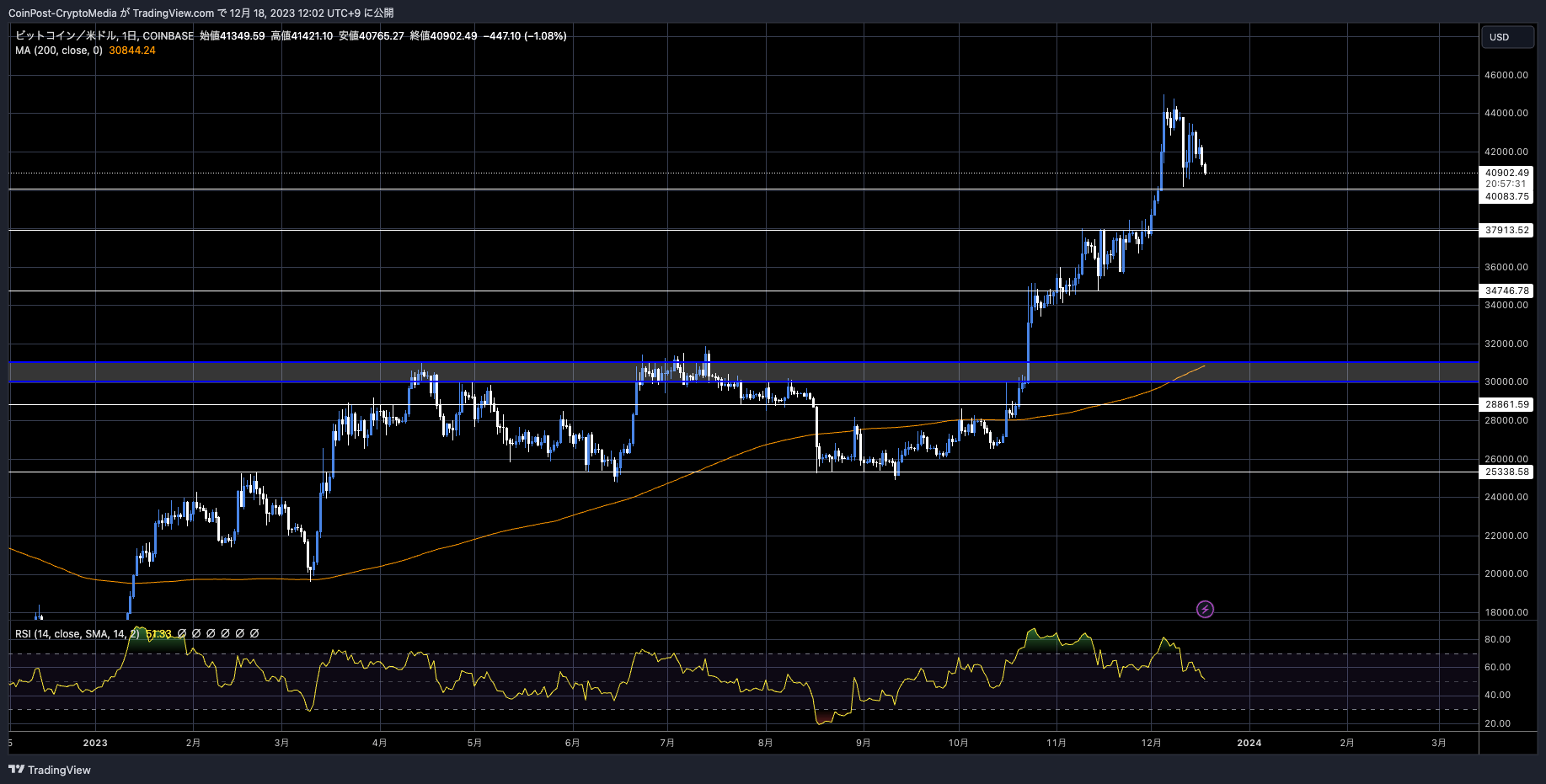

If Bitcoin, which is selling first, falls to the $30,000 level, what is the likely downside price?

Macroeconomics and financial markets

On the US New York stock market on the 15th last weekend, the Dow Jones Industrial Average closed 56.8 points (0.15%) higher than the previous day, and the Nasdaq Index closed 52.3 points (0.35%) higher.

Amid expectations of an early interest rate cut by the Federal Reserve (Federal Reserve System), the Dow Jones Industrial Average is pushing up.

connection:U.S. Nasdaq 100 index hits new high; two U.S. Federal Reserve presidents discourage interest rate cut expectations | 16th Financial Tankan

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price fell 2.3% from the previous day to 1 BTC = $40,978.

BTC/USD daily

On a weekly basis, the market has been on a positive line for eight consecutive weeks ahead of the US Federal Open Market Committee (FOMC) meeting, and the chart has deteriorated as a result of position adjustment selling in reaction to overheating. It suggests a near-term ceiling. This is the first time in 9 weeks since early October that there has been a weekly shadow line.

connection:Bitcoin is on a correction trend, does it need more material to break above $45,000? | Contributed by a bitbank analyst

On the 15th, the US SEC (Securities and Exchange Commission) rejected Coinbase’s request to regulate digital assets, which is currently in dispute over securities law violations, and reiterated that existing laws apply to crypto assets. Coinbase immediately appealed the decision.

connection:US SEC rejects Coinbase’s regulatory petition; Coinbase will appeal

Justin Bennett points out that a break below the trend line increases the possibility of a continued decline. He cited support and a downside target of $38,000.

Not a great look for $BTC while below $43,300.

Possible lower high forming and starting to weigh on trend line support.

The next stop is $38k on a sustained break#Bitcoin pic.twitter.com/dhMTmE619r

— Justin Bennett (@JustinBennettFX) December 15, 2023

If the support level at $38,000 cannot be maintained, we also assume a possible fall to $32,000.

We also assume a scenario where the market share of the stablecoin Tether (USDT) rebounds and retests the 7.6% resistance level. In that case, he viewed Bitcoin as negative, as it would imply a withdrawal of funds to stable coins.

Tether dominance $USDT.D — which moves inversely to #Bitcoin — telegraphed the recent pullback perfectly.

Tested and swept the Aug. 2022 low before bouncing.

I’m still eyeing channel support just below that mark, which could mean one more higher high for $BTC before a more… https://t.co/ou3K66QWQF pic.twitter.com/ps7Oo9pifR

— Justin Bennett (@JustinBennettFX) December 12, 2023

On the other hand, there is a strong view that the adjustment will only be temporary, as the market is likely to be bought on the back of speculation that Bitcoin ETFs (exchange traded funds) will be approved as early as January next year.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

On-chain data

On-chain analytics platform CryptoQuant’s weekly report confirms selling pressure from both whales (large investors) and miners (miners).

When the price soared to 1 BTC = $44,000, Bitcoin miners are estimated to have sold their holdings at an average profit margin of 40%. This is also clear from the high level of miner outflows recently confirmed.

Also, according to blockchain data tracker Lookonchain, a large sale of Ethereum (ETH), which had been dormant for about a year, was confirmed.

A whale that has been dormant for 1 year is dumping $ETH on #DEX!

So far, 18,865 $ETH has been sold for 42M $DAI through 4 new wallets, the average selling price is $2,229.

And currently has 5,588 $ETH($12.5M) left. pic.twitter.com/K6znM7pxxh

— Lookonchain (@lookonchain) December 16, 2023

On the other hand, there are occasional movements in the wallets of whales (large investors) to pick up on the downside. Over the past week, 100,000 ETH ($230 million) worth of Ethereum (ETH) purchases have been confirmed.

Some of the largest #Ethereum whales have been on a buying spree, scooping up over 100,000 $ETH in just the past week – that’s a whopping $230 million! pic.twitter.com/jWHY6MXDgs

— Ali (@ali_charts) December 16, 2023

Bitcoin ETF special feature

Due to the soaring price of Bitcoin, the number of downloads and MAU of the CoinPost official app is rapidly increasing.

In addition to virtual currency news, crypto indicators can also cover future materials. By using the My Coin function and Crypto Alert, you can quickly check for sudden rises and falls in altcoins.â– Explanatory article https://t.co/9g8XugH5JJ pic.twitter.com/gYtpheMykj

— CoinPost (virtual currency media) (@coin_post) December 6, 2023

[Recruitment]

CoinPost, Japan’s largest crypto asset media, is currently recruiting human resources due to business expansion (possible full-time positions)Editorial Department: Student interns interested in web3 and writers familiar with crypto assets

Sales department: Those who are good at English conversation and those with sales experience are welcome.

webX management: People who have strong research skills and are good at English conversation https://t.co/UsJp3v7P39— CoinPost (virtual currency media) (@coin_post) November 24, 2023

Click here for a list of past market reports

The post If Bitcoin, which is selling first, falls to the $30,000 level, what is the likely downside price? appeared first on Our Bitcoin News.