Bitcoin has rebounded to the $43,000 level, with the development of Bitcoin spot ETFs leading to strong buying appetite

Macroeconomics and financial markets

On the US New York stock market on the 18th, the Dow Jones Industrial Average closed 0.86 points higher than the previous day, and the Nasdaq Index closed 91.2 points (0.62%) higher.

connection:Significant rise in US Steel, virtual currency related stocks, etc. Today’s Bank of Japan monetary policy decision | 19th Financial Tankan

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price rose 5.1% from the previous day to 1 BTC = $43,056.

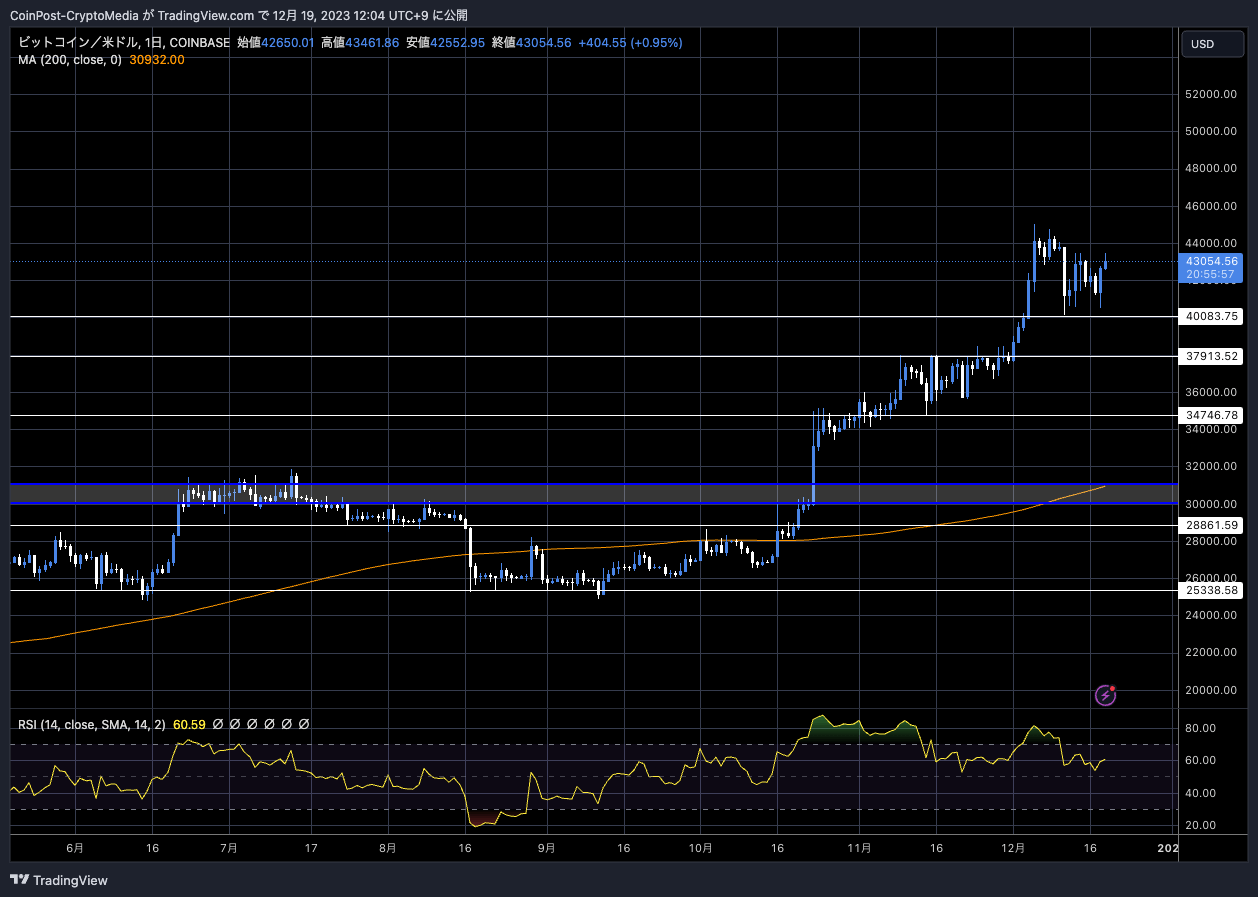

BTC/USD daily

Bitcoin continues to fall in a way that suggests a ceiling in the near future, and if 1 BTC = $40,000 were to fall below, approximately $38,000 would have been seen as a support line (lower price support line), but at the recent low price, there was a pushback buy. He gained the upper hand and reversed.

Did reports on Bitcoin spot ETFs (exchange traded funds) also support this?

With the crypto asset (virtual currency) market showing signs of correction, several analysts, including Michaël van de Poppe, predicted at the end of last week that the market could reach the lower end of the range of $36,000 to $38,000, taking into account the impact of profit taking towards the end of the year. Although we expected the price to continue falling, we expected it to rise again towards the beginning of the week.

To me, it’s still reasonable to expect that we’ll sweep the lows before we’ll grind back up on #Bitcoin.

Profit taking end of year, most likely from later this week/early next week we’ll be back in up-only mode. pic.twitter.com/wlPwS2qUe1

— Michaël van de Poppe (@CryptoMichNL) December 18, 2023

It has been newly revealed that the ticker “IBIT†has been assigned to the Bitcoin ETF “iSHARES® BITCOIN TRUST†filed by BlackRock. The S-1 application also includes references to the composition and redemption mechanism for adopting the fund, which appears to have heightened expectations for approval.

BlackRock’s proposed spot Bitcoin ETF trades under the ticker IBIT in an amended S-1 filing with the SEC on Monday. The revised document also adds new content on the creation and redemption mechanisms proposed for the fund. This was the subject of discussion during a recent …

— Wu Blockchain (@WuBlockchain) December 19, 2023

Additionally, the application was amended on the 13th to allow U.S. Wall Street banks facing restrictions on holding Bitcoin to participate.

connection:New developments in BlackRock Bitcoin ETF

BlackRock wants an “in-kind†redemption model that would give it more flexibility in managing its portfolio, while the SEC reportedly favors a “cash†redemption model.

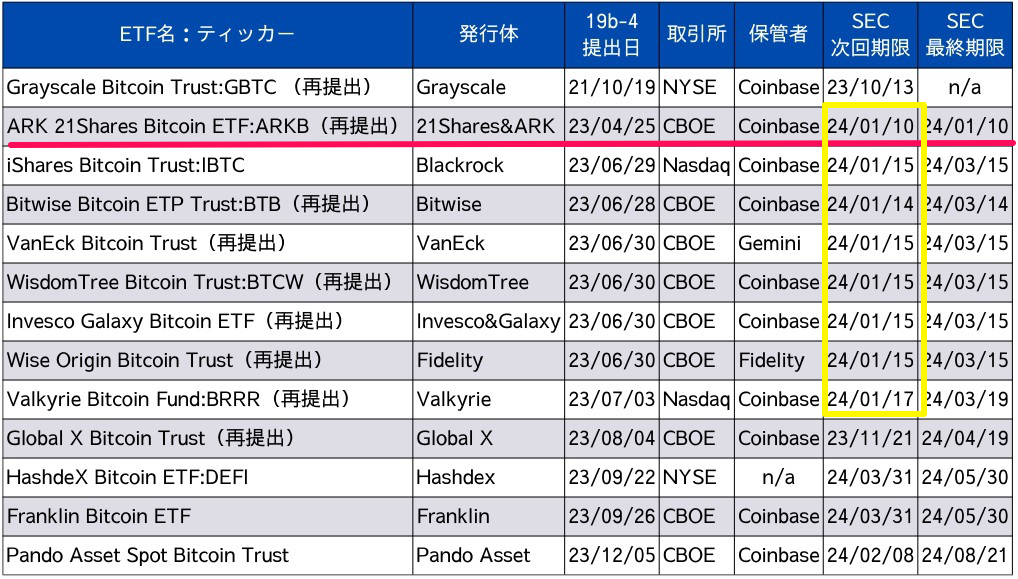

Ark Investment’s ARK 21Shares Bitcoin ETF also stated in its amended filing that redemptions and stock issuance will be in cash and there will be no in-kind options. Ark’s approval decision date is scheduled for January 10th next year, and the regulatory authorities’ moves foreshadowing the final stage of adjustment are seen as a premonitory signal, and speculative buying is once again intensifying.

The deadline for reviewing multiple applications is near the final deadline for ARK (1/10). Source: Bloomberg

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Other data

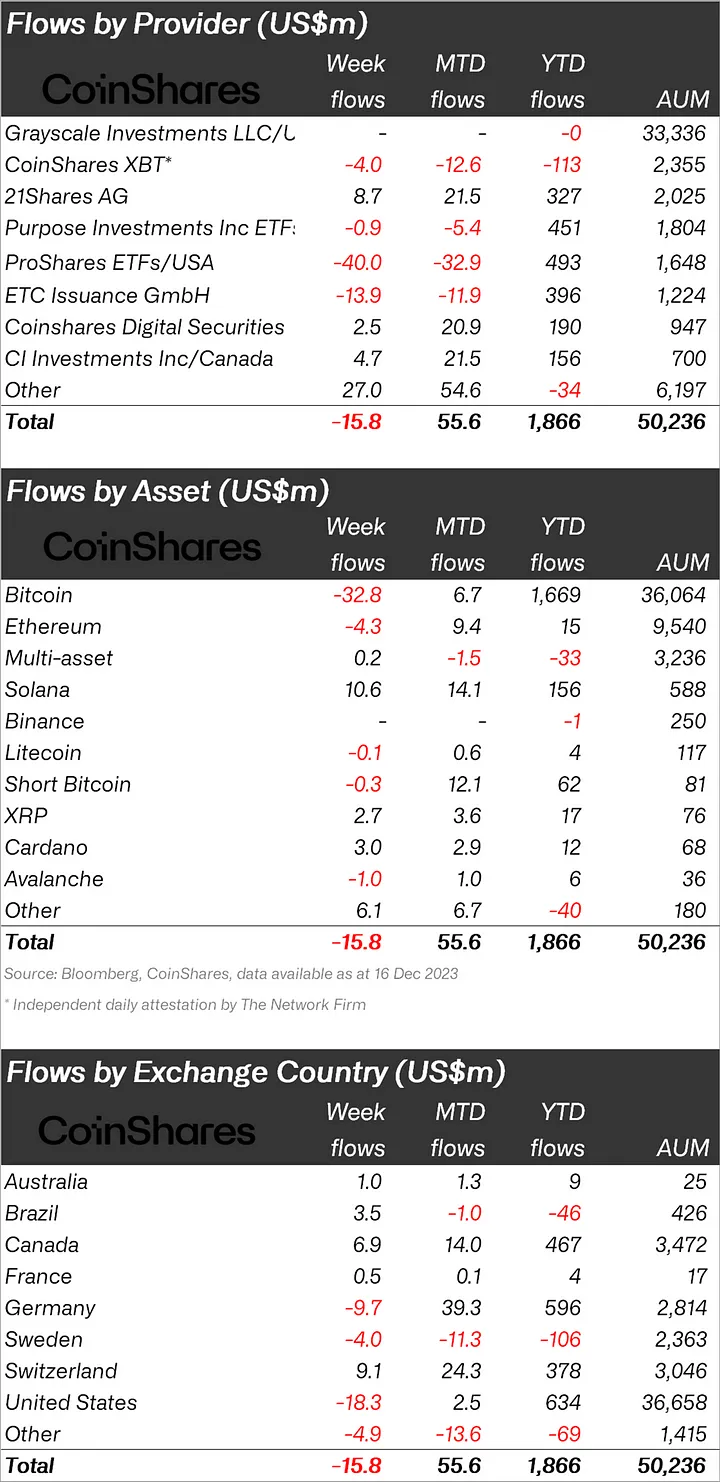

Institutional investor flows into digital assets such as crypto-asset (virtual currency) mutual funds have turned to net outflows after 11 consecutive weeks of net inflows, according to a weekly report from asset management firm CoinShares.

The source of the outflow is mainly concentrated in the United States, suggesting that institutional investors are taking profits and adjusting their positions.

On the other hand, altcoins bucked this trend and maintained an inflow of $21 million. The main stocks were Solana (SOL), Cardano (ADA), XRP, and Chainlink (LINK).

CoinShares

Interesting trends can be seen in the Coinbase Premium Index, which shows the market sentiment of institutional investors.

As of October 24, the BTC/USD price on Coinbase, the largest U.S. exchange, had a premium (price divergence) of nearly 0.5% compared to Binance Global’s BTC/USDT price, but the divergence has decreased recently. . It suggested that professional traders were showing less bullish sentiment than individual traders.

According to an analysis by Phi Deltalytics, a contributor to Crypto Quant, when the Bitcoin price rises while the Coinbase Premium Index declines, it is mostly driven by individual investors, which often indicates a feeling of overheating in the market. .

Some prominent investors are taking a bearish view. Peter Brandt expects a decline from the rising wedge and has set a target of 1 ETH = $650 to $1,000.

Classical chart patterns in price charts are not sacred – they fail to perform according to the textbooks all the time

But, if the rising wedge in Ethereum $ETH complies with the script, the target is $1,000, then $650

I shorted ETH on Friday — I have a protective B/E stop pic.twitter.com/76CciT3PE5

— Peter Brandt (@PeterLBrandt) December 18, 2023

Bitcoin ETF special feature

Due to the soaring price of Bitcoin, the number of downloads and MAU of the CoinPost official app is rapidly increasing.

In addition to virtual currency news, crypto indicators can also cover future materials. By using the My Coin function and Crypto Alert, you can quickly check for sudden rises and falls in altcoins.â– Explanatory article https://t.co/9g8XugH5JJ pic.twitter.com/gYtpheMykj

— CoinPost (virtual currency media) (@coin_post) December 6, 2023

[Recruitment]

CoinPost, Japan’s largest crypto asset media, is currently recruiting human resources due to business expansion (possible full-time positions)Editorial Department: Student interns interested in web3 and writers familiar with crypto assets

Sales department: Those who are good at English conversation and those with sales experience are welcome.

webX management: People who have strong research skills and are good at English conversation https://t.co/UsJp3v7P39— CoinPost (virtual currency media) (@coin_post) November 24, 2023

Click here for a list of past market reports

The post Bitcoin has rebounded to the $43,000 level, with the development of Bitcoin spot ETFs leading to strong buying appetite appeared first on Our Bitcoin News.