold out (forced liquidation).If things continue like this, another $1 billion short squeeze could occur, leading to further gains. There is,†he pointed out.

“Liquidity is KEY.â€

1. Bitcoin Analysis: Bitcoin surged to $42.2k, liquidity providing for long positions, with a neutral impulse.

2. Liquidity Gap: The price is moving to fill the liquidity gap above $42k, indicating potential volatility. Approximately $659 million in… pic.twitter.com/wStqXqmLRN

— ð—¡ð—²ð—´ð—²ð—»ð˜ð—¿ð—¼ð—½ð—¶ð—° (@Negentropic_) January 29, 2024

He also said that if the Chinese government were to try to support the market with vast amounts of liquidity, it would likely cause the crypto asset (virtual currency) market and stock market to soar.

This is because the Chinese authorities are considering relief measures of up to 2 trillion yuan (approximately 40 trillion yen) to support the slumping Chinese stock market and buy onshore stocks. China’s main stock index, the benchmark CSI300 index, has fallen to its lowest level in five years, and the Chinese authorities are said to be growing concerned.

On the 29th, it was reported that a Hong Kong court had issued a liquidation order to China Evergrande Group, a major Chinese real estate developer that is undergoing business restructuring.

Invesco, a major asset management company that has been struggling with the inflows of Bitcoin ETFs, has decided to significantly lower its fees. Invesco’s Bitcoin ETF’s trust fee was previously 0.39%, the highest among competitors.

This is what the fee table looks like now: pic.twitter.com/LPvd6YwGWJ

— James Seyffart (@JSeyff) January 29, 2024

The company plans to continue offering discounted fees for the first six months or until assets under management reach $5 billion.

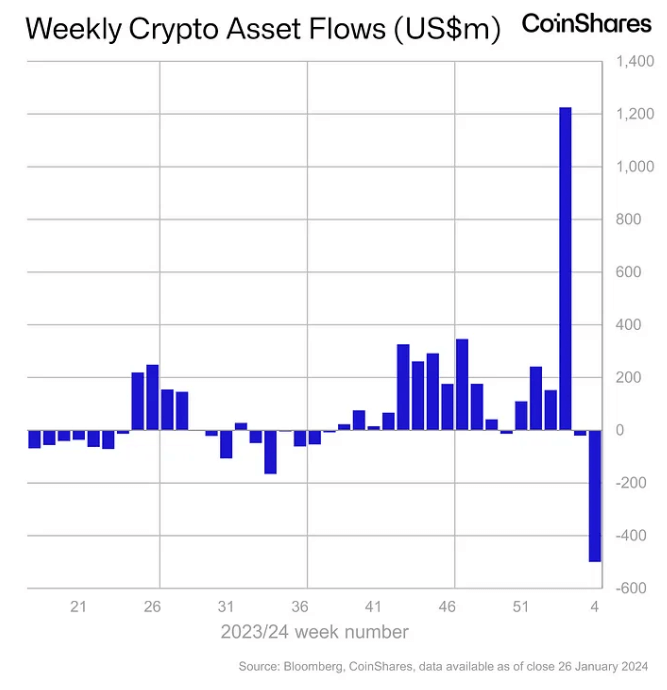

Excess outflow of $500 million

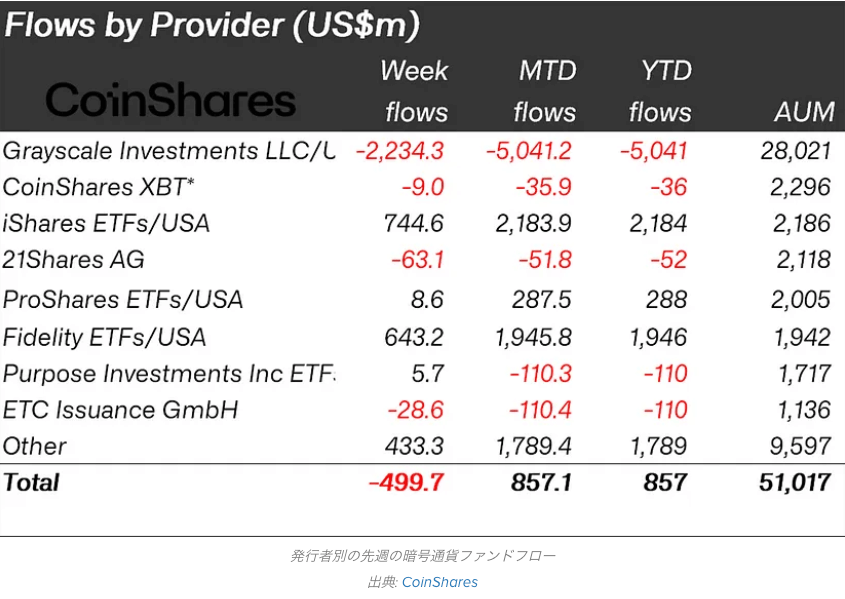

Meanwhile, capital flows into exchange-traded investment products (ETPs) turned into a significant outflow of $500 million last week, according to a weekly report from asset management firm CoinShares.

coin shares

In particular, Grayscale’s investment trust Bitcoin Trust (GBTC) has seen profit-taking behavior from investors who bought at a discount to net asset value (NAV).

coin shares

However, while outflows into Grayscale last week totaled $2.2 billion, the pace of daily outflows has slowed into this week, suggesting that selling pressure from Grayscale is starting to subside. .

“WebX2024†New IP area will be established where Kodansha, Toho and others will exhibit, ETH Tokyo and DAO Tokyo will also be held at the same time https://t.co/Gs5y7wI1Kx

Date and time: 2024/8/28 (Wednesday) – 8/29 (Thursday)

Location: The Prince Park Tower Tokyo

*The video is “WebX2023†pic.twitter.com/vHZmFbNjwM— CoinPost (virtual currency media) (@coin_post) January 18, 2024

Bitcoin ETF special feature

We have introduced the “Heat Map†function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.â– Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin recovers to $43,000 level with significant rebound from last week appeared first on Our Bitcoin News.