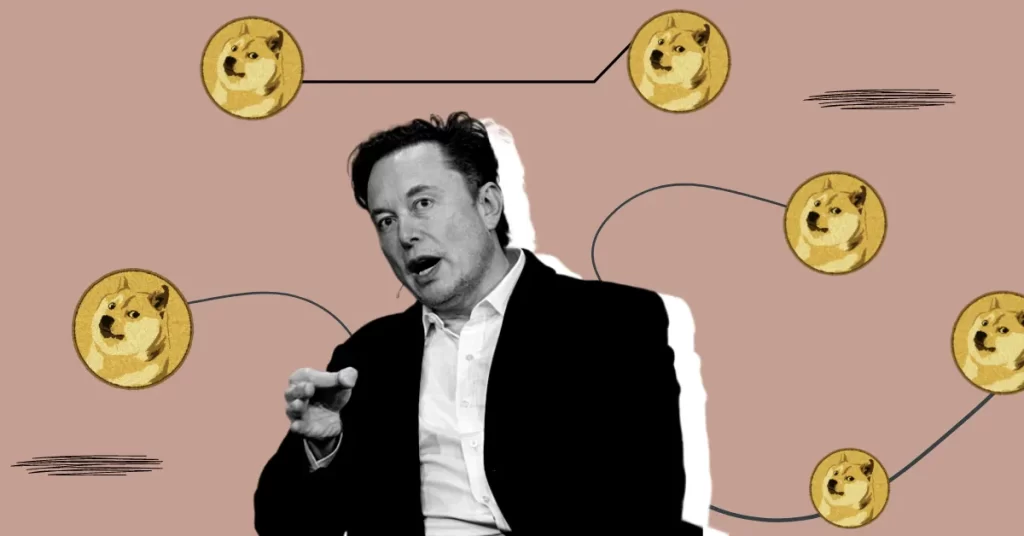

Elon Musk Faces Lawsuit as Dogecoin Investors Accuse the Billionaire of Insider Trading

The post Elon Musk Faces Lawsuit as Dogecoin Investors Accuse the Billionaire of Insider Trading appeared first on Coinpedia Fintech News

In a shocking turn of events, billionaire entrepreneur Elon Musk, the CEO of SpaceX and Tesla, finds himself embroiled in a legal battle as he faces accusations of insider trading from a group of Dogecoin investors.

Is Elon Musk Under Radar?

Investors have proposed a class action lawsuit against Elon Musk, CEO of Tesla Inc (TSLA.O), accusing him of insider trading and manipulation of the cryptocurrency Dogecoin, leading to losses amounting to billions of dollars.

Investors filed a lawsuit in a Manhattan federal court on Wednesday night, alleging that Elon Musk exploited Twitter posts, compensated online influencers, his 2021 appearance on NBC’s “Saturday Night Liveâ€, and other publicity maneuvers to trade Dogecoin profitably through several wallets controlled by him or Tesla, all at their expense.

The investors further claimed that Musk’s actions led to a significant increase in Dogecoin’s price when he sold approximately $124 million of the cryptocurrency in April. This followed his replacement of Twitter’s blue bird logo with Dogecoin’s Shiba Inu dog logo, which resulted in a 30% surge in Dogecoin’s value. It’s worth noting that Musk acquired Twitter in October of the previous year.

The filing stated that Musk engaged in a “calculated strategy of hype, market manipulation, and insider trading,†allowing him to deceive investors while promoting himself and his companies.

Musk’s attorney, Alex Spiro, chose not to comment on the matter on Thursday. Similarly, a representative for Tesla and the attorney representing the investors did not immediately respond to requests for comments.

Musk, who is recognized as the world’s second-wealthiest individual by Forbes magazine, has been accused by investors of intentionally inflating Dogecoin’s value by over 36,000% over a two-year period, only to let it plummet thereafter.

DOGE Investors Want Justice

The lawsuit, filed by a coalition of investors, alleges that Musk manipulated the Dogecoin market for personal gain. The plaintiffs claim that Musk’s tweets and public statements about Dogecoin were part of a calculated strategy to inflate the cryptocurrency’s price, allowing him to profit at the expense of other investors.

Elon Musk, known for his active presence on Twitter, has been a vocal supporter of cryptocurrencies, particularly Dogecoin. His tweets have often led to significant fluctuations in the value of the meme-inspired cryptocurrency. However, this is not the first time that his actions have led to legal repercussions.

The recent accusations form part of a proposed third revision to a lawsuit that began in June of the prior year. Musk and Tesla had previously attempted to dismiss the second revised complaint, labelling it as a “fantastical narrativeâ€. However, U.S. District Judge Alvin Hellerstein, on May 26, indicated that he would probably permit the third revised complaint, suggesting that the defendants would not suffer undue harm.

The lawsuit is presently lodged in the U.S. Court for the Southern District of New York, which holds Musk responsible for his purported insider trading and market manipulation activities concerning Dogecoin.