Circle Begins USDC Redemptions as It Burns 314 million USDC: On-Chain Data

The post Circle Begins USDC Redemptions as It Burns 314 million USDC: On-Chain Data appeared first on Coinpedia Fintech News

Following the unexpected collapse of Silicon Valley Bank on Friday, there were inquiries regarding the vulnerability of Circle, one of the leading companies in the crypto industry and the issuer of the second-largest stablecoin, USDC. After the firm revealed its $3.3 billion USDC exposure to the collapsed bank, the stablecoin quickly depegged, creating panic this weekend.

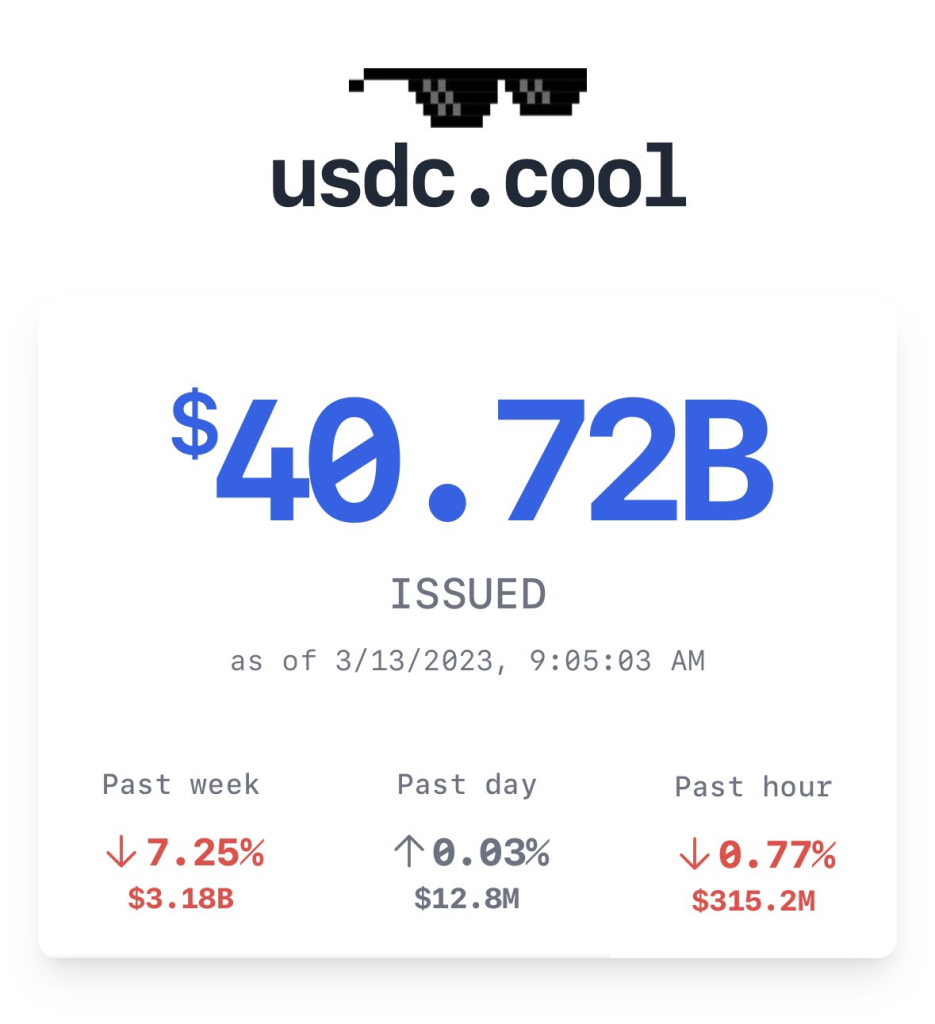

However, Circle is now successfully pushing USDC to its dollar peg as it recovers 100% of its reserved fund, and Fed’s $25 billion bailout is bringing back investors’ confidence. According to a report, Circle has begun its redemption by sending 314 million USDC to a null address to stabilize the market.

Circle Prioritizes 1:1 Redeemability Of All USDC In Circulation

On March 13th, the Web 3.0 analytics platform Watchers (0xscope) reported that Circle, the issuer of USDC, had transferred a total of 314.167 million USDC to the Ethereum null address with header 0x00. Typically, this null address is employed for removing tokens from circulation through one-way transactions.

The day before, Circle had declared that all depositors with Silicon Valley Bank (SVB) would be “fully available†following a joint statement by U.S. Treasury Secretary Janet Yellen and other regulators. This move would represent $3.3 billion or 8% of the total USDC reserve and would take effect as soon as U.S. banks open on Monday. Jeremy Allaire, co-founder and CEO of Circle said:

“Trust, safety and 1:1 redeemability of all USDC in circulation is of paramount importance to Circle, even in the face of bank contagion affecting crypto markets. We are heartened to see the U.S. government and financial regulators take crucial steps to mitigate risks extending from the banking system.â€

Circle’s USDC Redemptions May Relieve Investors

Circle has started the process of redeeming USDC, meaning that depositors can now get their money back. This move came as a relief to many investors who were worried about the stability of USDC after the collapse of SVB.

The burning of USDC, however, has led to some confusion and speculation about what Circle is doing. Some believe that it is a move to show that Circle is committed to the stability of the USDC, while others speculate that it is a way for the company to remove tokens from circulation and increase the value of the remaining USDC in the market.

Despite the speculation, Circle has not issued any official statement regarding the burning of USDC. However, the move has sparked a debate about the use of stablecoins, their role in the crypto market, and the need for transparency from issuers like Circle.

USD Coin was created to have a 1:1 redeemable value with fiat U.S. dollars. Its tokenomics are managed through the use of fiat collaterals, which are adjusted proportionally to the number of new tokens being minted or burned.

However, on March 10th, the token experienced a depegging from its intended value. This was caused by a bank run on Circle’s custodian bank, SVB, due to a series of failed leveraged long positions on the U.S. Treasury. As a result, federal regulators, including the Federal Deposit Insurance Corporation, were forced to intervene.

Stablecoin Burn Alerts:

Stablecoin Burn Alerts: .

.