9 Bitcoin ETFs including BlackRock bought over 100,000 BTC in the past week

Increased inflow, but outflow from GBTC is causing selling pressure

Excluding Grayscale’s GBTC, nine Bitcoin spot ETFs, including BlackRock, currently hold and manage 109,221 (approximately $4 billion) of virtual currency BTC. For simple comparison, MicroStrategy currently holds 189,150 BTC.

The nine stocks are BlackRock’s IBIT, Fidelity’s FBTC, Bitwise’s BITB, Ark’s ARKB, Invesco’s BTCO, VanEck’s HODL, Valkyrie’s BRRR, FT’s EZBC, and WisdomTree’s BTCW.

Among them, BlackRock’s IBIT holds the largest number of Bitcoins, with 40,213 BTC as of the 23rd. Fidelity’s FBTC ranks second with 34,152 BTC holdings.

January 23

The new ETFs took seven trading days to amass BTC holdings of more than 100,000 BTC.

BlackRock needed 7 trading days to become the third-largest BTC investment vehicle globally – set to become the second-largest after today.

Fidelity has also entered the top 4. pic.twitter.com/NUvkQQcHbt

— Vetle Lunde (@VetleLunde) January 23, 2024

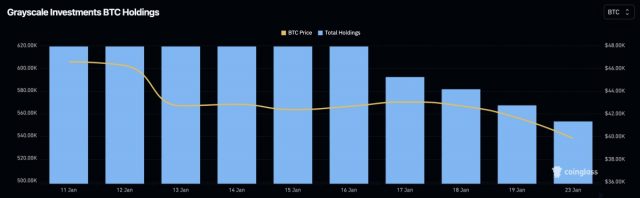

On the other hand, grayscale GBTC, which was excluded from the calculation, was outflowed (BTC sold), and more than 66,540 BTC was lost during the same period. (CoinGlass data)

Source: CoinGlass

Regarding GBTC, outflows occurred daily, and on the 24th, $660 million worth of BTC was transferred to Coinbase for sale (redemption). Meanwhile, on the same day, Fidelity’s FBTC also received $155 million in deposits.

Additionally, the total net flow (difference) for the 10 stocks in the past 7 days was +$1.1 billion, but on the 7th day it was -$76 million. However, GTBC’s selling pressure on Bitcoin is expected to continue. The price of Bitcoin fell below $39,000 last night, its lowest since December 2nd.

Update: BlackRock’s numbers are in for the #Bitcoin ETF Cointucky derby. Third biggest inflow day for $IBIT yet at $272 million. Only -$76 million in net outflows for the day. https://t.co/ySE0edbz4c pic.twitter.com/RzgH6qn5Md

— James Seyffart (@JSeyff) January 23, 2024

Half-life special feature

We have introduced the “Heat Map†function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.â– Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU— CoinPost (virtual currency media) (@coin_post) December 21, 2023

The post 9 Bitcoin ETFs including BlackRock bought over 100,000 BTC in the past week appeared first on Our Bitcoin News.