Step by Step Guide to Coding a Crypto Algorithm (No Coding Needed)

Cryptocurrency trading can be a lot of fun only when profit making becomes consistent.

Developing a winning strategy in the world of cryptocurrency trading may involve a lot of input in time, research and study of cryptocurrency pairs and their trend patterns. For traders who rely on technical indicators for market prediction, choosing the right combination that would deliver consistent winners can be more difficult than it seems.

Why traders lose money

While the search for the right winning formula presents a tedious task already, the lack of discipline in adhering to trading rules and strategies has become the undoing of a lot of traders. Fear and greed have been identified as factors that lead to trader’s succumb to knee-jerk formulas that mess up their promising trading careers.

Another factor that is identified to be behind the failing career of most traders is their inability to match the market speed and endurance. This can sometimes be as a result of technical reasons like slow internet connection and delayed feed processing by their gadgets. Also, being that a lot of traders engage the market as a part time opportunity, there is always the tendency of missing out on opportunities during their absent periods.

Attempting to save the situation

The above mentioned challenges among others has led to the creation of computer algorithms that represent traders in an automated manner. These algorithms, which are popularly referred to as trading bots are connected to exchanges and trading platforms, working in proxy for the account owners.

In terms of functionality, a typical trading bot simply operates within the bounds of instructions upon which it is programmed. Hence, every trading bot is actually a computerized form of a trading strategy as configured by its creator.

The popular kinds of trading bots that exist today are those that are created by coders or developers who are familiar with computer and machine languages. What these coders do is to translate a trading idea into a language that the computer understands in an executable format. This system comes with certain limitations.

Imagine that I am a trader with an excellent strategy but without a coding skill.

My best bet for automated trading with my strategy will remain to employ an expert coder who will fully understand my strategy and write down an algorithm that will represent such a strategy without any form of error or mistake. What are the guarantees that this will be 100 percent accurate?

Any other option will be to buy or subscribe to a trading bot which is entirely borne out of another trader’s or coder’s idea and strategy. This is the most popularly obtainable scenario within the trading circle. The risk here is that a trader remains 100 percent at the mercy of another person’s knowhow.

The real personal solution

All that is history today, as Capitalise has taken the trading practice a step higher, returning control totally into the hands of the traders as long as their strategy can be typed out in plain text English.

With Capitalise, all a trader needs to do is to fill out in plain English the entry and exit conditions for their trading algorithms to execute. This is performed on a user-friendly platform that provides leads and support as users describe their strategies and conditions.

For instance, in order to create an entry order, a trader simply types out in plain English the various conditions that must be met in order for their trading bot to execute a specific type of order (buy or sell).

This is shown in the figure below:

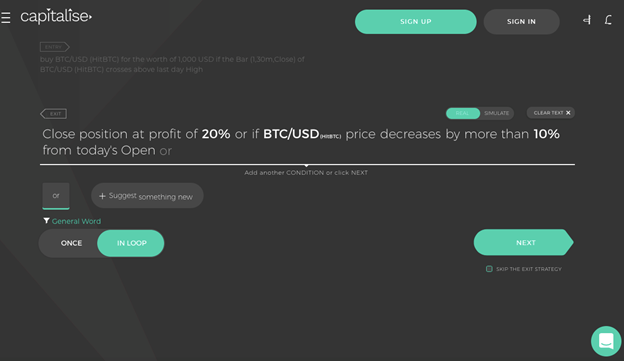

The set up continues with a close order which comprises of another set of instructions that instructs the trading bot to exit the opened trade. This completes a trading cycle, based on the strategy and rules specified by a trader who in this case is the creator of the algorithm. This is illustrated by the following example:

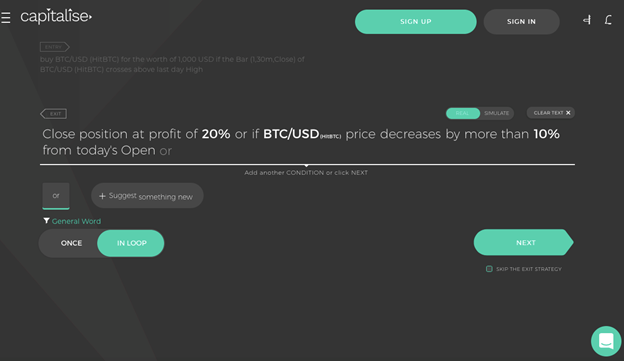

A close trade order completes a trading cycle. However, as one of the benefits of trading bots mentioned earlier, traders should be able to participate in the market at the right opportunities even when they are physically absent.

Therefore, for a bot to continue in the process of repeated trading when new opportunities arise after an initial trading cycle, the “IN LOOP” mode must be activated. This ensures that more than one trade can be executed automatically by following the same entry and exit rules. This is shown in the figure below:

That does it for simplified trading algorithm creation on the Capitalise platform.

However before going live, every newly created algorithm is presented with the opportunity of being test run and for possible corrections. This can be done by using the “RUN SIMULATION” and “LET ME FIX IT” buttons on the summary page after creating the bot. Once a trader is satisfied with the created algorithm, the process is confirmed and the bot is activated. An example of the summary page is shown below:

Indeed, the hassles of inconsistency and doubts in the attitude of traders have been addressed by the Capitalise platform. Not only can traders now employ the services of trading bots, they can actually now employ their own personal and proven trading strategies without risking the understanding of such by third parties. Also, the emotion factor of fear and greed can be completely exorcised while failure due to machine processes can as well be addressed through this indigenous trading procedure.