Will the virtual currency Bitcoin price accelerate its rise in 2024? Grayscale Market Report

Virtual currency market report

Grayscale, a major US crypto asset (virtual currency) management company, released its November 2023 market report on the 1st.

He pointed out that the price of Bitcoin (BTC) continued to rise in November, and its impact spread widely to the virtual currency market. He also expressed the view that a combination of conditions could put upward pressure on the price of Bitcoin in 2024.

Grayscale explained that in November, the market was less cautious about geopolitical risks in the Middle East and a hard landing (sudden economic slowdown) in the U.S. economy. We believe that this is one of the factors that led to the rise in virtual currency prices.

He said the price of Bitcoin is up 130% in 2023 and is on track to become one of the best-performing major assets.

connection:Bitcoin returns to $38,000 level, setting new year-to-date high, reports continue regarding Bitcoin ETFs

Future predictions

On the other hand, he argues that further price increases may be difficult, especially in the short term, given the situation with long positions (buy orders). Major cryptocurrencies have risen significantly so far, and he expressed the view that positive factors are already factored into prices.

It also sees risks that could cancel out this year’s upward trend, including a sharp slowdown in the U.S. economy, a resumption of U.S. interest rate hikes or lower-than-expected interest rate cuts, and delays in the review of Bitcoin spot exchange-traded funds (ETFs).

connection: BlackRock and Invesco meet again with the SEC regarding Bitcoin ETF listing application

However, Grayscale said the central financial market and economic scenario is positive for Bitcoin and other cryptocurrencies. Supporting this view is the supply and demand of Bitcoin.

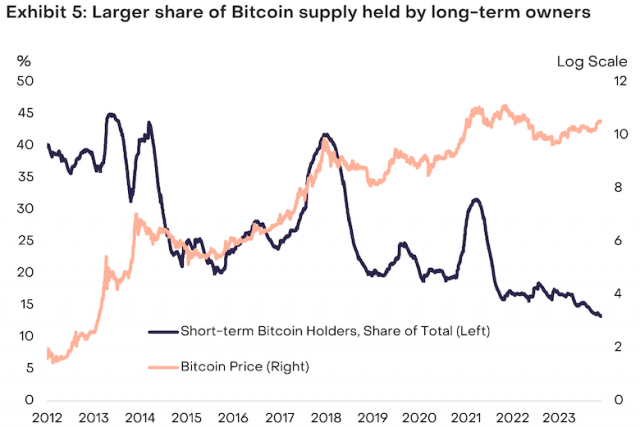

According to data from Glassnode, Bitcoin holdings by short-term speculators have fallen to record lows. In the graph below, “Short-term Bitcoin Holders (left axis)†is the share of short-term holders.

Source: Grayscale

Grayscale’s analysis also shows that much of the bitcoin is held by accounts that sell at a slower pace. Furthermore, there will be a Bitcoin halving next year.

Grayscale also explained that if a Bitcoin spot ETF is approved, new institutional investors will enter the market. He said the combination of tight supply and new investor entry will put upward pressure on Bitcoin prices in 2024.

connection: Learn about Bitcoin ETFs from the beginning: Explain the advantages and disadvantages of investing and how to buy US stocks

What is half-life?

It refers to the timing when the mining reward (=newly issued amount) of virtual currency is reduced by half. During the halving scheduled for 2024, mining rewards will decrease from 6.25 BTC to 3.125 BTC.

Virtual currency glossary

Virtual currency glossary

Half-life special feature

The post Will the virtual currency Bitcoin price accelerate its rise in 2024? Grayscale Market Report appeared first on Our Bitcoin News.