Bitcoin (BTC) Price Will Hit $4.8 Million If This Happens, Says Popular Investment Firm

The post Bitcoin (BTC) Price Will Hit $4.8 Million If This Happens, Says Popular Investment Firm appeared first on Coinpedia – Fintech & Cryptocurreny News Media| Crypto Guide

Bitcoin, the king currency which holds the first position by market capitalization, is currently experiencing a correction after successfully surpassing the $47,000 level recently. Hence, the flagship currency is facing a 24hr loss of 4.89% and trading at $44,840.

Bitcoin To Be A Gold Reserve Asset?

Basically reserve assets can be currencies or any kind of assets such as gold or silver. These assets can be used for international payments, investments, and other aspects of the global economy.

American investment firm VanEck expects that Bitcoin’s valuation could rise as high as the US $4.8 Million per token if Bitcoin ever becomes a ‘global reserve currency.’

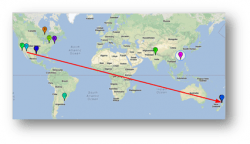

That being said, there is certainly a big ‘if’ in the course of Bitcoin becoming a global reserve currency and VanEck believes the Chinese Yuan to stand as a competitor.

To elaborate in detail, VanEck executives Eric Fine and Natalia Gurushina suggest a valuation range between the US $1.3 million to US $4.8 million for BTC.

Also Read : Altcoins Ready for a new Leg Up, These May be the Best Bets for April 2022!

As per the reports, Bitcoin’s lower prediction is based on BTC as a monetary base (M0) that includes the currency’s circulating supply and bank deposits. The higher prediction comes from the M2 assessment which is a measure of money supply consisting of currency’s all bank deposits and its ability to get converted into cash.

The recent political disturbance has led Russia to consider Bitcoin and other currencies for oil transactions along with their partners China and Turkey.

Over the last couple of years, VanEck has increased its stake in the crypto space through Bitcoin Strategy ETF (XBTF), an offering that has accumulated over $30 million in total net assets. Furthermore, the company has also filed an appeal with the US Securities and Exchange Commission (SEC) to release a new ETF focusing on companies related to the gold and crypto mining sectors.