Passing Bitcoin Around the World: Next Event – February 8, 2014

This is a repost of the article we ran about the Passing Bitcoin Around the World last October. The next event is Saturday, February 8, 2014.

Hope to see you there!

_________________________________________________

The velocity of Bitcoin made the news a few weeks ago and is set to make it again in another few weeks.

The first news story about the velocity of Bitcoin came when Rick Falkvinge, founder of the Pirate Party, wrote an article claiming that the value of Bitcoin was artificially inflated to a hundred times or more of its true value. He says that a small number of investors are colluding to sell Bitcoin back and forth to each other as a way to create market trends that less sophisticated traders will follow. They can then create panics that cause the price to drop and buy cheap, or rallies that cause the price to spike and sell high.

Falkvinge has been pretty roundly refuted at this point. One of his arguments is that the true value of Bitcoin should be estimated by gauging how many Bitcoins are being traded in the real world. In fact, there are a lot of ways to estimate value, but for Bitcoin one reason it’s rising in value is the expectation of its future value based on its utility as both a currency that can be used to purchase things and as a way to store money safely.

It’s also no surprise that there is market manipulation going on. Right now, Bitcoin is a very small pond and it’s easy for big, or even small, players to make a ripple. One of the commenters on Falkvinge’s article said that he himself had caused a change in price based by making a large trade. And with the number of trading bots out there, it is difficult to assume that we even need a small group of people colluding. It could be automated collusion.

Finally, we wonder why he chose Mt. Gox to do his analysis on. Until Mt. Gox can solve its problem of moving between dollars and bitcoin, it’s marginalized. The only reason it’s still mentioned is its historical dominance and the fact that many sites’ tickers, including mine, are set to that exchange. When I want a real read on the price of Bitcoin, I go to Bitstamp or Coinbase, which provide a much better picture of how many dollars my bitcoin are really worth.

Passing Bitcoin Around the World

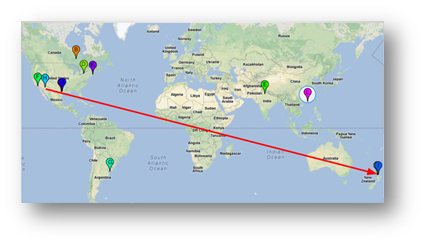

The second news story is from Passing Bitcoin Around the World. The brainchild of Paul Snow (AKA AlanX on Reddit and Bitcointalk.org), Passing Bitcoin Around the World (PBAW) is helping to prove how useful Bitcoin is conducting a kind of relay race. One bitcoin is sent from person to person around the world ending back where it started. If people can see how a single bitcoin can be passed wallet to wallet around the world, they can also see that they can send money very fast, across borders, at very low cost.

The second news story is from Passing Bitcoin Around the World. The brainchild of Paul Snow (AKA AlanX on Reddit and Bitcointalk.org), Passing Bitcoin Around the World (PBAW) is helping to prove how useful Bitcoin is conducting a kind of relay race. One bitcoin is sent from person to person around the world ending back where it started. If people can see how a single bitcoin can be passed wallet to wallet around the world, they can also see that they can send money very fast, across borders, at very low cost.

Just today I listened to an NPR Planet Money Podcast which featured how inefficient checking is—how antiquated the system is and how prone it is to mistake and fees. Although there are banking systems, and methods of payment that are better than the American check, they cannot come close to the speed, low cost, and personal control provided by Bitcoin.

As a further way to promote Bitcoin, and the event, Paul is giving people the option of donating Bitcoin to charity. Each person acting as a relay point will be asked to put one bitcoin into a deposit wallet. When the event is finished, that bitcoin will be returned the relayer or be given to their selected charity. In fact, it has been shown that contrary to media reports, Bitcoin is used more for charity than for illicit purposes. By including the option of donating to charities, Paul is showing people how they can get their donation nearly instantly to the people who need it most.

The next PBAW is scheduled for October 26, 2013. You can learn how to participate here.

Paul was kind enough to answer a few of my questions about himself and PBAW:

Could you tell us something about yourself?

I grew up on a farm in Louisiana, and I went to Louisiana Tech University for my BS in Computer Science, and Texas A&M for my Masters in Computer Science with a minor in Electrical Engineering.

I have started a few companies, one that developed a PostScript clone (first shipped in December of 1987), and a couple consulting companies. Cliff Click and I developed Fifth, a 32 bit Forth development environment which embodied a number of interesting innovations. You can download the Fifth environment and run in in a Dos Emulator today: https://github.com/PaulSnow/Fifth

I am also one of two organizers for the Bitcoin and Cryptocurrency Meetup in Austin Texas. I organize and run the Mini Bitcoin Conference Series in Austin. The third in the series will be on October 19th. We provide a live feed via Google Hangouts, and the YouTube videos of the presentations are on the web.

In 2000, I joined AMS and worked on the TIERS project for the state of Texas. TIERS is an eligibility determination system for assistance programs offered by the state. These programs include Medicare, Medicaid, Food Stamps, TANF, and others. I designed and wrote the Rules Engine used to define all those eligibility rules. This is a huge policy engine (about 3000 decision tables, more or less).

I wrote the open sourced version of the same Rules Engine approach. You can find that project at http://DTRules.com. This version is used in many states to process Medicare enrollments into the private programs that administer Medicare. DTRules is also used in a number of other projects around the world.

How did you get involved in Bitcoin?

In 2011, I read an article about Bitcoin http://arstechnica.com/tech-policy/2011/06/bitcoin-inside-the-encrypted-peer-to-peer-currency/ and found it fascinating. At the time, Bitcoin was selling for something like 70 cents a coin, and Mt. Gox would take PayPal, so I sent a few dollars to Mt. Gox and bought most of the Bitcoin I own today.

I set up some machines to mine Bitcoin, but I didn’t learn about mining pools, so after a short while I gave up, and shut them off. Never did make any  Bitcoin mining.

Bitcoin mining.

Now and again I would look at Bitcoin, but didn’t really study it until January of 2013. Then I became quite the fan.

Could you describe what Passing Bitcoin Around the World is?

We start with some portion of a Bitcoin. We pass it from one person to the next, in a kind of financial transaction relay. The last participant passes the Bitcoin to a featured charity. With the first Passing Bitcoin Around the World, that featured charity was The One Foundation (a disaster relief organization set up by Jet Li, the actor).

We organized the event on the fly, using an Internet Chat Session. We may use Google Groups and a Chat Session this time around.

How did you come up with the idea and what kind of response have you gotten?

I kept reading articles about how Bitcoin has no value. Sometimes people say Bitcoin has no “Intrinsic Value.” What they mean is that gold can be used to crown teeth, or improve electrical connections, make wedding rings, etc. Because Bitcoin isn’t physical (they assert), Bitcoin cannot have “Intrinsic Value.”

What I wanted to demonstrate is that, in fact, Bitcoin does have value regardless of your perspective about  value. (Many argue that there is no such thing as “Intrinsic Value,” that all value is subjective. Not our fight.) The value can be found in what can be done with Bitcoin.

value. (Many argue that there is no such thing as “Intrinsic Value,” that all value is subjective. Not our fight.) The value can be found in what can be done with Bitcoin.

The other argument continually put forth is that Bitcoin is only useful for buying drugs, or to arrange a hit man. I wanted to forcefully demonstrate how much Bitcoin can do to mobilize funds for a charity to meet an immediate need.

Bitcoin provides for frictionless, rapid, international transfers. At the same time, it allows for complete transparency of money movements among interested parties. It is the perfect vehicle for mobilizing support for a charity.

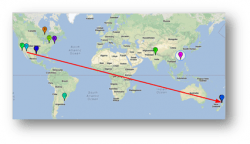

About 20 people signed up for the event, but of the lack of a website and other organizational structures we only had about nine show up at the right time. The event nonetheless went very smoothly, and the full half a Bitcoin (about 66 dollars at the time) was deposited with The One Foundation 1 hour, 51 minutes, 45 seconds later, after 10 International Transfers through 5 countries, over a distance 3 times around the world.

Can anyone be a link? How can they get involved?

Anyone can be a link. We especially need people outside the USA. Also, there is work to be done promoting Bitcoin and raising additional donations for the event.

In the last event we only donated the passing Bitcoin. This time, all participants need to deposit one Bitcoin prior to their turn at an address we set up for them. They are encouraged to deposit more. Once their turn is complete, they can either choose to donate their deposit directly to the Charity or ask for it to be returned to them.

What people can do is set up an address with us (which we will publish): If their intention is to donate their deposit, then that will be noted on the site. If they are donating the deposit, then they can ask others to donate to their address. The full sum of their donation will either be donated after their turn, or at the end of the event (should they fail to show up for the event).

If an individual accepts the passing bitcoin, but fails to pass it along, the event will continue with a Bitcoin from their deposit address. This removes the problem of having to trust people or screen people who want to participate.

Are you planning on this as an ongoing event?

Yes. Many people did enjoyed the last event, and it did get a significant bump in interest afterward. I expect if we do this two or three times a year, interest will grow, and with more people involved, the event will become more impressive.

Switching the question to Bitcoin itself, what do you see as the real value of Bitcoin?

The Real Value in Bitcoin is the financial independence it gives people to manage and secure their money. Over time we are going to see products that provide incredible security against theft that are easier to use than traditional banking products, and yet are practically free. Bitcoin provides for more rapid response when the movement of funds is necessary. This makes it the perfect vehicle for mobilizing a response to a disaster, whether literal, or figuratively (like a business issue, or family issue).

The greatest obstacle to Bitcoin is the existing financial infrastructure. Bitcoin is hard to purchase or sell without significant risk, just like the risks of exchanging digital credit for cash. Bitcoin also has political and cultural barriers. We are used to the way things are done today, and people do not like to change.

But when change comes, it comes rapidly. Look at how quickly email replaced letter writing. It took maybe 20 years, but it did happen. And across all age groups.

Thank you to Paul Snow for taking the time to answer our questions. We encourage people from around the world to take part. Bitcoin Warrior intends to be a relay point for Tokyo, Japan. Please leave a comment—we love to hear from you.