Buying a total of 121 billion yen worth of Bitcoin in one day “IntoTheBlock†reports whale buying line

whale buying line

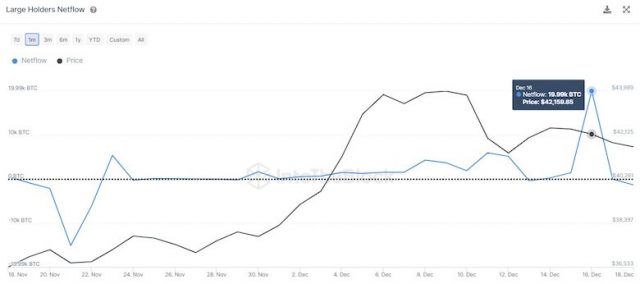

IntoTheBlock, a crypto asset (virtual currency) analysis company, reported that multiple large holders of Bitcoin (BTC) collectively bought around 20,000 BTC (equivalent to 121 billion yen) on the 16th.

At this time, the Bitcoin price rose to the $44,000 level at the beginning of December, then stopped and remained at the $42,000 level. From the IntoTheBlock post below, you can see that the amount of purchases has been outstanding over the past month.

source:IntoTheBlock

According to the official website, the data “Large Holders Netflow†(hereinafter referred to as “Netflowâ€) in the image above is based on the amount owned by each address. IntoTheBlock classifies addresses into three categories:

- Whale: Owns more than 1% of the circulating supply of a particular stock

- Investor: owns 0.1% to 1% of circulating supply

- Small owner: owns less than 0.1% of the circulating supply

What is a whale?

A large holder of virtual currency. Trading by whales is attracting attention because it can affect market prices.

Virtual currency glossary

Virtual currency glossary

On top of that, stocks with large market capitalizations like Bitcoin are defined as having a “large ownership amount, even if it exceeds 0.1%,†and Netflow explains that it is “the inflow of funds minus the outflow by whales and investors.†did.

He added that an increase in inflows “could be seen as large investors buying up stocks, while a decline could indicate that they are selling or reducing their long positions.â€

connection:Bitcoin rebounds to the $43,000 level, with the development of Bitcoin spot ETFs, there is a strong desire to buy the push

Is it a harbinger of price rise?

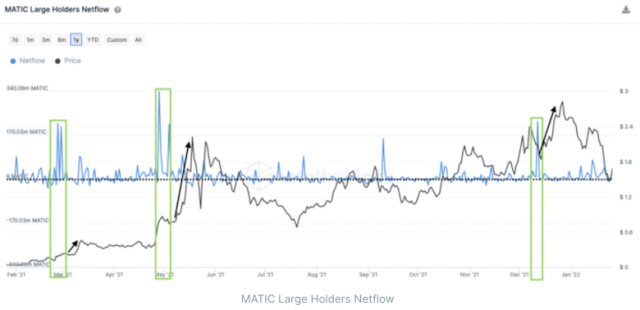

IntoTheBlock includes the following graph of Polygon (MATIC) when explaining how to use this graph.

Source: IntoTheBlock

In this graph, the areas surrounded by green lines are the areas where Netflow increased rapidly. As the black arrow on the right side shows, the price of MATIC increases after Netflow increases sharply.

IntoTheBlock explained that Netflow’s graphs are effective for exploring the trends of investors with large holdings. He said that when inflows increase sharply, buying is strong, and it could be a sign that the market is on the rise.

Furthermore, as of this writing, Bitcoin is still hovering around $42,000. In a report published on the 17th, Mr. Hasegawa, an analyst at Bitbank, a major domestic exchange, expressed the view that “Additional materials are likely to be needed for the price to break above $45,000.â€

connection: Bitcoin on a correction trend, does it need more material to break above $45,000? | Contributed by a bitbank analyst

CoinPost Special feature for virtual currency beginners

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7— CoinPost (virtual currency media) (@coin_post) November 15, 2023

The post Buying a total of 121 billion yen worth of Bitcoin in one day “IntoTheBlock†reports whale buying line appeared first on Our Bitcoin News.