Total BTC held by global Bitcoin ETFs reaches 3.8% of maximum supply = CoinGecko analysis

to 3.8% of maximum supply

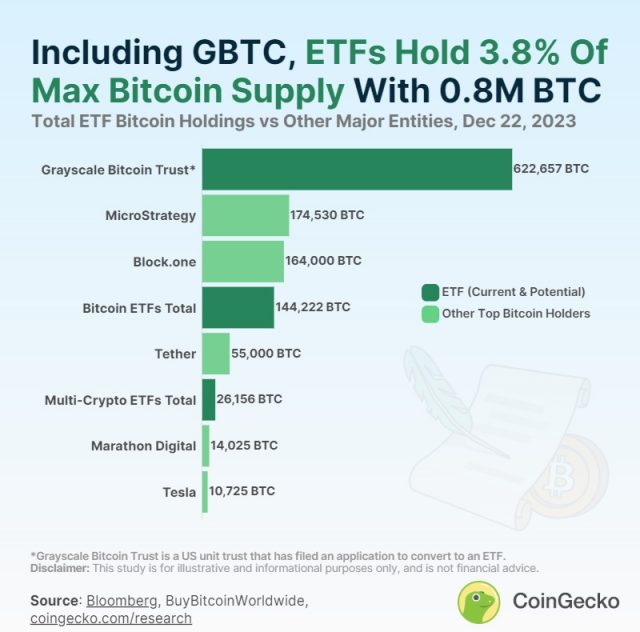

According to CoinGecko, existing crypto asset (virtual currency) Bitcoin exchange traded funds (ETFs) around the world hold a total of approximately 793,034 BTC (approximately 5 trillion yen), which is the largest supply of Bitcoin. It was found to be equivalent to 3.8% of the 21 million BTC (as of the 22nd).

Currently, ETF providers manage only a small portion of the total Bitcoin, but investor demand is expected to increase if the U.S. approves the listing of Bitcoin spot ETFs.

Examining Bitcoin holdings in Bitcoin futures and spot exchange-traded funds (ETFs) or exchange-traded products (ETPs), physically backed ETFs or ETPs, and other organizations based on public data such as Bloomberg and BuyBitcoinWorldwide. :As of December 22, 2023 Source: CoinGecko

The statistics also include Grayscale Bitcoin Trust (GBTC). GBTC is in the process of applying to the U.S. Securities and Exchange Commission (SEC) to convert from a closed-end unit trust to an ETF and holds 622,657 BTC. This is equivalent to 3.0% of Bitcoin’s maximum supply.

Excluding GBTC, existing ETFs’ BTC holdings are only 0.8% of Bitcoin’s maximum supply.

There are 22 other Bitcoin-only ETFs around the world holding a total of 144,222 BTC. GBTC is more than three times as large as the Bitcoin held by these ETFs. Looking at individual holdings, they range from 2 BTC for Valour Bitcoin Carbon Neutral (1VBT) to 35,523 BTC for Purpose Bitcoin ETF (BTCC).

connection:“Cash ETFs could destroy the Bitcoin network†Arthur Hayes’ thoughts

BTC held by companies

On the other hand, the amount of BTC held by a single company is also noteworthy. MicroStrategy, led by Michael Saylor, and EOS developer Block.one hold approximately 174,530 BTC and 164,000 BTC, respectively.

connection:Why does MicroStrategy, a listed US company, continue to buy large amounts of Bitcoin?

There are 14 basket-type ETFs for crypto assets, with a total holding of 26,156 BTC. Bitwise 10 Crypto Index Fund (BITW) holds the most Bitcoin of any cryptobasket ETF with 11,066 BTC.

Complete List of Cryptocurrency Related ETPs

In anticipation of the SEC approving the spot Bitcoin ETFs, we present what we believe to be a comprehensive list of all the existing crypto related exchange traded products

We have found 150 products with $50.3bn of assets, as at 22… pic.twitter.com/cFUxtuvXgd

— BitMEX Research (@BitMEXResearch) December 25, 2023

Additionally, according to BitMEX, as of December 22, 2023, there are approximately 150 cryptocurrency-related exchange traded financial products (ETPs), with assets amounting to $50.3 billion (approximately 7 trillion yen).

connection:US SEC hints at January approval for Bitcoin spot ETF, setting deadline for submission of application documents on the 29th = Report

What is GBTC?

GBTC (Grayscale Bitcoin Trust) is a Bitcoin-only investment fund that has been on the market since 2013 and is managed by Grayscale Investments. Assets under management (AUM) are $27 billion (3.8 trillion yen) as of December 22, 2023, and management fees are 2%.

GBTC is currently a closed-end mutual fund, but it can trade at a premium or discount depending on market fluctuations, and Grayscale is in talks with the SEC to convert it into an open-end ETF.

Bitcoin-related investment products are diverse, each with different characteristics and risks. Physical ETFs are expected to stimulate the competitive environment for these existing Bitcoin investment products, expand the investment market, and attract a diverse range of investors.

connection:Bitcoin investment trust GBTC’s “negative divergenceâ€, the background to the rebound

Half-life special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7— CoinPost (virtual currency media) (@coin_post) November 15, 2023

The post Total BTC held by global Bitcoin ETFs reaches 3.8% of maximum supply = CoinGecko analysis appeared first on Our Bitcoin News.