Largest Bitcoin Futures ETF sets record high in assets under management in 2021 | CoinDesk JAPAN

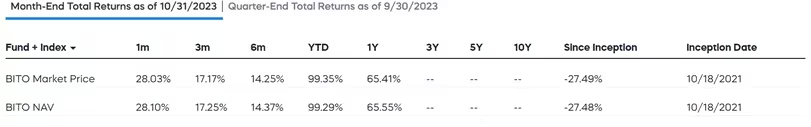

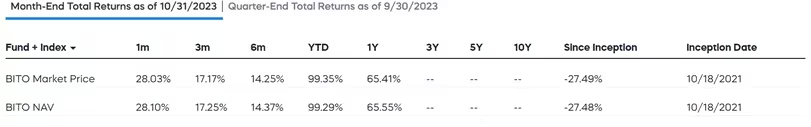

ProShares Bitcoin Strategy ETF (BITO), a futures ETF offered in the United States, this week surpassed its December 2021 record in assets under management (AUM), reaching $1.47 billion (approx. Billion yen (exchanged at 1 dollar = 150 yen) soared to a record high.

This surge indicates that institutional demand for Bitcoin (BTC) is once again on the rise, following a flurry of applications for Bitcoin spot ETFs in the US.

Listed on the Chicago Mercantile Exchange (CME), BITO allows investors to gain exposure to Bitcoin-linked returns through regulated products.

Simeon Hyman, global investment strategist at ProShares, said in a comment to CoinDesk: “As evidenced by the record-high amount of ETF assets under management, the investment in BITO “Demand for homes remains strong.†“This speaks to the demand for a familiar, accessible, and regulated way to target Bitcoin returns.â€

“BITO’s average daily trading volume of $160 million since its inception ranks it in the top 5% of all ETFs in the U.S.,†Hyman added.

Unlike other Bitcoin futures ETFs, BITO closely tracks Bitcoin’s spot price, which appears to be increasing its appeal among traders. In June, investors brought in more than $65 million (about 9.75 billion yen) in one week, the largest inflow in a year, compared to just over $40 million (about 6 billion yen) in April. This was the highest value set in 2023.

Bitcoin prices have been on the rise in recent months as various investment giants, including BlackRock and Fidelity, wait for US regulators to approve them offering Bitcoin Spot ETFs to their customers. It is rising.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Cheyenne Ligon/CoinDesk

|Original text: World’s Largest Bitcoin Futures ETF Breaks 2021 Record Highs for Assets Under Management

The post Largest Bitcoin Futures ETF sets record high in assets under management in 2021 | CoinDesk JAPAN appeared first on Our Bitcoin News.