BTC-ARBS.com J.A.S. (Just Another Scam)

In five or ten years, the Bitcoin landscape is going to be very different than it is right now. In the last few months, the community has been hit over and over by hacks, thefts, mind-boggling amateurishness in businesses at the heart of Bitcoin, and China. At the end of five years, most of these problems will have shaken out.

We’re not there yet, though. I have recently been looking at some arbitrage sites claiming to be able to make investors huge profits for no effort. Can this be real? Despite what I felt were a huge number of red flashing lights all over the site, I decided to invest a small amount of bitcoin in BTC-Arbs.com as an experiment.

This is not my first foray into BTC high-reward sites. In July of last year, with far less caution than I have now, I got involved with a site called Coinlenders. This site was run by a person using the name Tradefortress. He claimed (and apparently was) doing short-term BTC loans to miners and brokers when they were running short. Initially this seems to have been a good business, but the increase of hashing difficulty and decrease of miner profits led to the mining shares he used for collateral to be nearly worthless. So, when the site was hacked in October emptying a hot wallet of 4,000 BTC, investors lost nearly everything.

What I learned from this experience was that when looking at one of these investment opportunities, it’s really important to get answers to the nagging questions you have. In the case of Coinlenders, some of the questions were: Why does this guy only go by a handle if he’s building a reputable business? (So he could run away if he got into trouble), Were the funds collateralized in the way that he said? (Yes, but the collateral had dropped in value and was meaningless when push came to shove), Are the funds secured (No. The site claimed he kept most of the funds in a cold wallet, but he apparently left everything in a hot wallet), Is the site professionally secured? (No. The exploit the hackers used involved an old, unsecured admin email and software with well-known vulnerabilities), and Is the site itself professional? (No. In August 2013 the site was plastered with a warning that the site was just for fun and no real money was being used – apparently as a way to stave off law enforcement and law suits).

When the Coinlenders hack was revealed, it was interesting watching the community on the forums. There was terror and hope. The fact that Tradefortress was still in contact with people and pledging to make good on losses from his own reserves made people hope for the best. The fact that he had outstanding loans made people guess that the site could be rehabilitated by calling in those loans. People made public offers to keep their money in Coinlenders for years with no interest if it meant the site could recover and they could eventually count on getting their funds back. And of course, there were threats of lawsuits and ass-kickings. It took Tradefortress disappearing, reportedly to China, for the message boards to finally admit that all was lost.

All of that played out just last November. Now I am watching a similar story playing out with BTC-Arbs.com. Here are some of the flashing red lights I noticed before investing anything:

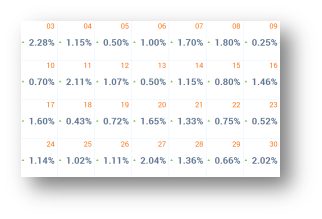

- They claimed to earn between 1 and 10 percent daily with an average of 1.4 percent. Incredible to say the least.

- They claim to be located in Geneva and have 10 employees. Even small legitimate companies I have seen (and a few illegitimate ones) have information about the company’s principles to garner trust in the community.

- They have no social media presence so the only way to contact them is through their support ticketing system.

- A cursory search revealed that the site’s design was a near perfect match for a gambling site that had turned out to be a Ponzi scheme. The operators had apparently just repurposed it.

- The chatter on the message boards seemed to indicate that almost everyone realized that the likelihood is that the site was a Ponzi scheme, but that most people felt they might be able to make enough and pull out before the collapse.

After my experience with Coinlenders, I made a rule for myself that I wouldn’t invest any more of my hard-earned bitcoin in any business where I didn’t know the real names of the operators. I had no faith that Adam, the person responding to BTC-Arbs support, was a real person with his personal reputation on the line, but I also felt a kind of morbid curiosity – so I put in a bit of BTC to see what would happen.

This was a matter of weeks ago. Last week, BTC-Arbs had a 12 hour outage. The site was a blank, white screen. Since there is no email address for the site, all communication is through their support system, and since they have no social media, there was no information whatsoever, only speculation about what happened. The chatter on the boards mostly acknowledged that this was probably a scam, but also noted that withdrawals had been processed right up to the time of the outage, so many felt that the site would be back. If it did come back, many promised to leave their funds in since the site had proved itself.

The site did in fact come back up. Another red flag: no mention of the outage anywhere on the site. No apology. No explanation. On the message boards there were quotes from responses some people got to support tickets suggesting server problems, but no announcement to the investors in general. Not a smart business decision if the trust of your investors is your bread and butter. Cut to one week later. There is a sudden announcement, not by email or by a notice on any of the site’s main pages, but buried in the support center that the site had been bought by Global Capital Alliance. That’s Global Capital Alliance, not Global Alliance Capital. The latter is an actual operating company, and the former seems to have existed in Atlanta, Georgia between 2007 and 2010 and is now defunct. As a result of the sale, all accounts have been sequestered in a ‘Legacy Fund’ for each user. This fund will not accrue profits and cannot be withdrawn pending verification that the sums are correct. New deposits are still being accepted and theoretically accruing profits.

At this point, none of the details of the current company or of the purchasing company can be verified. All the investors really know is that they cannot withdraw their money and have no idea when they might be able to. On the message boards, what I saw after the Coinlenders hack I am seeing again – terror and hope. I have reached out to BTC-Arbs through their support system to give them a chance to correct me if I am wrong, but that was five days ago and I have gotten no response. (One fun note is that one of the people on the message boards reports that he got a response from Adam informing him that things would be going quicker if they didn’t have to deal with so many pesky support inquiries).

At this point, I think it’s safe to say that BTC-Arbs is now just one more scam to add to the already long list in annals of Bitcoin. And worse, these folks, and people like them, will be back again to entice investors with hope and greed, string them along with just enough good will, and then finally bilk those investors of as much as they can get away with.

In five years’ time, I do fully expect that a lot of the security issued regarding Bitcoin will have been worked out – stronger, more user-friendly wallets, more professionally run companies, and yes, even a bit of regulation. In the meantime, though, I think we should all be keeping an eye out for those flashing red lights, and if they’re flashing, steer away.

Mark Norton for BitcoinWarrior.com 04/26/2014