Bitcoin (BTC) Price Will Recover, but the Gains May Be Capped at These Levels!

The post Bitcoin (BTC) Price Will Recover, but the Gains May Be Capped at These Levels! appeared first on Coinpedia – Fintech & Cryptocurreny News Media| Crypto Guide

The top crypto asset Bitcoin is ranging in a very narrow range between $29,000 and $30,000 for a pretty long time. After recording 6 bearish weekly candles, Bitcoin is on the verge to register the 7th one, which is a big matter of concern for the investors and the entire crypto ecosystem. As the BTC prices displayed a huge correlation with the U.S markets in the past few months, a turmoil in the stock markets due to heavily impacted BTC prices.

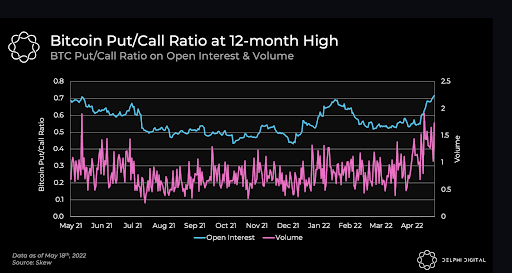

In an interesting update, many investors now believe the BTC price slash may be extended for long as the BTC Put/Call Ratio on Open Interest & Volume is at a 12-month high.

As per the data from Delphi Digital, the Put/Call ratio which is the rate of bearish sentiment prevailing among the investors is at a record high. A high ratio indicates more people believe BTC prices may continue to slash or it also indicates more investors are now shorting Bitcoin. On the other hand, nearly 63,000 BTC are set to expire on May 27, which may also impact the price accordingly.

Bitcoin (BTC) Price Analysis

The Bitcoin weekly forecast suggests the asset is all set for another rebound before igniting a capitulation phase. The asset is showcasing some bullish signs in the short-term which the traders can take the maximum benefit from. As the BTC price is currently sticking within the range between $31,218 and $28,636 since the recent crash, the possibility of hitting the monthly lows at $26,759 hovers the rally.

Moreover, in an extended bearish case, the BTC price may even crash below these levels to mark the new 2022 lows, and again flip to test the support flipped to resistance levels at $28,000 again.

Currently, it appears that the Bitcoin price is still pretty unsure of the upcoming price move, as both the possibilities on either side are popping up. If the price after reaching the apex of the consolidation breaks out and ranges high, it may slice through the immediate resistance at $32,000 and quickly make a larger move beyond $34,000. Else if the bears drag the price below, it may again make a visit to the 2022 lows below $27,000.

Therefore, the upcoming weekend may be pretty crucial for the entire crypto space as the Bitcoin price may make a significant move, irrespective of the direction.